- EUR/USD remains positive ahead of the European session.

- US Senate infrastructure bill and rising Delta variant are weighing on the risk sentiment.

- EU retail sales and PMI data are key for today’s directional bias in the EUR/USD.

The EUR/USD outlook is tracking its weekly losses and maintaining daily highs at 1.1875 ahead of the European session on Wednesday. In spite of a weaker US dollar, the major currency pair is showing a three-day decline with a potential upside of 0.10% on the day before key Eurozone and US data.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Even if stock futures and government bond returns reflect market trepidation, the EUR/USD seems to be preparing for a long, tough economic line that will consolidate recent losses. At the same time, the S&P 500 futures are down 0.10% for the day, while the 10-year US Treasury yield is up 1 basis point to 1.18% at the time of publication.

A recently escalating Delta Covid problem and the stalled Senate infrastructure funding bill have undermined risk-taking recently. In addition, the Fed’s hawkish comments about stronger-than-expected industrial orders in the US played a major role. Furthermore, the recent surge in viral infections in China and Australia has been causing traders concern over simple UK COVID-19 data. Finally, geopolitical concerns regarding Iran and China and Beijing’s tough measures against technology stocks also weighed on sentiment.

Traders are encouraged by news from the New York Times that the FDA is ready to approve Pfizer’s Covid vaccine. Positive data from the US and EU and widespread optimism about the viability of western economies and Asian economies also support bulls.

Nevertheless, today’s composite PMI for Germany and the bloc and EU retail sales for July will show the immediate direction of the EUR/USD. A decline in the US retail sales from 9.0% to 4.5% YoY could upset buyers, but positive US ADP Employment and ISM Services PMI might sway sellers later.

ADP data will serve as a leading indicator before Friday’s US Nonfarm Payrolls (NFP) data. Thus, the short-term EUR/USD movement may be mainly directed lower.

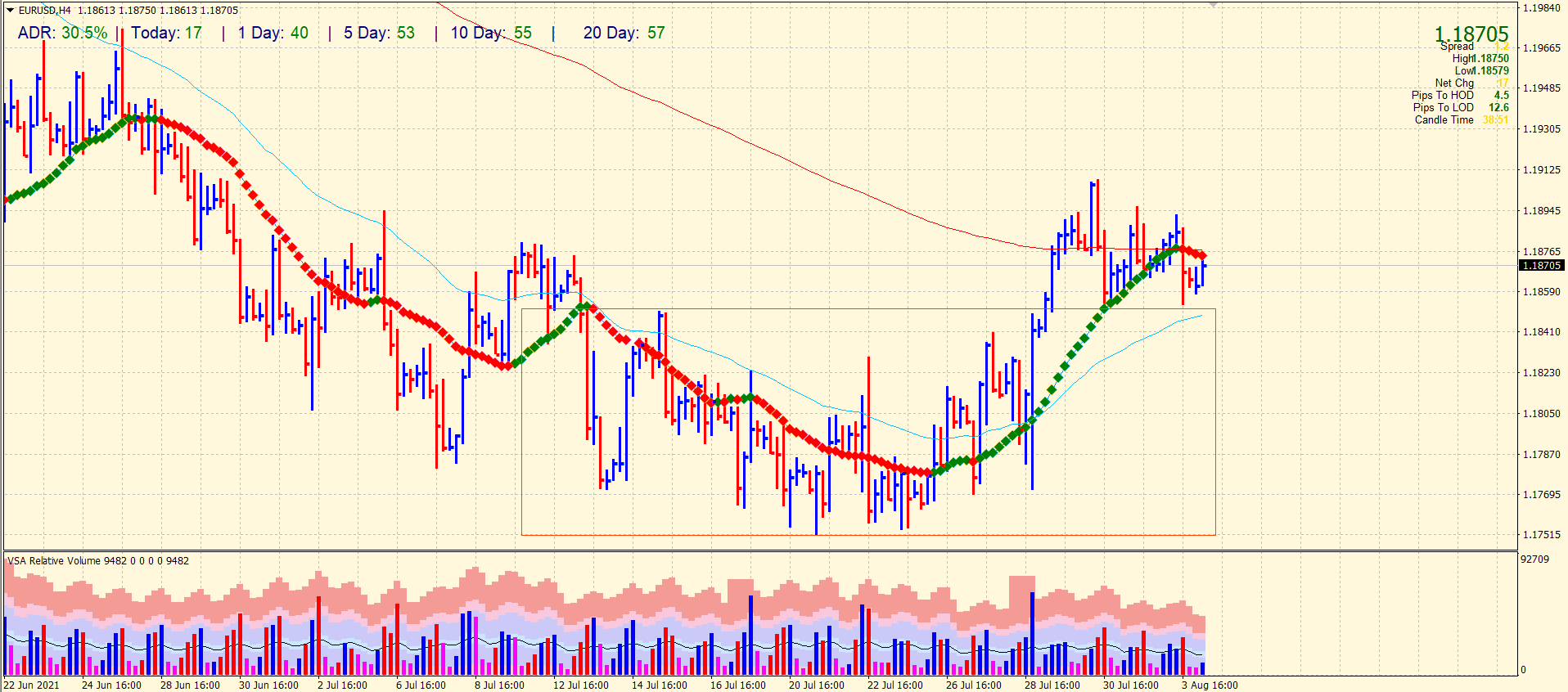

EUR/USD technical outlook: Volume supporting short-term bulls

After falling below, the congestion of 20 and 200 periods SMAs on the 4-hour chart on Tuesday, the price is struggling to post gains. The congestion of SMAs continues to cap the upside. However, the pair remains well supported by the broken sideways channel. The broken level has been tested twice and still holding. Further on the downside, the 50-period SMA can lend support near 1.1850.

–Are you interested to learn more about forex signals? Check our detailed guide-

The volume data is not clear. Although the down bar closing in the middle with very high volume indicates that the upside potential is boiling. We may see a rally towards 1.19 or beyond during the European session.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.