- Lagarde believes financial market volatility might assist the ECB in lowering inflation.

- The ECB increased the interest rate on bank deposits by 50 basis points to 3%.

- Investors have reduced bets on ECB’s peak rate to 3.1%.

Today’s EUR/USD outlook is bullish. According to ECB President Christine Lagarde, financial market volatility might assist the central bank if it reduces demand and inflation.

-If you are interested in forex day trading then have a read of our guide to getting started-

Lagarde emphasized that market turmoil won’t stand in the way of the ECB’s fight against inflation and that it may even help it. This was said in response to investors’ and bankers’ concerns about the possibility of a financial crisis.

This was a reference to the fact that increased central bank interest rates and banking industry fears frequently have the same result of limiting lending and slowing economic growth.

On Thursday, the ECB increased the interest rate on deposits to the bank by 50 basis points to 3%. On Monday, Lagarde reiterated that the inflation outlook alone would justify further rate increases.

She remained noncommittal nevertheless, probably worried that market volatility may drastically alter the outlook.

Investors have reduced their bets on how far the ECB will raise the deposit rate this year from over 4% only two weeks ago to 3.1%.

Lagarde strongly refuted the claim made by certain critics that the ECB will be forced to choose between battling inflation and protecting financial stability. This was during a meeting before the European Parliament’s Committee on Economic and Monetary Affairs.

According to Lagarde, banks in the Eurozone were resilient, with their exposure to Credit Suisse being in the millions of euros rather than billions.

EUR/USD key events today

Investors will be keen on another speech from ECB President Lagarde and an existing home sales report from the US. They are expecting an increase in existing home sales.

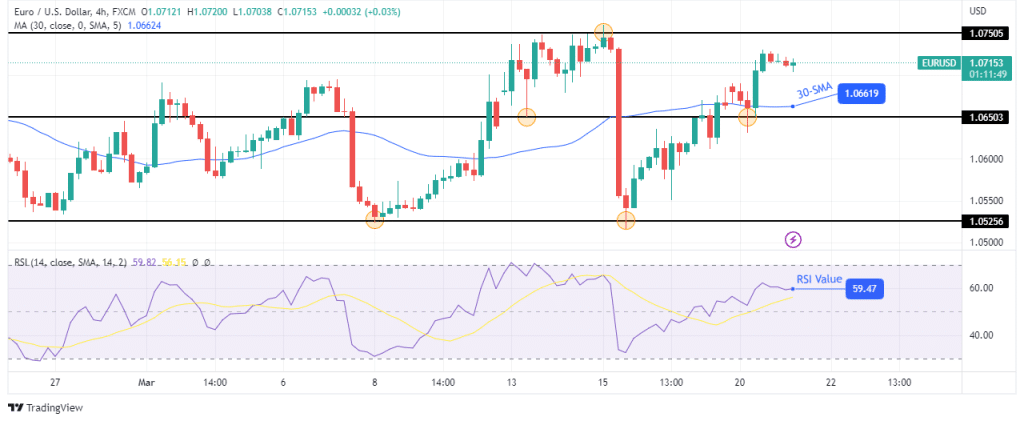

EUR/USD technical outlook: Bulls are eyeing the next resistance at 1.0750

The 4-hour chart shows EUR/USD moving up after breaking above and retesting the 1.0650 key level. The price also broke above the 30-SMA with the RSI crossing above 50, all signs of a shift in sentiment to bullish.

-Are you looking for automated trading? Check our detailed guide-

Bulls are visibly stronger than bears, as seen in the candle sizes. Bears have returned for a retracement, but the bullish move will likely continue, with bulls looking to take out the 1.0750 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.