- In the short term, the EUR/USD consolidates its greatest daily weekly losses.

- China’s PMI from Caixin Services and remarks from Fed policymakers suggest that a corrective retreat is warranted.

- Bears hope to face Sino-US tensions over Taiwan and fears of Fed aggression.

The EUR/USD outlook shifts to slightly bearish as the pair retraced from monthly highs yesterday. The regain attempts were capped by 1.0200. In the meantime, the major currency pair incorporates Wednesday’s morning market sentiment changes.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The US-China dispute over Taiwan is challenging risk appetite, and recent stronger Caixin Services PMI data seems to remind EUR/USD buyers of the pair ahead of much European and US data. According to the Dragon Nation Private Service score, it has increased to 55.5 from a previously expected 48 or 54.5. The S&P 500 futures climbed 0.15%, while the 10-year Treasury yield fell three basis points (bps) to 2.71%.

Furthermore, Federal Reserve System (FRS) policymakers’ mixed signals boost EUR/USD buyers’ confidence. The St. Louis Federal Reserve president dismissed fears of a recession in favor of raising interest rates by 50 basis points (bp). According to Reuters, San Francisco Fed President Mary Daly said she was seeking input to determine whether to cut interest rate hikes or keep them the same. However, Chicago Fed President Charles Evans said that if inflation did not improve at its September meeting, the Fed should raise rates by 50 basis points (bp). Furthermore, Cleveland Fed President Loretta Mester said the job market is doing well and that the country is not in a recession. However, when it came to inflation, she noted that it “hasn’t decreased at all.”

China’s warnings to the US not to play the Taiwan card, promises to punish Taipei for independence, and blocking natural sand exports to Asian economies seemed to spoil sentiment and dampen the US dollar.

A recent report from the European Central Bank (ECB) suggesting that economic conditions are improving in the bloc could also support the EUR/USD rally. In a preliminary reading of a monthly bulletin published by Bloomberg, the ECB stated that financial support to Eurozone economies boosts GDP while lowering inflation.

What’s next to watch for the EUR/USD?

As we look ahead, the German trade data for June will follow the final Eurozone PMIs for July and the June Block Retail Sales to provide support for EUR/USD bulls in advance of the US manufacturing orders data for June and July ISM Services PMI amuse. If the data from the region comes in better than expected, the pair may see further gains, given the recent buoyancy in the market.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

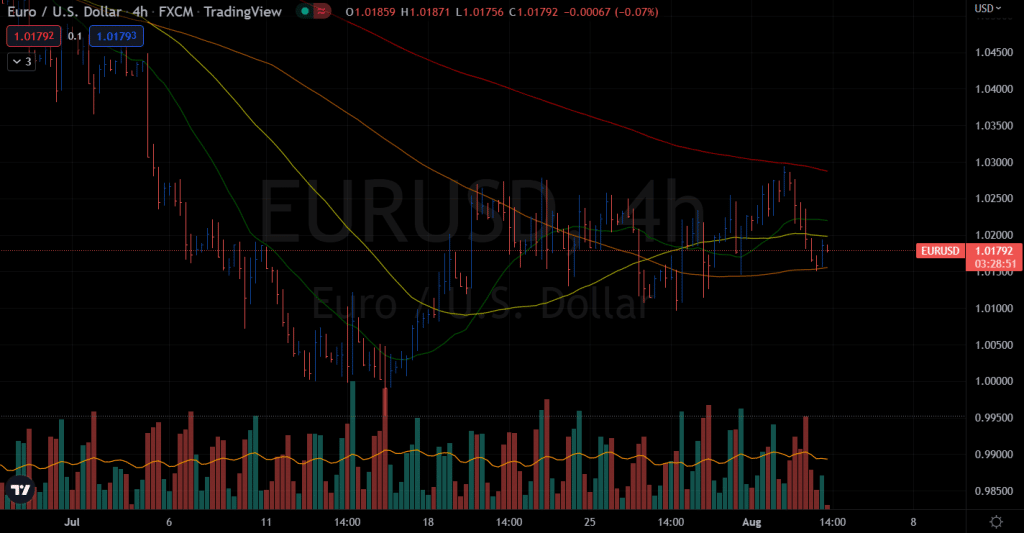

EUR/USD price technical outlook: Ranging between 50 and 200 SMAs

The 4-hour chart for the EUR/USD shows a ranging behavior as the price remains trapped between the 200-period and 50-period SMA. However, the price action shows a weakening Euro that may break below the 50-period SMA and aim for July 27 lows of 1.0950. Alternatively, the pair may surge higher towards 1.0250 ahead of 1.0300 if the buyers jump in at the current level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.