- EUR/USD gained after ECB meeting but couldn’t sustain.

- ECB was not hawkish, but US inflation could still keep the Euro bid.

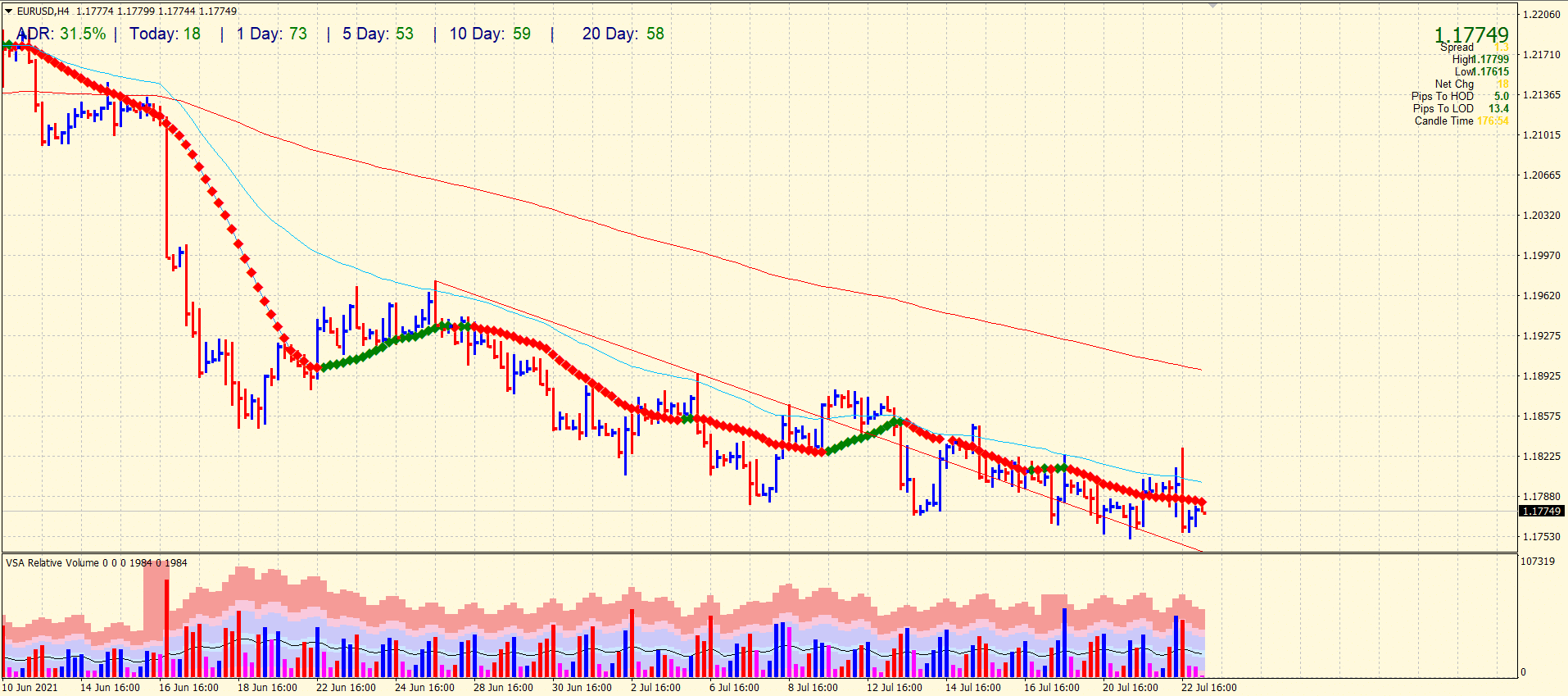

- The technical picture is neutral to bearish at the moment.

The EUR/USD outlook on Thursday, July 22, continued to move very sluggishly until the moment when the results of the ECB meeting began to be announced.

During the summing up of the meeting and their announcement, the pair began to jump from side to side and eventually began an upward movement. We will consider the results of the ECB meeting a little below, but for now, we want to say that there was a very little hawkish tone in the ECB’s rhetoric.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Nevertheless, the European currency, following the British Pound, began to rise. We had reiterated a similar scenario in previous stories. We drew traders’ attention to the fact that the Euro has been very reluctant to fall lately. On the contrary, it practically crawled down, suggesting that the markets are not eager to invest in the Dollar and sell off the Euro. Thus, we believed that the markets were just waiting for the right moment to start a new wave of buying. In principle, this is exactly what happened yesterday. The rhetoric of the ECB and Christine Lagarde again did not contain any “hawkish notes”.

Nevertheless, the European currency rose after the meeting and only after a while began to fall again. We would like to draw your attention to the fact that the EUR/USD pair reached the level of 1.1700, which we called the target within the framework of the new global round of the corrective movement.

We expected that both the Euro and the Pound would resume their upward movement shortly. At the moment, it is too early to draw final conclusions, but the beginning of new trends for the Euro and the Pound can be laid. Even if the Euro is still slightly lower in the coming days. We also remind you that the fundamental global factor in injecting trillions of Dollars into the American economy under the QE program has not gone anywhere. This means that the money supply in the country, like inflation, continues to increase. Therefore, it is very difficult for the American currency to rise at this time.

Now let’s consider the results of the ECB meeting. First, the European Central Bank very predictably left the key rate unchanged and did not make any adjustments to the volume of the PEPP program.

The only thing that the ECB said is that the pace of asset purchases under the PEPP program will remain “much higher than at the beginning of the year.” Agree, this is a bearish factor for the European currency. Also, the ECB’s Monetary Committee said that key rates will remain at current levels or lower until inflation stays stable at 2%.

Thus, the PEPP program will continue until the end of March 2022, or until the regulator decides that the crisis caused by the “coronavirus” is behind and no longer has a devastating effect on the economy. Moreover, reinvestment of payments on securities purchased under the PEPP program will continue until the end of 2023.

–Are you interested to learn about forex robots? Check our detailed guide-

EUR/USD technical outlook: Bears holding dominance

Technically, the pair remains bearish under the 1.1800 mark. We saw a sudden jump yesterday that surpassed the 20 and 50-period SMAs on the 4-hour chart. However, the price returned back below both Mas. The volume of the down bar was very high. Right now, the volume is declining. It shows that bears are trying to gain further strength. We can expect a play of range between 1.1750 to 1.1800. We need a clear breakout of the range to find directional bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.