- EUR/USD price fell on upbeat US PPI data.

- The pair maintains a tight range, giving no breather to the buyers.

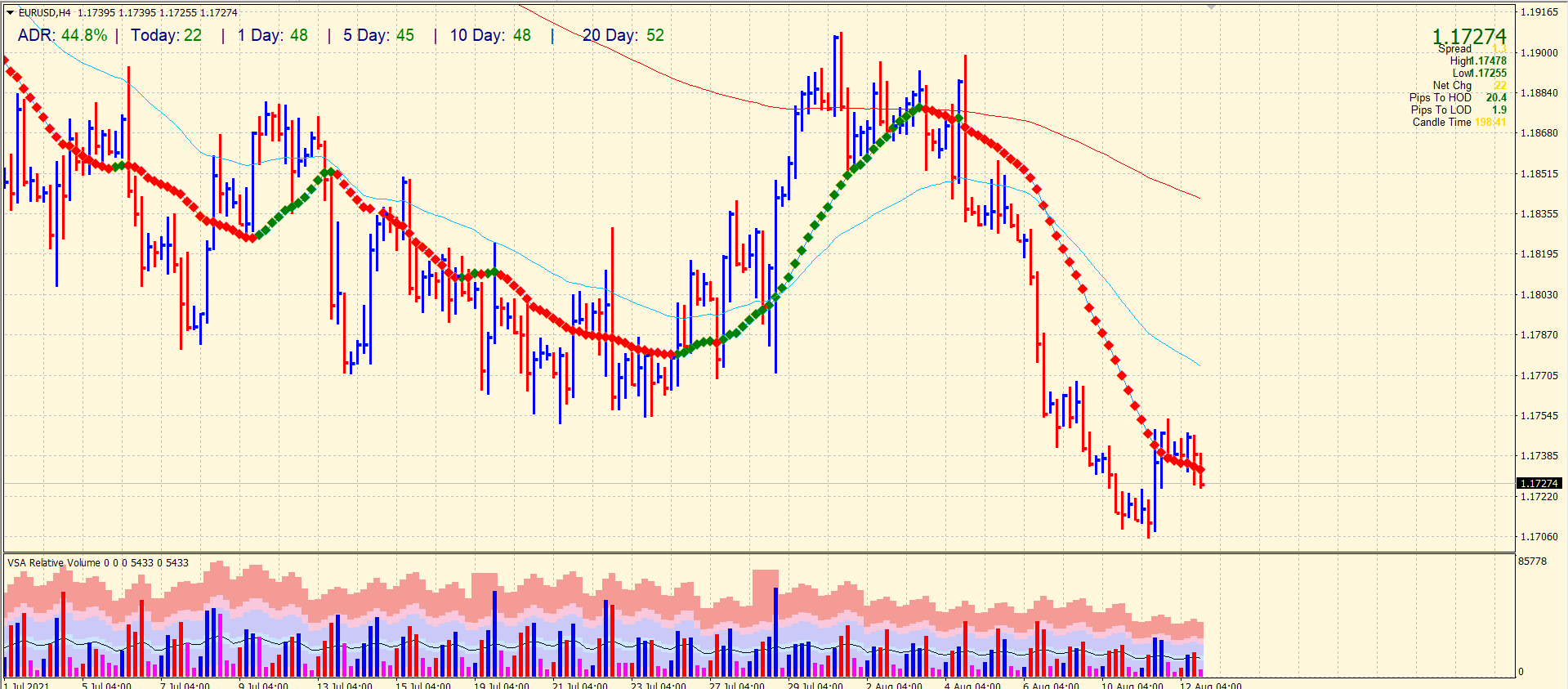

- The price remains confined within the 1.1700 to 1.1750 range.

The US PPI data and government announcements pushed the EUR/USD outlook to a new daily low. The United States PPI increased by 1.0% in July, beating the 0.6% estimate.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

It has come in line with 1.0% growth in June. Moreover, the Core PPI registered a 1.0% growth, exceeding the 0.5% forecast, while the Unemployment Claims dropped from 385K to 375K as expected. So, the USD could increase in the short term versus its rivals after these positive economic figures.

Yesterday the pair rose after the CPI came in as expected, but still 5.4% y / y. This is higher than other global inflation indicators (Germany 3.8%, UK 2.5%, France 1.2%). Within the swing range mentioned above, the high stalled between 1.1751 and 1.17566.

On the same day, Eurostat reported that Industrial Production decreased by 0.3% in the euro area for June. The reading was slightly worse than the market expectation of a 0.2% drop and was mostly ignored by market participants.

EUR/USD technical outlook: Bears looking to break 1.1700

The EUR/USD price is wobbling around 20-period SMA on the 4-hour chart. The volume for the last few bars is quite encouraging for the bears. The average daily range has been 42% so far. Thus, it seems like the volume and volatility are dried up. However, the 1.1700 swing low of the August and multi-month low is still holding. Therefore, we can expect some support to be seen at the level. On the upside, 1.1750 continues to resist gains.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Today’s high has stalled below the swing higher between 1.1751 and 1.17566 (red circles and yellow areas). We stay at the bottom and are more bearish. Technical sellers could be encouraged to take short positions if this level is breached (and perhaps make traders more worried about moving higher).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.