- EUR/USD bulls have been in control in a strong hourly to resistance.

- A 38.2% Fibo retracement of the hourly impulse could be on the cards before advancement to 1.2110.

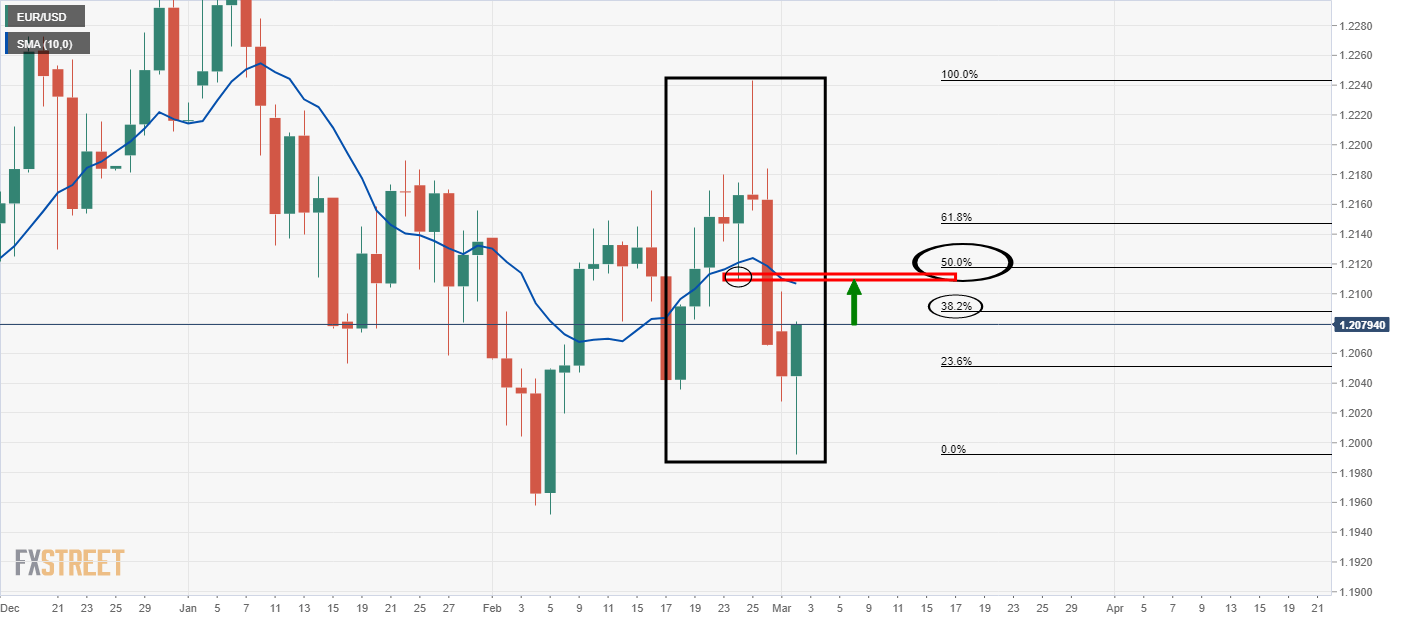

As per this week’s, The Watchlist: GBP/JPY, EUR/USD, CHF/JPY and more setups in the making, the euro is making upside progress to complete a significant correction of the M-formation’s bearish leg.

The week started off favourably for the US dollar but a snapback in US Treasury yields is enabling recovery in the forex space which plays into the hands of the euro bulls.

This exposes the neckline of the M-formation and target of 1.2110.

