- EUR/USD keeps its daily gains in the 1.1060/70 band.

- US-China trade jitters are back to the fore.

- Attention stays on ECB minutes, Lagarde, PMIs.

EUR/USD keeps trading within a narrow range in the 1.1060/70 band amidst the resurgence of some trade concerns the continuation of the selling mood in the buck.

EUR/USD looks to data, trade

Spot is up for the third session in a row on Monday, prolonging the bounce off recent 5-week lows in the 1.0990/85 band, always on the back of the unremitting selling pressure in the greenback and some fresh trade concerns.

In fact, Chinese officials expressed some concerns earlier in the session regarding the sign of the ‘Phase One’ deal after President Trump is said to have ruled out the roll over of some tariffs. These corcerns translated into lower US yields and some renewed inflows to the safe havens, undermining further the mood around the dollar.

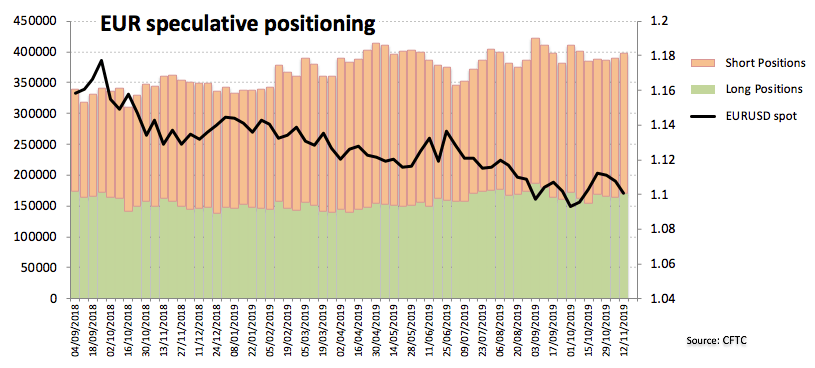

On another direction, the speculative community maintained their positions roughly unchanged during the week ended on November 12, taking EUR net shorts to 2-week lows as per the latest CFTC Positioning Report.

In the docket, the ECB’s C.Lagarde is due to speak in Frankfurt later in the week, while investors should be closely following the release of the ECB minutes and the preliminary prints of November’s PMIs in core Euroland.

What to look for around EUR

Spot is prolonging the rebound from last week’s lows in sub-1.10 levels, always underpinned by the renewed weakness around the greenback and hopes of a US-China trade deal. On the macro view, the outlook in Euroland remains fragile and does nothing but justify the ‘looser for longer’ monetary stance by the ECB and the bearish view on the single currency in the medium term at least. In this regard, all the attention will be on the publication of flash PMIs for the current month later in the week.

EUR/USD levels to watch

At the moment, the pair is gaining 0.10% at 1.1060 and faces the next up barrier at 1.1067 (high Nov.18) followed by 1.1093 (100-day SMA) and finally 1.1179 (monthly high Oct.21). On the downside, a breach of 1.0989 (monthly low Nov.14) would target 1.0925 (low Sep.3) en route to 1.0879 (2019 low Oct.1).