- EUR/USD rises in Asia despite losses in the S&P 500 futures.

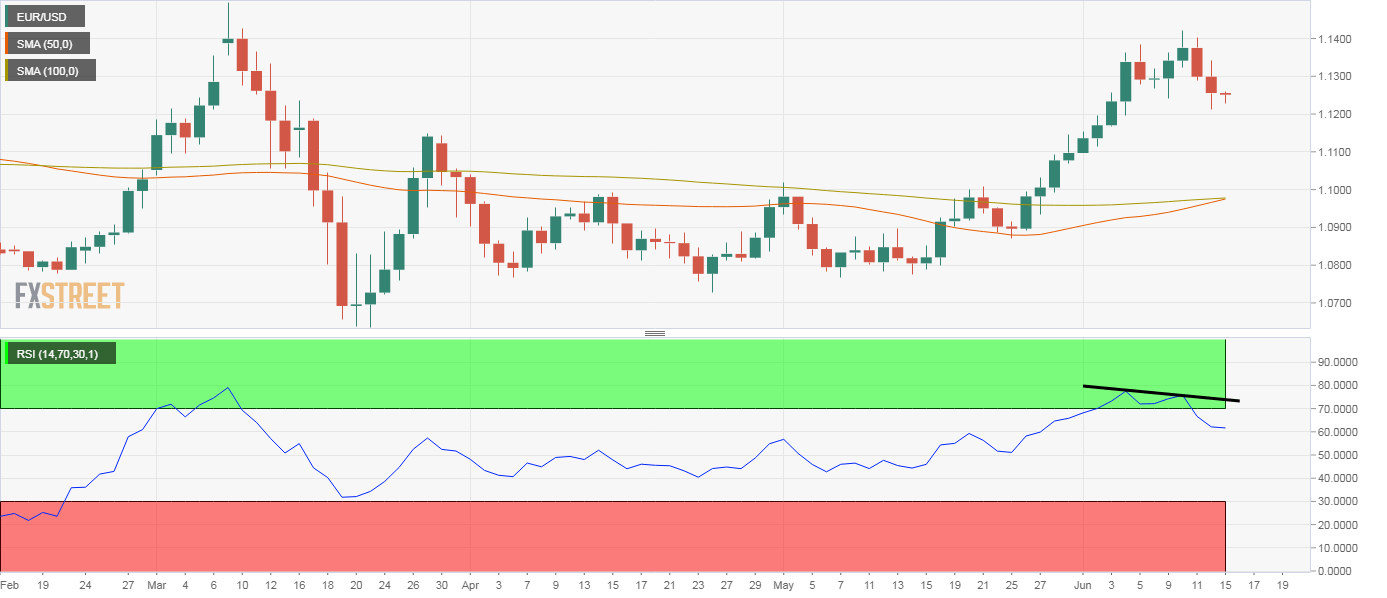

- The impending bull cross between key averages contradicts the bearish divergence of the RSI.

EUR/USD is trading near 1.1255 at press time, having found bids near 1.1225 during the early Asian trade.

The pair has added more than 25 pips despite strengthening fears of the second wave of the coronavirus and the resulting risk-off aversion, as evidenced by the 1% decline in the futures on the S&P 500. Dollar usually draws bids against the EUR, GBP, commodity dollars, and emerging market currencies.

EUR/USD’s positive move seen so far on Monday is backed by the upward sloping 50-day simple moving average (SMA), a sign the pair is looking to build upward momentum. More importantly, the 50-day SMA looks set to cross above the 100-day SMA in the next 24 hours. The resulting bull cross would be the first since December 2019.

The long-term MA crossovers, however, are lagging indicators. In addition, other indicators suggest the path of least resistance is to the downside. For example, the daily chart shows a bearish divergence of the 14-day relative strength index, and the MACD histogram is printing lower bars above the zero line. That is a sign of the weakening of the bullish momentum.

As a result, the pair could reverse gains during the day ahead. On the downside, support is located at 1.1175 (38.2% Fib Retracement of 1.0775-1.1422). Meanwhile, resistance is seen at 1.1326 (10-day SMA).

Daily chart

Trend: Bearish

Technical levels