- The bias is bullish after taking out the immediate resistance levels.

- The FOMC could bring sharp movements today.

- The R2 is seen as the first upside obstacle.

The EUR/USD price rallied after the US inflation data was released. The pair climbed as high as 1.0673, registering a new high yesterday.

Now, it has retreated a little and is trading at 1.0630 at the time of writing. Despite minor corrections, the bias remains bullish, so further growth is in the cards.

-Are you looking for automated trading? Check our detailed guide-

The US inflation figures weakened the USD. The CPI m/m reported a 0.1% growth versus the 0.3% growth expected, while Core CPI registered only a 0.2% growth compared to the 0.3% growth estimate. As you already know, lower inflation helps the Federal Reserve to deliver lower hikes.

Today, the FOMC represents a high-impact event. The FOMC Press Conference, FOMC Statement, and the FOMC Economic Projections could shake the markets resulting in sharp movements on both sides. The Federal Funds Rate is expected to be increased from 4.00% to 4.50%.

The ECB is expected to increase the Main Refinancing Rate from 2.50% to 2.00%. In addition, the US retail sales data could also have an impact. So, the fundamentals will drive the markets during the week.

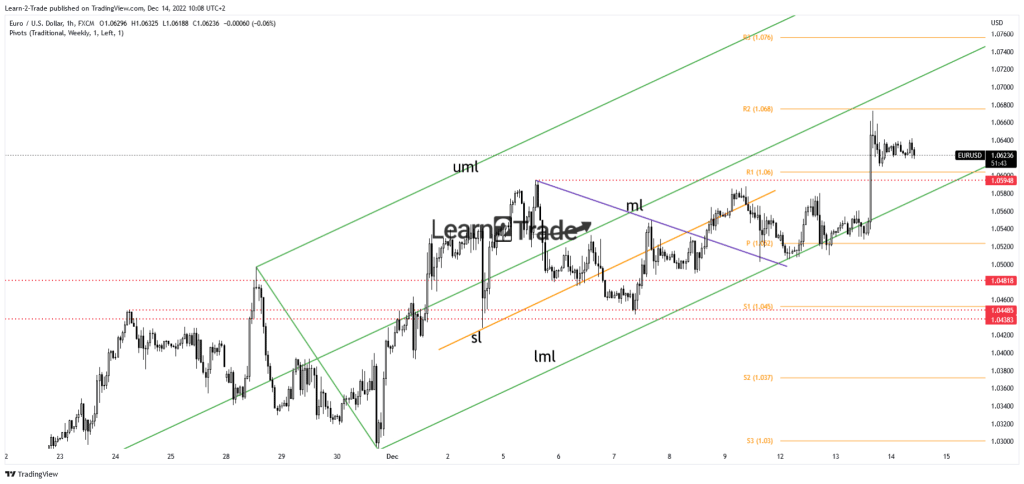

EUR/USD price technical analysis: Consolidating gains

Technically, the EUR/USD pair rallied after failing to stabilize below the ascending pitchfork’s lower median line (LML) and below the weekly pivot point of 1.0520. It has ignored the 1.0594 and the R1 (1.0600) upside obstacles signaling strong buyers and an upside continuation.

-If you are interested in forex day trading then have a read of our guide to getting started-

The bias remains bullish as long as it stays above these levels (resistance turned into support). The weekly R2 (1.0680) represents the first upside obstacle. An upside continuation, a larger growth could be activated only after making a new higher high, after taking out this static resistance. The current retreat and a sideways movement could bring new long opportunities. Testing and retesting the support levels could announce a new leg higher.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.