- Despite rising above 1.1200, EUR/USD is vulnerable.

- EUR/USD will continue to be undermined by Hawkish Fed and European covid curbs.

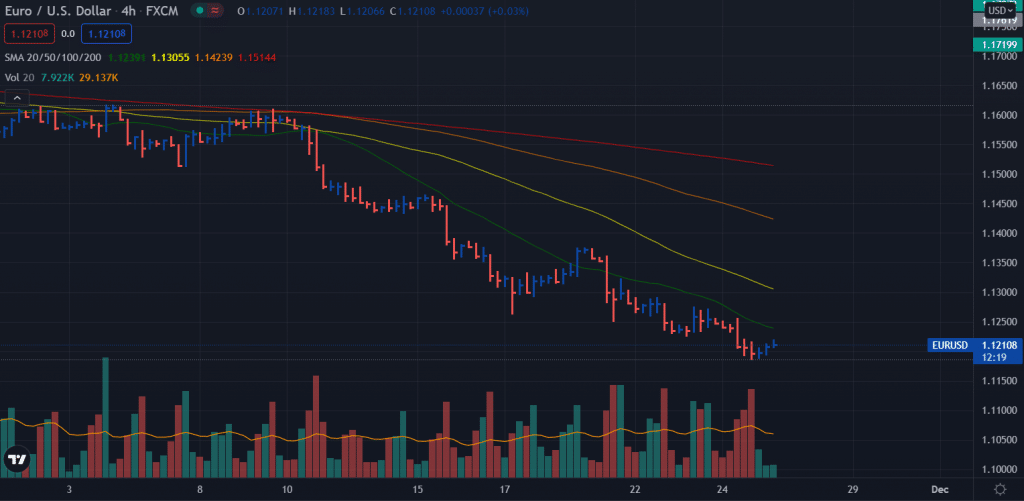

- While the 4-hour chart is below the 20-SMA, downside risks remain intact.

The EUR/USD outlook remains neutral to bearish despite the mild gains in the Asian session. The Greenback remains strong across the board in a broad trend.

–Are you interested to learn more about forex signals? Check our detailed guide-

Despite its sustained rebound from 2021 lows of 1.1186, EUR/USD is now above 1.1200. Despite a cautious sentiment after Thanksgiving, the US dollar is falling along with US bond yields.

European restrictions and political divergences are expected to keep the euro under pressure in the run-up to the ECB minutes and speeches by several ECB politicians, including President Christine Lagarde.

A government spokesman warned the country’s Covid-19 incidence is expected to rise to 200 in the coming days after Austria announced nationwide isolation last week.

Germany is reportedly planning on tightening Covid-19 restrictions and may even opt for full isolation thanks to the daily record infections and increasing pressure on hospitals.

Dollar prices will likely remain supported by Fed spokeswoman Mary Daly’s restrictive remarks combined with the Fed’s protocol, which favors faster throttling and earlier rate hikes.

EUR/USD price technical outlook: Bulls lack follow-through

The EUR/USD price gained slightly above the 1.1200 mark. However, the selling volume for the previous few bars suggests that the up wave will be minor and won’t find any follow-through momentum. Hence, we expect the upside to be strong resistance around the 20-period SMA on the 4-hour chart near the 1.1240 area. Furthermore, further resistance is seen around the 1.1300 handle.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

On the flip side, if the bearish sentiment resumes, we may see a deeper correction towards the 1.1000 level as the greenback strength remains unabated.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.