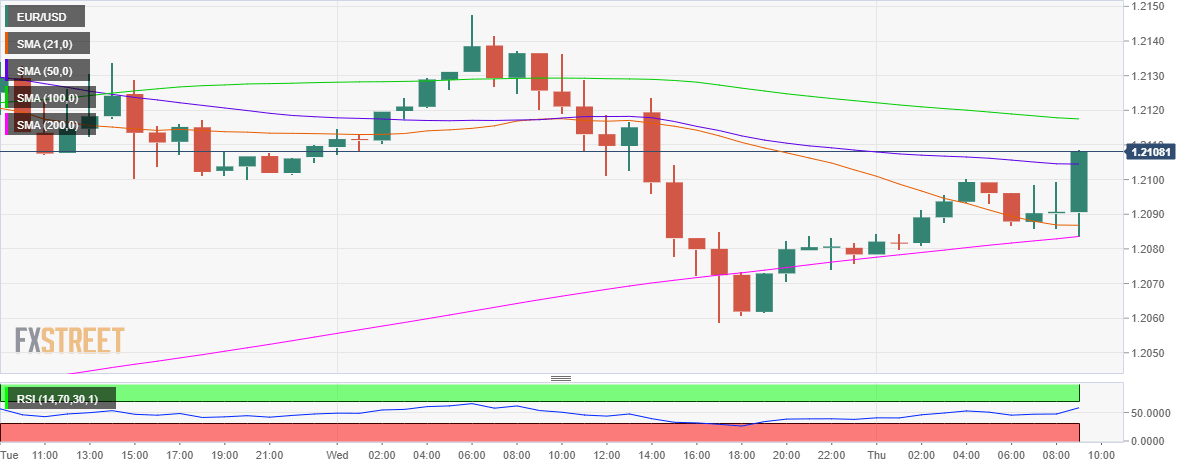

- EUR/USD’s upside intact while above 200-HMA.

- Hourly RSI points north while above 50.00.

- Will it sustain the bounce ahead of ECB’s expected stimulus?

EUR/USD is challenging highs once again above 1.2100, as the recovery from Wednesday’s corrective decline regains traction ahead of the all-important ECB monetary policy decision.

The ECB is expected to boost the stimulus to stimulate economic recovery. However, the central bank’s projections and President Christine Lagarde’s comments on the euro strength will be of significance for fresh direction on the single currency.

From a near-term technical perspective, the rebound in the main currency pair could likely remain intact so long as the bulls manage to defend the upward-sloping 200-hourly moving average (HMA) at 1.2083.

A breach of the latter could put Wednesday’s low of 1.2059 at risk.

On the flip side, recapturing of the horizontal 50-HMA at 1.2105 is critical to extending the recovery towards the 100-HMA hurdle, aligned at 1.2117.

Further north, the confluence of Wednesday’s high and psychological level around 1.2150 could be challenged.

The hourly Relative Strength Index (RSI) points north above the midline, currently at 57.73, allowing more room to the upside.

EUR/USD: Hourly chart

EUR/USD: Additional levels