- EUR/USD seesaws in a choppy range above 1.2075 near intraday top.

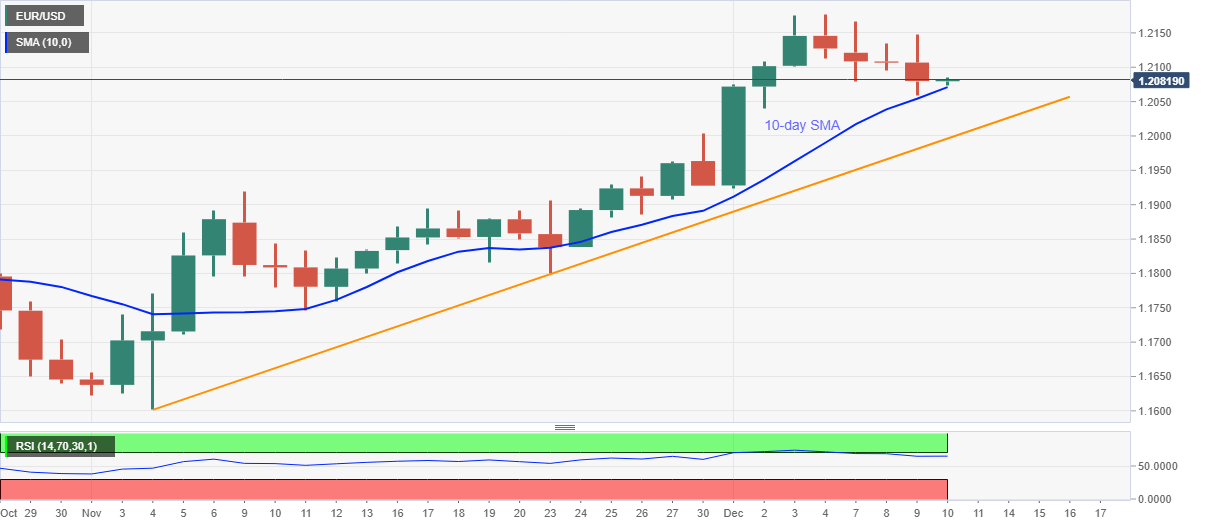

- 10-day SMA snaps four-day losing streak, five-week-old support line add to the downside filters.

EUR/USD wavers around 1.2080 during early Thursday. The pair has been trading in a range between 1.2075 and 1.2084 off-late while keeping the bounce off 10-day SMA.

As a result, the strong RSI conditions, not overbought, favor the pair buyers to stop the previous four days’ downtrend.

However, a clear break above the 1.2100 threshold will be needed for the EUR/USD bulls to challenge the monthly top near 1.2180.

If at all the quote remains positive beyond 1.2180, lows marked during February and early April 2018, around 1.2205/15, will be important to watch.

Meanwhile, a downside break of 10-day SMA, at 1.2071 now, will eye an upward sloping trend line from November 04, currently around 1.1996.

Though, a daily closing below 1.1996 can make the EUR/USD vulnerable to revisit November’s high near 1.1920.

EUR/USD daily chart

Trend: Bullish