- The risk of recession for many countries has grown, as announced by the World Bank.

- Janet Yellen expects inflation in the US to remain high.

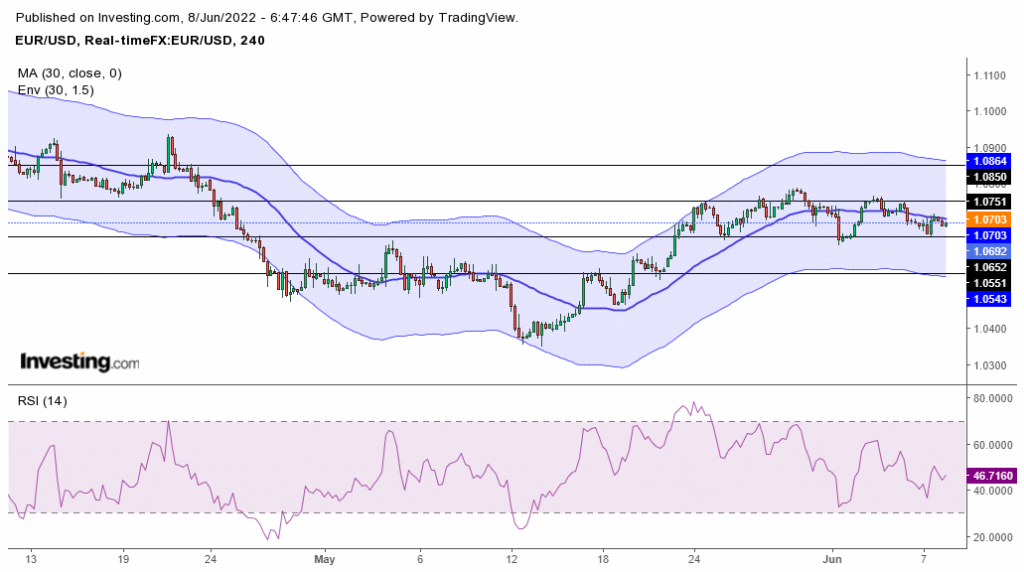

- EUR/USD is consolidating in the charts.

The EUR/USD outlook remains neutral even though it closed slightly higher on Tuesday, though on a largely undecided candle with large wick. The wicks show there was a lot of activity in the market, but there was indecision at the end. The pair is pushing lower on Wednesday morning.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

There was panic in the markets after the World Bank dropped its global growth forecast to 2.9% for 2022. The bank went on to say that the Ukraine war had made the damage from the pandemic worse, and many countries now faced recession.

At the same time, Janet Yellen, the US Treasury Secretary, told senators that she expected inflation to stay high and predicted an increase in the Biden administration’s 4.7% inflation forecast. This news gave the dollar strength against the euro.

All eyes are on the ECB meeting tomorrow, and markets are expecting the bank to start working towards rapid rate hikes.

EUR/USD key events today

EUR/USD investors will be paying attention to GDP data for the Euro Area, which they expect to hold at the previous values. There will be the weekly crude oil inventory data from the US, which will show the state of demand in the country.

However, these releases might not be enough to push the EUR/USD out of its current consolidation as investors wait for tomorrow’s ECB meeting. Some wonder whether the ECB could surprise the markets, and investors are likely to remain undecided until then.

EUR/USD technical outlook: Bears attempting a break of the range

The 4-hour chart shows the price is trapped in a sideways move between the 1.0750 and 1.0650 levels. The pair is chopping through the 30-SMA, showing indecision in the markets. Bulls and bears are testing each other to see who emerges victorious.

-Are you interested in learning about the forex indicators? Click here for details-

A victor will be chosen when the price breaks out of the current range. A break above 1.0750 would be a win for the bulls, and they could push the price to 0.0850. A break below 1.0650, on the other hand, would be a win for the bears, and they could push the price to 1.0550.

Bears are in charge in the short-term as RSI trades below the 50 level within the range.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money