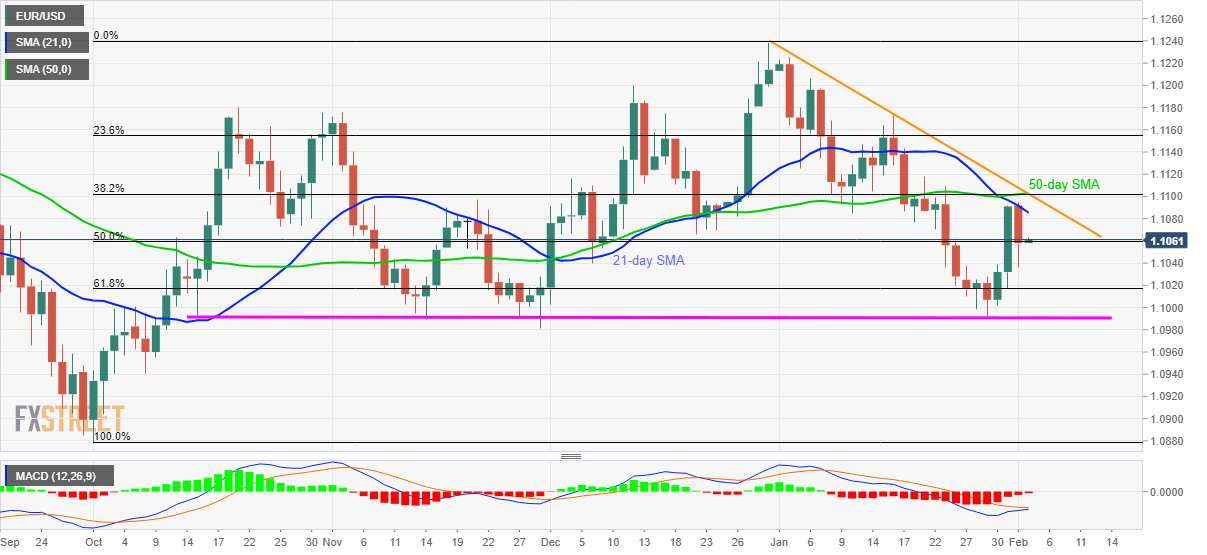

- EUR/USD remains below 21-day SMA, nears 50% Fibonacci retracement.

- A confluence of 50-day SMA, 38.2% Fibonacci retracement and five-week-old descending trend line offers the key resistance.

- 61.8% Fibonacci retracement, 1.0990/95 can please sellers during further declines.

EUR/USD recovers the previous day’s losses while trading around 1.1060 during early Tuesday. The pair recently took a U-turn from 21-day SMA but failed to stay longer below 50% Fibonacci retracement of its October-December 2019 upside.

With this, prices are likely to again challenge 21-day SMA level of 1.1085. However, 50-day SMA, 38.2% Fibonacci retracement and a short-term falling resistance line could keep challenging the buyers around 1.1100/05.

In a case where prices manage to provide a daily closing beyond 1.1105, January 16 high near 1.1175 and 1.1200/05 can offer intermediate halts during the run-up to December 2019 monthly top close to 1.1240.

Alternatively, 61.8% Fibonacci retracement near 1.1017, followed multi-week-old horizontal support around 1.0995/90, can limit the pair’s further declines.

EUR/USD daily chart

Trend: Pullback expected