- Risk-on powers a 20-pip gain in the EUR/USD pair.

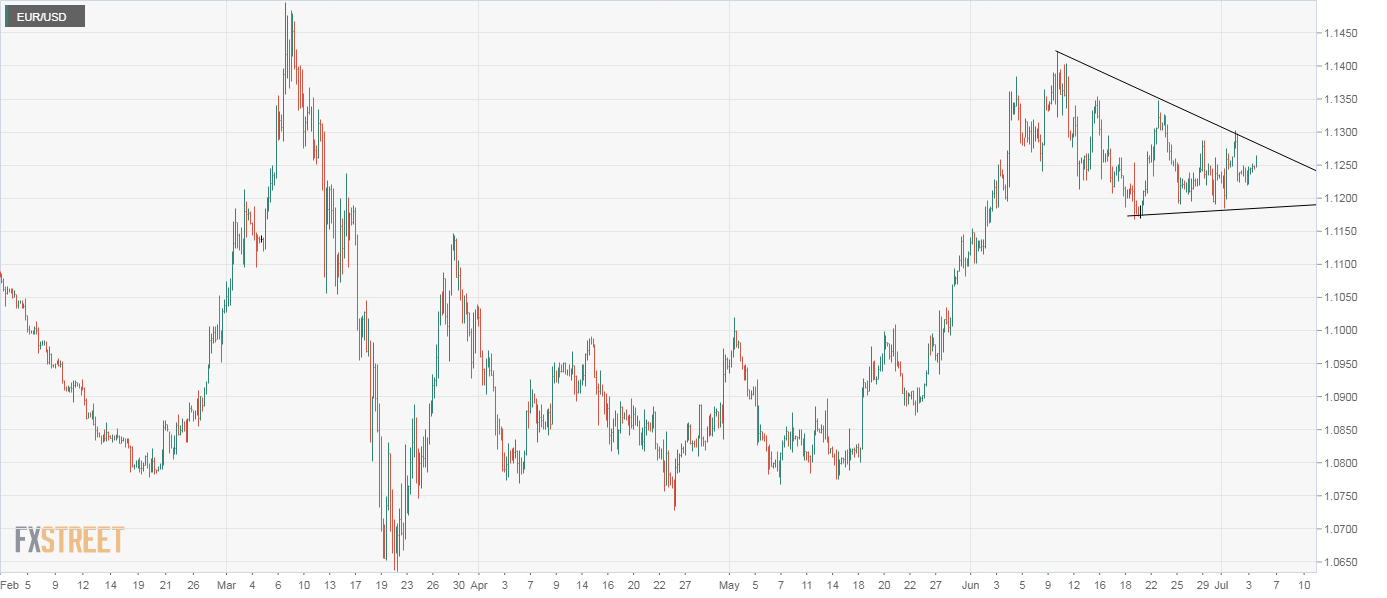

- The currency pair remains trapped in a descending triangle pattern.

EUR/USD is flashing green in Asia amid classic risk-on action in the financial markets.

At press time, the pair is trading at session highs near 1.1262, having put in a low of 1.1241 early Monday.

The US dollar is losing ground against other majors like the AUD, NZD, and CAD, but is pushing higher against traditional safe-haven currencies like yen and Swiss franc. As such, AUD/JPY and other JPY crosses are rising, indicating risk-on sentiment. The S&P 500 futures, too, are signaling risk-on with a 0.28% gain.

However, while the EUR/USD pair has risen by 20 pips, the bias remains neutral, as the pair is still trapped inside a descending triangle, as seen on the 4-hour chart.

A break above the upper end of the triangle, currently at 1.1280 would confirm a bullish breakout and signal a continuation of the rally from lows near 1.0775 seen in May. The triangle breakout would open the doors for a re-test of June highs above 1.14.

Alternatively, a downside break of the triangle would shift risk in favor of a slide to the 200-day simple moving average (SMA) at 1.1039.

Daily chart

Trend: Neutral

Technical levels