- Spot keeps the familiar range around 1.1150 on Monday.

- US-GE yield spreads rebound to 252 pts., daily tops.

- US Core PCE came in flat MoM in April.

The positive note remains well and sound around the European currency following results from the US docket, with EUR/USD gyrating around the 1.1150 region.

EUR/USD upside capped near 1.1170

Spot remains bid following today’s publications in the US calendar, where inflation figures gauged by the Core PCE came in flat on a monthly basis in March and rose 1.6% from a year earlier, both prints missing consensus.

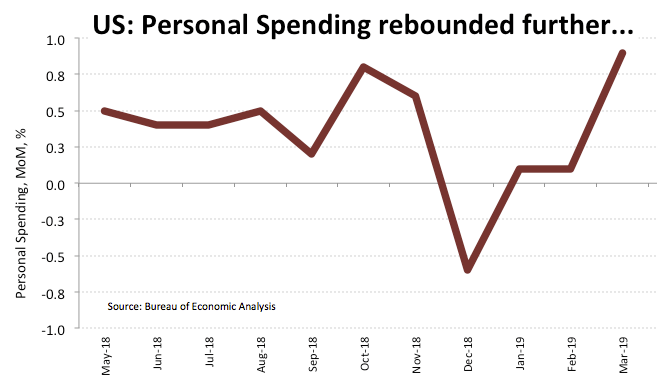

Further data saw Personal Income expanding 0.1% inter-month and Personal Spending rising 0.9% MoM, beating forecasts.

In the meantime, the pair saw a brief knee-jerk to the 1.1150/45 band in the wake of the data releases amidst a strong rebound in yields of the US 10-year benchmark, which in turn pushed US-GE to fresh tops, favouring the buck.

What to look for around EUR

The broad-based risk-appetite trends and USD-dynamics are posed to rule the sentiment surrounding the European currency for the time being, all in combination with the onoging US-China trade dispute and potential US tariffs on EU products. Recent weak results from key fundamentals in the region plus a now unlikely rebound in the activity in the second half of the year have added to the prevailing concerns that the slowdown in the region could last longer that initially estimated and the ECB is therefore likely to remain ‘neutral/dovish’ for the foreseeable future (say until mid-2020?). On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections in late May, as the populist option in the form of the far-right and the far-left movements appears to keep swelling among voting countries.

EUR/USD levels to watch

At the moment, the pair is up 0.16% at 1.1157 and a breakout of 1.1174 (high Arp.26) would target 1.1230 (21-day SMA) en route to 1.1280 (55-day SMA). On the flip side, initial contention emerges at 1.1109 (2019 low Apr.26) seconded by 1.0839 (monthly low May 11 2017) and finally 1.0569 (monthly low Apr.10 2017).