- EUR/USD wavers inside a five-pip trading range after refreshing one-month high.

- Bullish MACD, sustained trading above 200-day SMA favor buyers.

- Six-week-old horizontal area adds to the upside barriers.

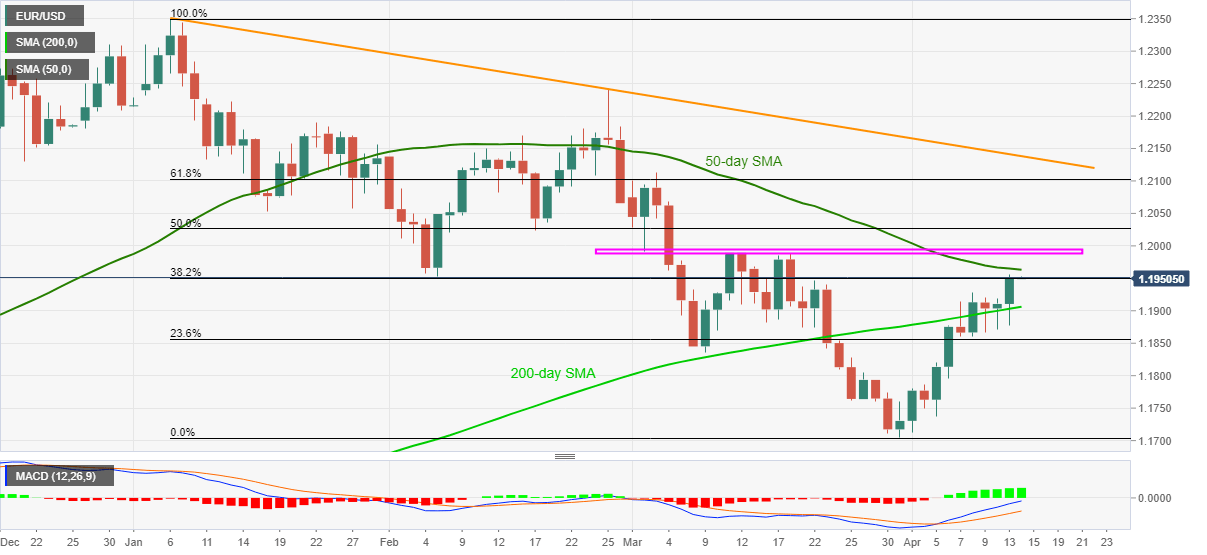

Having refreshed the highest levels since March 18 the previous day, EUR/USD bulls catch a breather around 1.1950 during Wednesday’s Asian session. In doing so, the quote seesaws around 38.2% Fibonacci retracement of January-March downside.

It should, however, be noted that the currency major’s ability to stay strong beyond 200-day SMA, backed by the strongest bullish MACD signals since early December 2020 suggests the quote’s further upside.

Though, a clear run-up past-50-day SMA level of 1.1965 becomes necessary for the EUR/USD buyers before confronting a horizontal area comprising multiple levels marked in March, around 1.1988-95.

It’s worth mentioning that the 1.2000 threshold and 50% Fibonacci retracement level of 1.2026 add to the upside filters.

Meanwhile, a daily close below the 200-day SMA level of 1.1906 can recall EUR/USD sellers targeting the early March low near 1.1835.

However, 1.1760 and the previous month’s low near the 1.1700 round-figure will question the pair’s any further weakness.

EUR/USD daily chart

Trend: Further upside expected