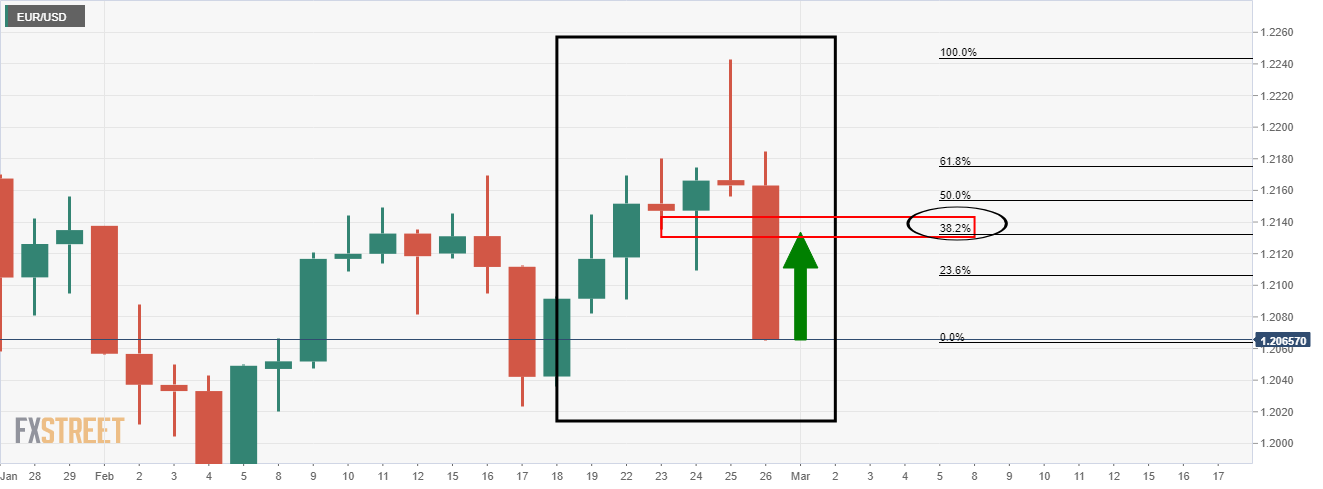

Prior analysis, daily chart

The M-formation is a bullish pattern where the price would be expected to revert back to test the neckline and prior support, or, to at least the 38.2% Fibonacci level.

Live market, daily chart

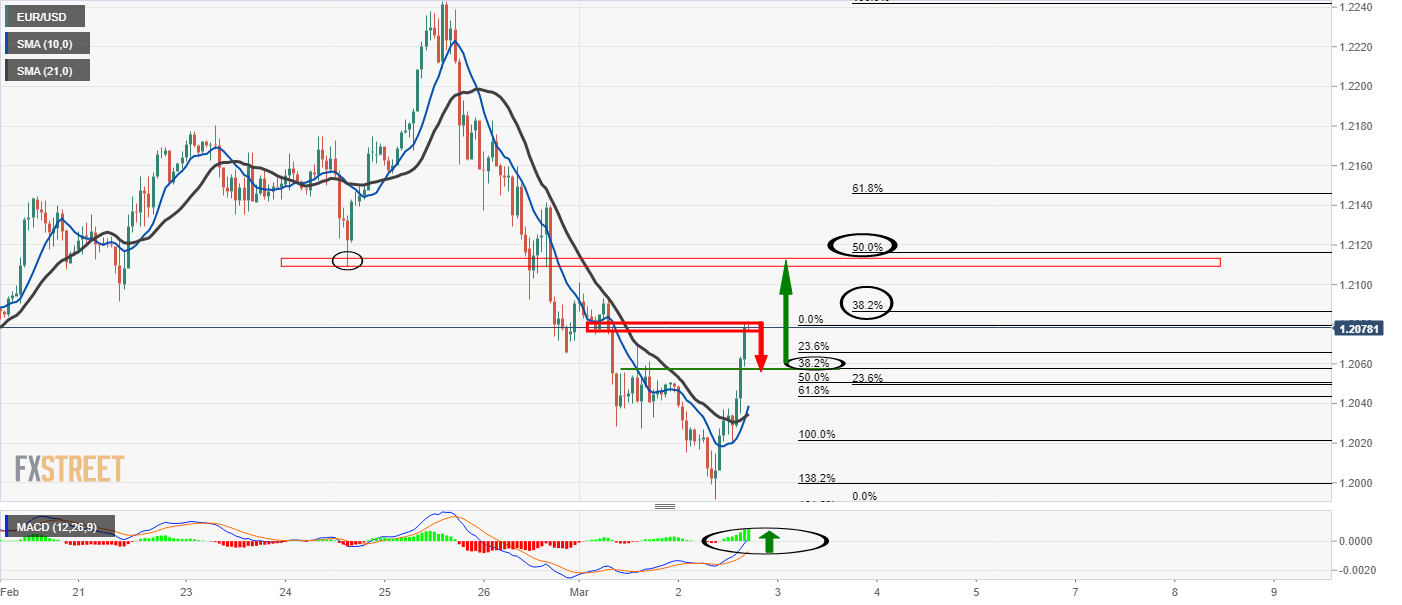

Live market, hourly chart

The hourly conditions are highly bullish with the 10 SMA crossing up the 21 SMA and MACD turning positive, albeit lagging the recent rally in the price to resistance.

Therefore, a pullback can be expected to test prior resistance and the confluence of the 38.2% Fibonacci retracement.

If the bulls commit at that juncture, then an advance to the neckline of the daily chart’s M-formation is a high probability to complete a 50% mean reversion of the latest bearish leg.