- The ECB might raise rates by a smaller size at its next meeting.

- There is increasing risk aversion in the markets, boosting the dollar.

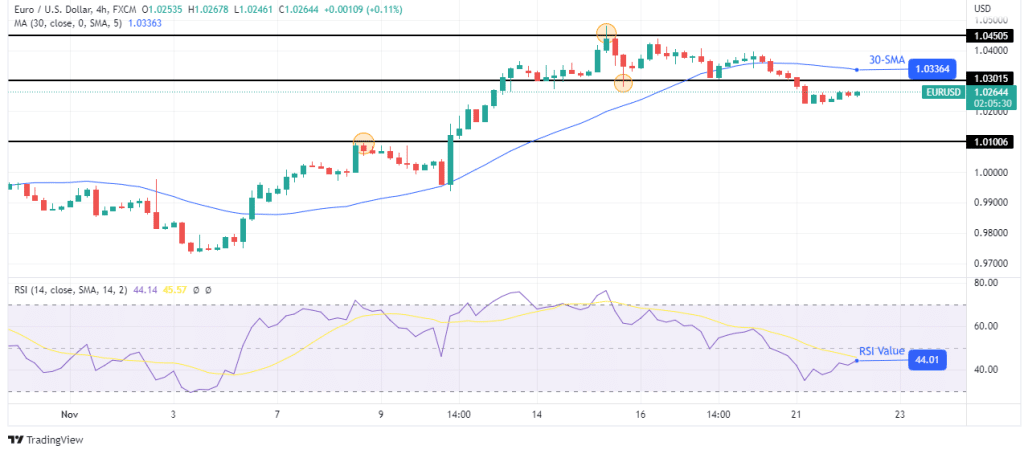

- Bears have taken over in the charts, taking the price below the 30-SMA.

Today’s EUR/USD outlook is bearish. According to policymaker Mario Centeno, the European Central Bank’s upcoming rate hike could be less than the record 75 basis-point increase decided at its most recent two meetings.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The ECB has increased interest rates by 200 basis points in three months from record low levels. The inflation rate has reached double digits. Centeno stated that the ECB had to stop the trend of growing inflation and could not allow it to get entrenched in the economy.

He seemed to share Philip Lane’s perspective, the bank’s chief economist, who stated in an interview that the ECB would hike interest rates again in December and next year to combat inflation, though those rises might be less than the most recent ones.

Additionally, he urged moderation in wage increases and company margins, saying that doing so “may greatly assist the ECB in tackling inflation.”

Tuesday saw the dollar give up significant overnight gains when investors fled to safe-haven assets due to anxiety over COVID flare-ups in China. However, the risk aversion might continue as long as China’s restrictions increase.

“The safe-haven appeal of the U.S. dollar is coming back into vogue as the concerns around China and the outbreaks from COVID are keeping markets nervous,” said Rodrigo Catril, a currency strategist at National Australia Bank (NAB).

EUR/USD key events today

Investors will pay attention to speeches from FOMC members, including Mester, George, and Bullard. These speeches will likely contain clues on future monetary policy.

EUR/USD technical outlook: Lower low confirms the new bearish trend

Looking at the 4-hour chart, we see the price trading below the 30-SMA and the RSI below 50, showing bears are in control. The bearish trend comes after the price broke below the 30-SMA and the 1.0301 support, making a lower low.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Currently, the price is pulling back and might retest the recently broken 1.0301 key level before the bearish trend resumes. If bears can keep control, the price will likely fall to the next support level at 1.0100. However, if the price breaks back above the 30-SMA, bulls will look to retest the 1.0450 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.