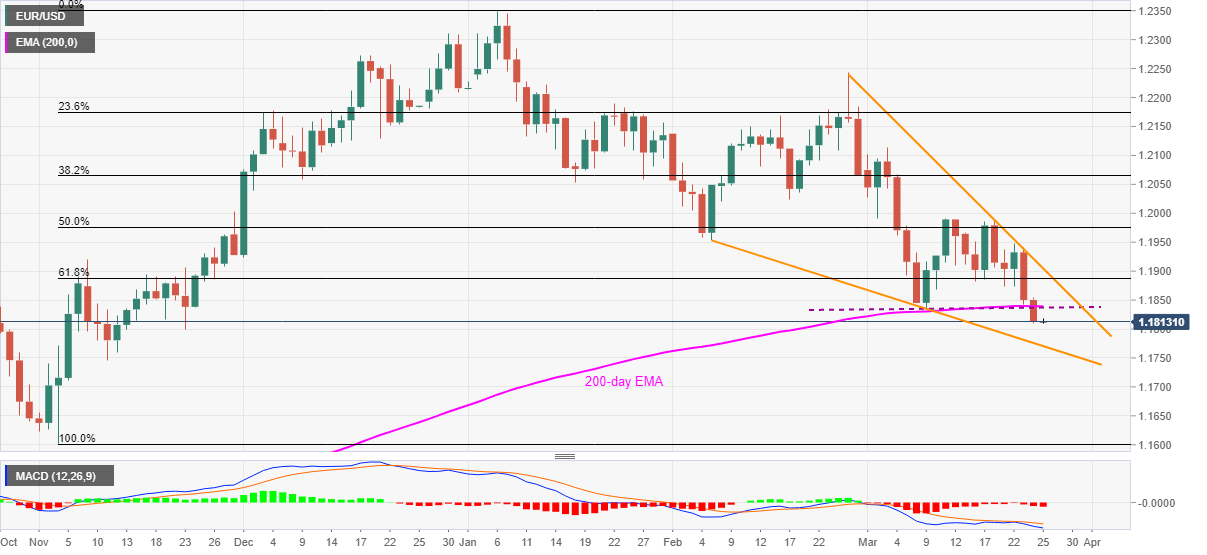

- EUR/USD fades bounces off four-month low after two consecutive days of downtrend.

- Confluence of 200-day SMA, early March low guards corrective pullback.

- Seven-week-old support line lures sellers amid bearish MACD.

EUR/USD drops to 1.1810 during the latest pullback from intraday top of 1.1817 amid early Thursday. The currency major slumped to the lowest since late November the previous day before bouncing off 1.1809.

However, the failures to keep the corrective pullback amid bearish MACD, coupled with sustained trading below 1.1840 confluence comprising 200-day SMA and March 09 low, suggest further downside of EUR/USD.

Hence, sellers currently eye the downside break of the 1.1800 threshold before attacking a short-term support line from February 05, at 1.1770 by the press time.

Meanwhile, corrective pullback beyond 1.1840 needs to break a downward sloping trend line from February 25, near 1.1905, to confirming the bullish chart pattern, namely falling wedge.

Following that, the EUR/USD buyers will be able to challenge the 1.2000 psychological magnet.

EUR/USD daily chart

Trend: Bearish