- EUR/USD hold lower ground amid stimulus hopes, risk-off mood.

- US policymakers up for conveying aid package details, stop-gap funding.

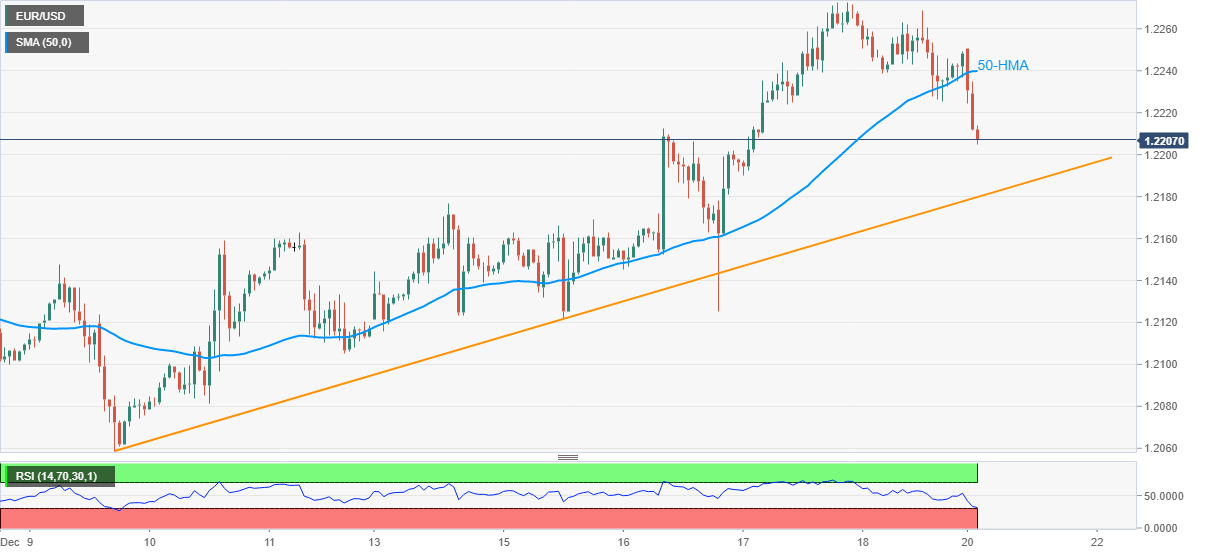

- Downside break of 50-HMA favor sellers to eye two-week-old support line.

EUR/USD refreshes intraday low to 1.2205, down 0.33% intraday, during Monday’s Asian session. In doing so, the quote extends losses after breaking 50-HMA support. Also favoring the bears are fundamentals suggesting a stronger US dollar.

US House Speaker Nancy Pelosi conveyed official agreement over the much-awaited coronavirus (COVID-19) stimulus while favoring the risks and the US dollar off-late.

Read: US House Speaker Pelosi: Congressional Democrats have reached an agreement…

As a result, EUR/USD prices are declining towards an upward sloping trend line from December 09, at 1.2179 now. Though, the 1.2200 round-figure may offer immediate support.

If at all the bears keep the reins below the stated support line, the 1.2100 threshold and the monthly low near 1.2040 will be on their radars.

Alternatively, 1.2230 can offer immediate resistance ahead of the 50-HMA level around 1.2240.

Even if the corrective recovery crosses 1.2240, if any, the monthly peak surrounding 1.2272 and the 1.2300 round-figure will add barriers to the quote’s upside.

EUR/USD hourly chart

Trend: Further downside likely