- The pair might get to parity due to the growing monetary policy divergence.

- The Eurozone is economically vulnerable, making it hard for the ECB to be aggressive.

- Investors are awaiting Lagarde’s speech for pointers on the way forward.

Today’s outlook for EUR/USD is bearish as the Eurozone’s economic outlook further darkens and the dollar rallies on its safe-haven status. There was once a time when banks in the US bought one Euro for one dollar.

-Are you interested to find high leverage brokers? Check our detailed guide-

That was back in 2002 when the EUR/USD was at parity. Investors have debated whether this price level might be seen again, and now it seems likely that the pair will get to parity.

The ECB is in a tight spot. On the one hand, there is the beast called inflation, and on the other, there is the monster called recession. Fighting one means turning your back on the other and possibly getting beaten. If the ECB decides to fight inflation by raising rates, the Eurozone might tip into a recession. How can the Fed, which faces the same enemies, raise rates so aggressively while the ECB crouches in the shadows?

The Eurozone is in a very vulnerable position compared to the US. The region is hugely dependent on Russian gas, which might be cut off at any moment with the Ukraine war. For this reason, the likelihood of a recession is higher, leading to a growing divergence in monetary policy between the Eurozone and the US.

EUR/USD key events today

EUR/USD investors are waiting for ECB president Lagarde’s speech, which is expected to give clues on the central bank’s plans to weaken the Euro. There will also be a jobs report from the United States, which might cause a lot of volatility for the pair.

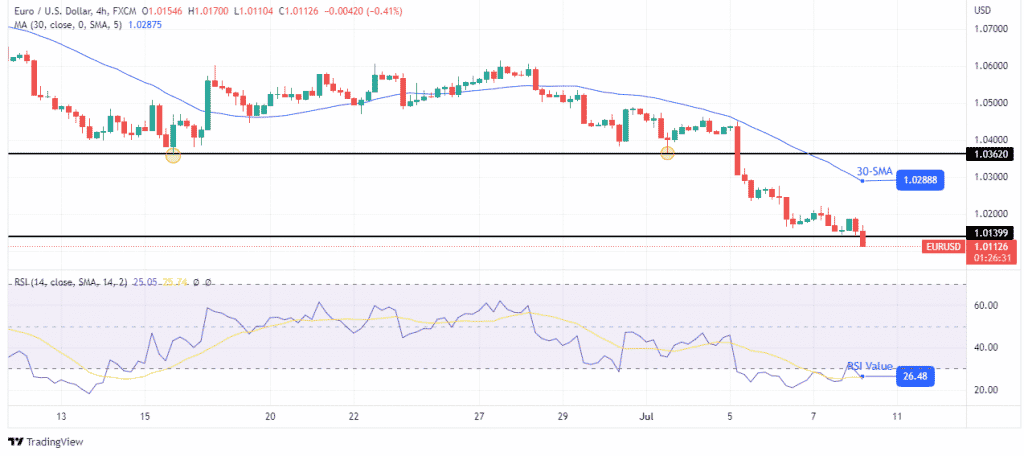

EUR/USD technical outlook: Bears heading for 2002 lows

Looking at the 4-hour chart, we see prices last seen in the year 2002. EUR/USD is heading for parity at 1.00000, and the bears are not stopping. The price is trading well below the 30-SMA, and the RSI is oversold, showing how strong bears have been. The price has just broken below 1.01399, which last acted as resistance on November 11th, 2002.

-Looking for high probability free forex signals? Let’s check out-

If bulls come in because the price is currently oversold, we might only see a short pullback before the price collapses further. The next stop for EUR/USD is at parity, a critical psychological level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money