- EUR/USD has consistently closed below the three-month average target.

- If this pattern persists, there may be substantial downside in the next three months.

- The FXStreet Forecast Poll provides in-depth sentiment for selected financial assets.

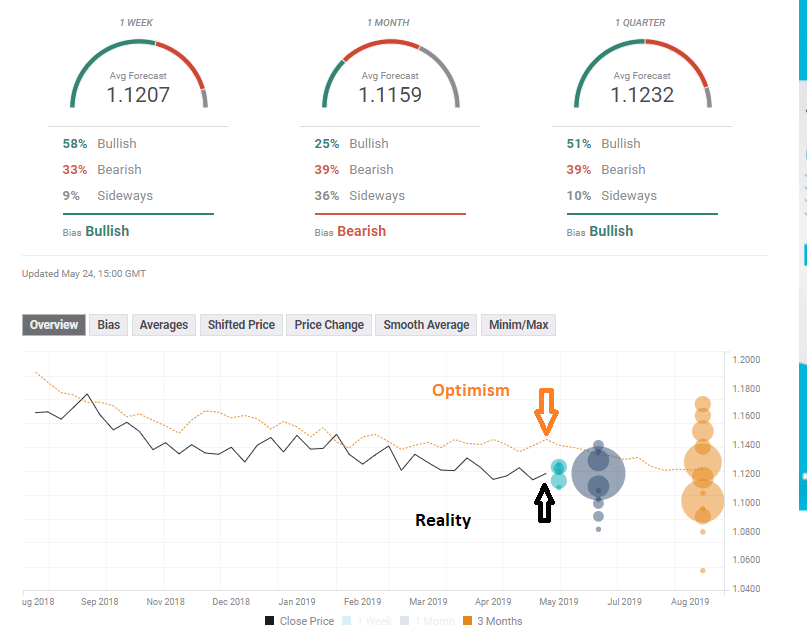

Experts’ average target for EUR/USD has been very close to the weekly closing price in the following week – but the same does not apply for the three-month projection. The relative accuracy in the short-term can be attributed to the low volatility the pair has experienced of late, while the long-term misses are natural – it is harder to predict further ahead into the future.

We may have left it alone if the three-month forecasts had missed both to the upside and to the downside. However, these long-term targets have consistently been below the closing prices in the next 90 days.

The chart below shows how the actual closing price (in black) is repeatedly below the forecast provided three months beforehand (in orange).

For example, EUR/USD’s final price on Friday, May 24th, stood at 1.1205, while the forecast for that date was 1.1442 – a miss of 237 pips.

If we examine the previous weeks we see gaps of 237, 111, 279, and 160 pips. While the gap varies, it is always in one direction, with the average in the past five weeks standing at 205 pips.

Looking forward, the target for the next three months is 1.1232 on August 16th. If the trend persists and experts miss the mark by 205 pips on average, the target is 1.1027, which is still a hefty decrease, despite the recent rout.

If it indeed falls, what levels should we look at? The Dukascopy team says:

The EUR/USD has once more bounced off a lower dominant trend line. The bounce off happened near the 1.1100 level. In regards to the future, expect the rate to wait for the 55-day SMA, which would provide the needed technical resistance to push through the just mentioned support line.

Nevertheless, the USD has its own reasons to fall. Here is Dmitry Lukashov:

The euro rose last week but there was nothing particularly good in the EU. The greenback was damaged due to data about U.S. manufacturing activity for May, displayed its weakest pace of growth in almost a decade. The Fed is going to lower the rate. This is an additional negative for the dollar.