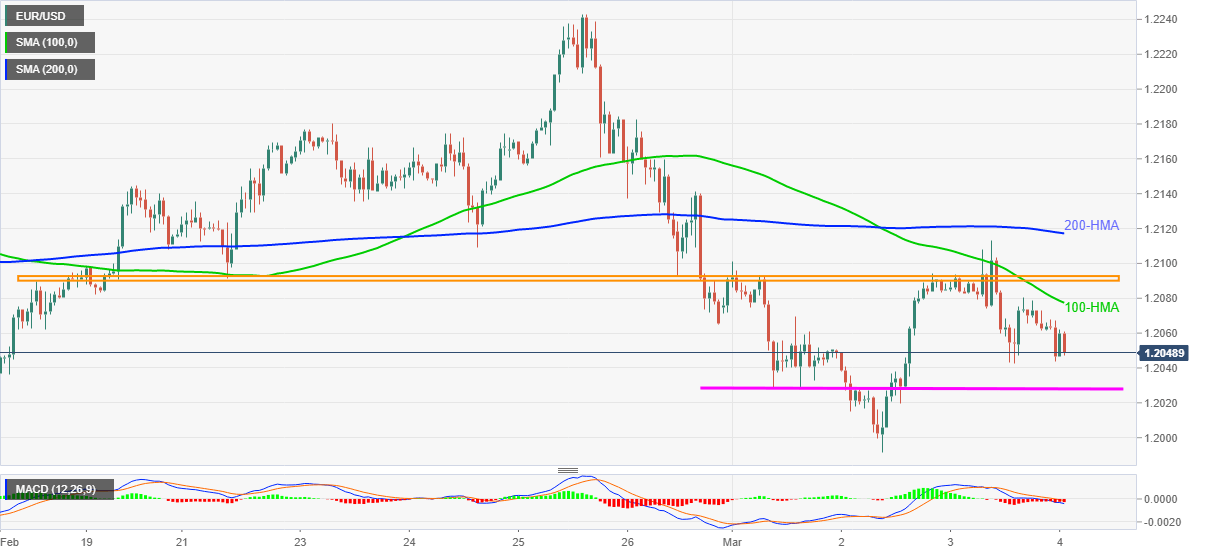

- EUR/USD stays mildly offered near intraday low, extends pullback from 200-HMA, two-week-old horizontal hurdle.

- 1.2030-25 can offer immediate support, 100-HMA adds to the upside filters.

EUR/USD drops to 1.2050 while printing 0.10% intraday losses amid Thursday’s Asian session.

The major currency pair marked an uptick to 1.2113 the previous day before taking a U-turn below 200-HMA and breaking down a horizontal hurdle, earlier support, established since February 18.

The following losses extended below 100-HMA wherein the bearish MACD signals add to the EUR/USD sellers’ hopes.

Even so, a horizontal area from Monday, around 1.2030-25, can act as a buffer before recalling the 1.2000 psychological magnet on the chart. It should, however, be noted that further weakness below 1.2000 needs to break the monthly low of 1.1990 to eye the previous month’s low near 1.1950.

Alternatively, 100-HMA and the stated horizontal region, respectively around 1.2080 and 1.2090, can test the pair’s short-term rebound.

If at all the EUR/USD bulls manage to cross 1.2090, a 200-HMA level of 1.2117 will validate the quote’s fresh rally towards February’s top of 1.2243.

EUR/USD hourly chart

Trend: Further weakness expected