- EUR/USD meets daily support, bulls looking for a correction to at least a 38.2% Fibo.

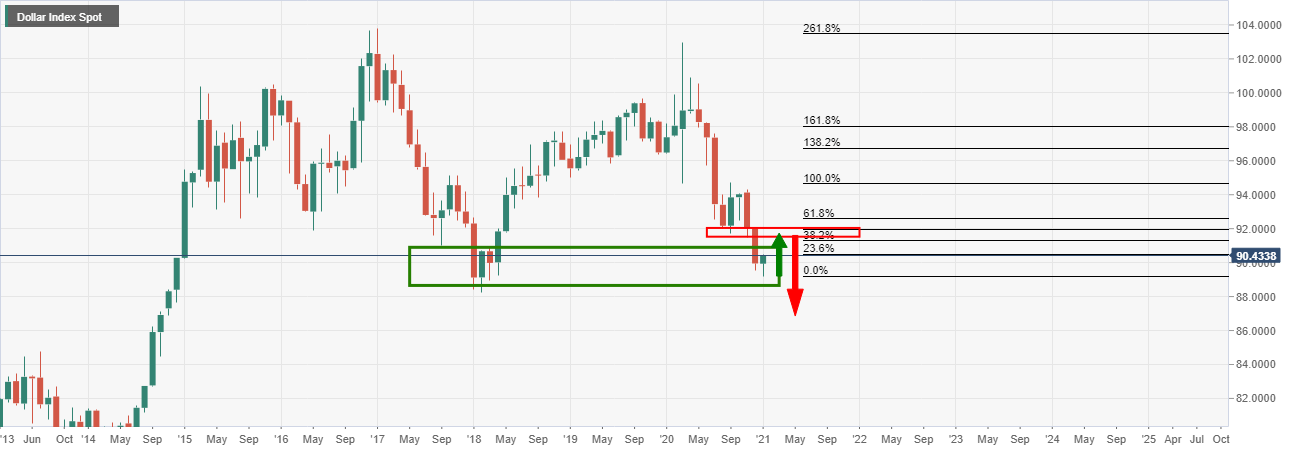

- US dollar extending the upside correction from monthly support.

EUR/USD extended the downside at the start of this week as the US dollar continues to recover from the near 3-year low hit last week as US yields climb.

The DXY is in its fourth straight session of gains, trading some 0.36% at the time of writing with price embedded in monthly demand territory:

Meanwhile, the euro is potentially overextended to daily support territory and a correction could be in order before a further decline.

