- EUR/USD manages to rise beyond 1.1750 as risk sentiment improves.

- Better Eurozone data continues to provide support to the Euro.

- Delta variant is still a concern that may keep the gains in Euro limited.

The EUR/USD outlook is slightly positive on the day as the price surged beyond mid-1.1700 during the European session. The recent surge is attributed to improved risk sentiment on the day and some upbeat Eurozone data.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The trade balance of the Eurozone in June amounted to 12.4 billion Euros against the expected 9.3 billion Euros. As a result, exports were down 0.7% MoM, while imports were generally more stable in June as trade conditions continue to normalize over time as the pandemic resumes.

The wholesale price index in Germany for July came at + 1.1% against the forecast of + 1.3% m / m. Another month – another jump in wholesale prices amid continuing inflation and disruptions in the supply chain. The increase in the monthly annual rate is the highest since October 1974.

European indices rose slightly during trading hours but gradually increased profits in August trading. The DAX touched 16,000 for the first time, and the price saw record highs this week.

While concerns about the Delta variant remain a risk factor, the valuation of European equities is much better than the US equities. Thus, it is difficult to combat accommodative policy despite all the talk of tapering/normalization policies.

The market participants await University of Michigan consumer sentiment and inflation expectation figures to provide fresh stimulus to the pair.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

EUR/USD technical outlook: Bulls finding strength at key levels

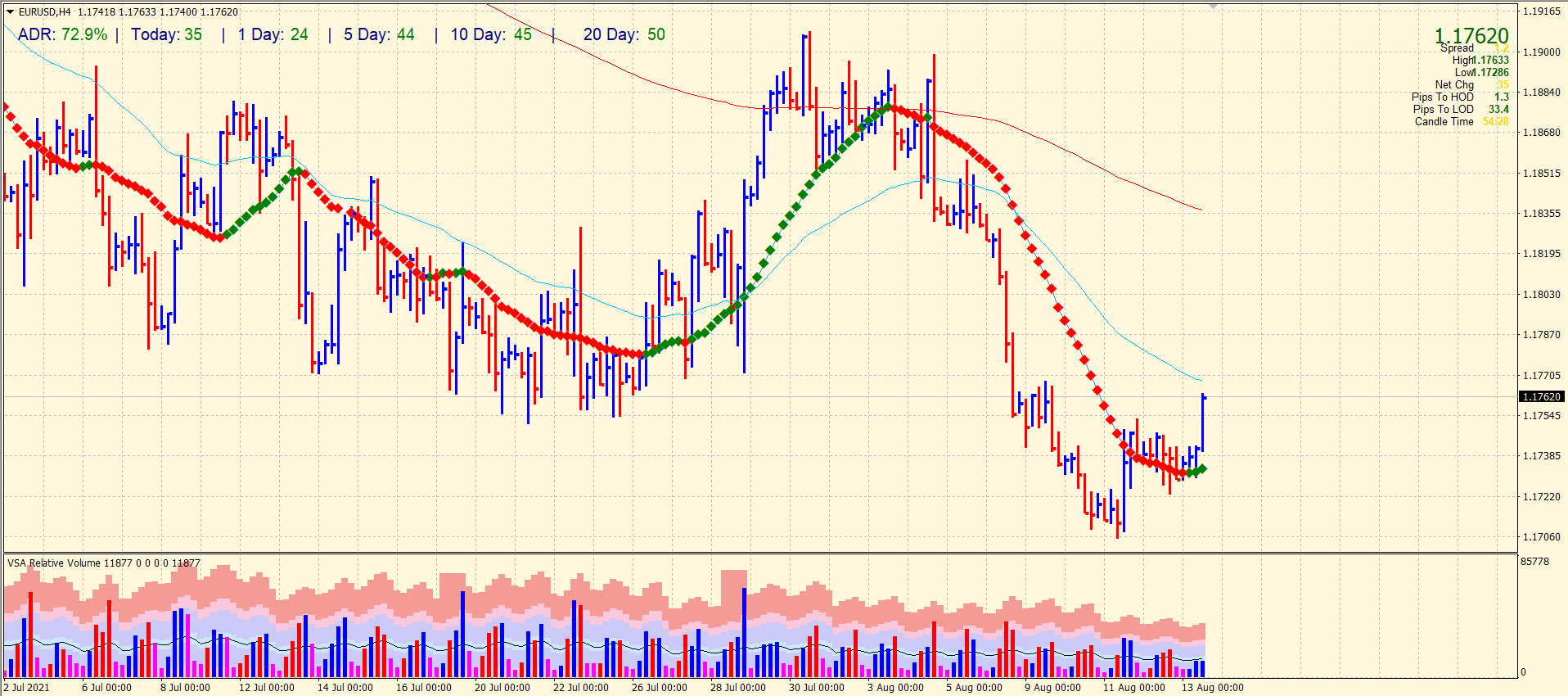

The EUR/USD price rallies to 1.1760 and is testing July lows (now resistance). It will be a key region to watch daily as sellers seek to lock in at 1.1700 after failing to break 1.1704-11 support earlier this week.

In other words, sellers tried to break the support below 1.1704-11 but failed. Technically, they have maintained some semblance of control below 1.1750-55, but if buyers manage to break this range, sellers will see a loss of momentum.

The price has been able to move above the 20-period SMA on the 4-hour chart. The average daily range has been 71% so far. It signals room for more gains. However, the volume bars are very low. It means the upside may lose traction on the ways as it could only be a corrective wave that may meet fresh selling near 1.1800.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.