- Traders are refraining from making big moves before the US inflation data.

- US inflation will provide a clearer picture of interest rates’ direction.

- There are continued problems associated with natural gas supply restrictions in the eurozone.

Today’s EUR/USD outlook is slightly bullish. The euro was mostly flat on Thursday after temporarily reaching a seven-month high versus the dollar on Wednesday. It stayed inside a small range as traders refrained from making big moves before the US inflation data. The report will provide a clearer picture of interest rates’ direction.

–Are you interested in learning more about forex robots? Check our detailed guide-

The dollar has recently been on the back foot as traders anticipate the Federal Reserve won’t need to hike rates as quickly and as high as previously thought to tame stubbornly high inflation. The euro reached $1.07765 on Wednesday, its highest level since May 31.

Since reaching a 20-year high in September, the dollar’s value against the euro has fallen by roughly 12% as data indicates that the Fed’s rate hikes are slowing the economy.

According to futures pricing, markets currently favor a 3/4 chance of a quarter-point raise next month, with the Fed’s target rate rising to 4.947% in June before tumbling to 4.465% by December.

While the euro has benefited from the eurozone’s improved growth prospects, Isabella Rosenberg, an analyst at Goldman Sachs, suggested that the absence of inflows into the common currency may be caused by continued problems associated with natural gas supply restrictions.

Due to a mild winter and high inventory levels, natural gas prices have decreased to their lowest point in almost a year and a half. However, concerns about Russia’s conflict in Ukraine, which halted shipments last year, still exist.

EUR/USD key events today

Investors are anticipating the US inflation report, which will likely reveal that inflation dropped in December. The pair will probably experience some volatility as a result.

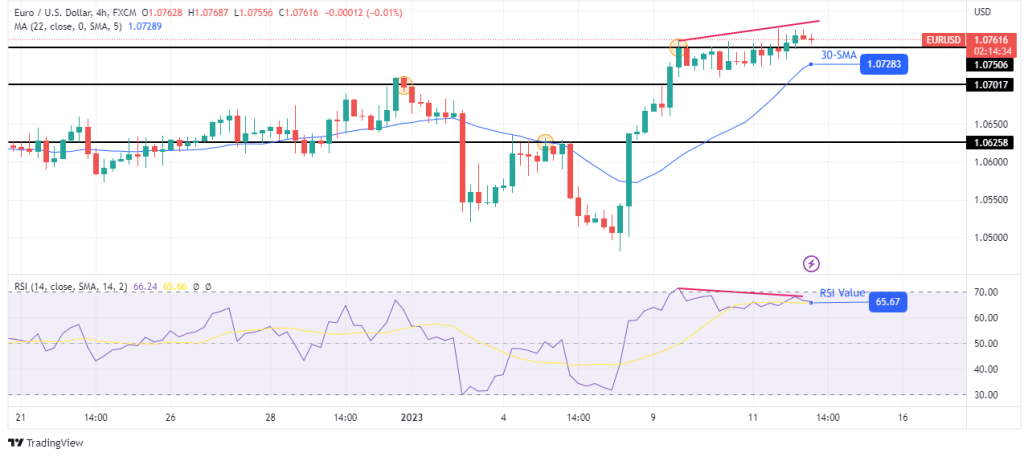

EUR/USD technical outlook: Bearish divergence points to weakness

The 4-hour chart shows EUR/USD in a bullish move, with the price trading slightly above the 1.0750 resistance level. The bullish move is supported by the 30-SMA, below the price, and the RSI, above 50.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

However, there is weakness in the move, as seen in the small candles and the bearish RSI divergence. The bulls need to regain their strength for this move to continue. Otherwise, we might see a break below the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money