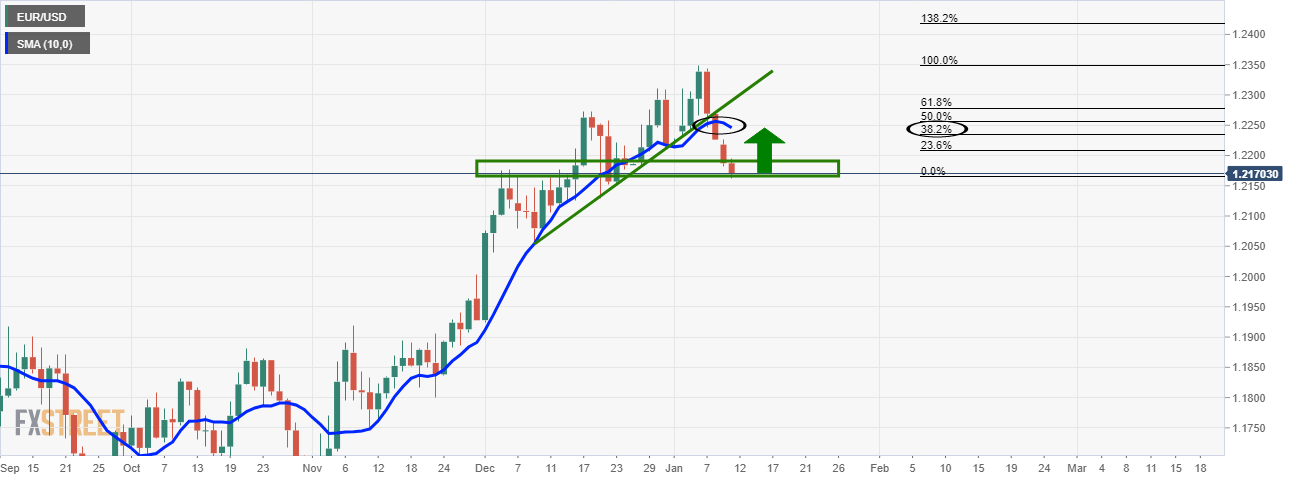

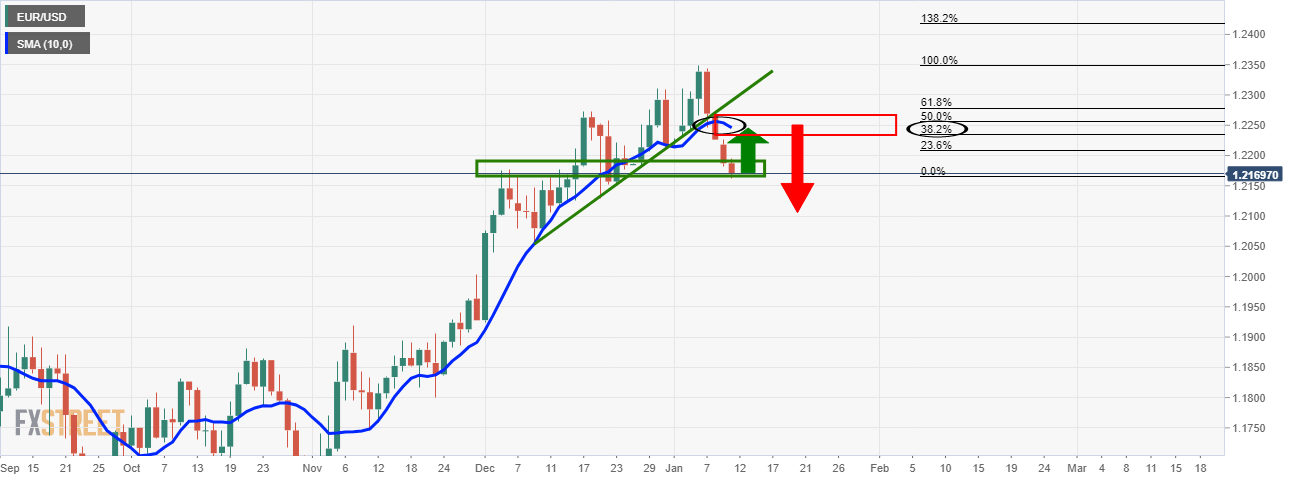

The following offers technical analysis on the daily chart:

The topping formation following the bearish engulfing candlestick has been confirmed with the latest break below the 10-day moving average and dynamic trendline support.

The daily support could lead to a correction back to test the 10-DMA in at least a 38.2% Fibonacci retracement.

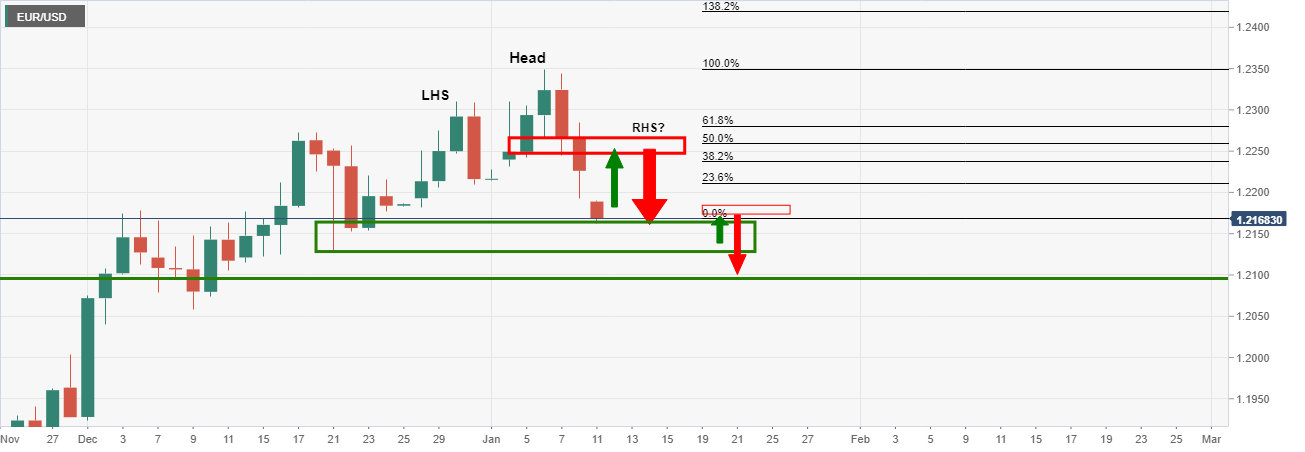

If a correction does indeed come as a consequence of the demand area, then a re-run to the downside would leave a topping pattern in the head and shoulders as follows:

-637459840617994655.png)