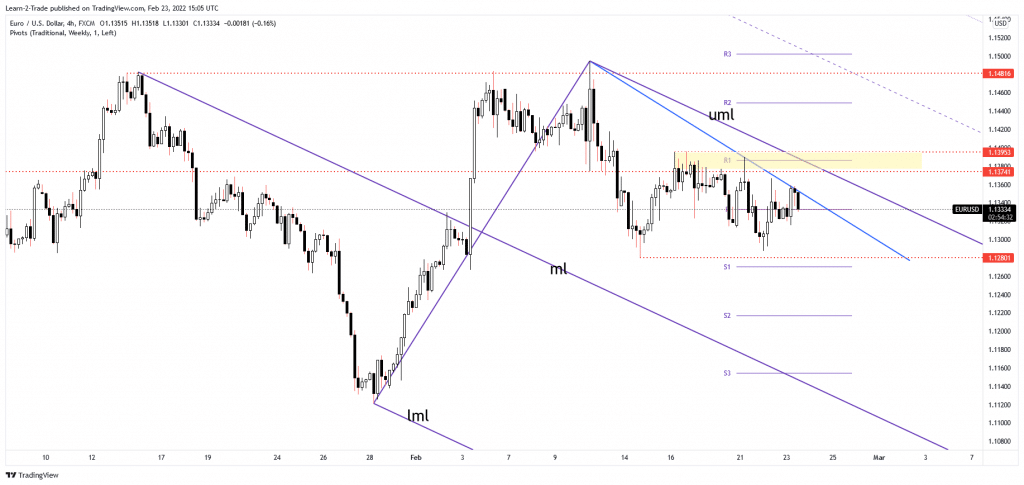

- The EUR/USD pair maintains a bearish bias as long as it stays below the down trendline.

- A new lower low may exacerbate more selling.

- The descending pitchfork’s median line (ML) could attract the price.

The EUR/USD price is trading red as the Dollar Index rebounds. The DXY and EUR/USD have a strong negative correlation. The pair is trading around 1.1328 level at the time of writing, far below today’s high of 1.1359. In the short term, the bias remains bearish as the price stands below strong near-term upside obstacles. After yesterday’s better than expected US data, the USD was somehow expected to rise.

–Are you interested in learning more about STP brokers? Check our detailed guide-

As you already know, the Flash Services PMI and Flash Manufacturing PMI came in better than expected, announcing an expansion in both sectors. Furthermore, the CB Consumer Confidence, HPI, and the S&P/CS Composite-20 HPI reported better than expected figures as well.

Today, the German Gfk Consumer Climate was reported at -8.1 points below -6.2 points expected, the Euro-zone Final CPI and the Final Core CPI came in line with expectations. Tomorrow, the US Prelim GDP may register a 7.0% growth versus 6.9% in the previous reporting period, while the Unemployment Claims could drop in the last week to 233K.

EUR/USD price technical analysis: Sideways movement

The EUR/USD pair drops after retesting the down trendline. Technically, the bias remains bearish as long as it stays under this dynamic resistance. The price is trapped between 1.1374 and 1.1280 levels. A valid breakout from this range could bring great trading opportunities and a clear directional bias. As per descending pitchfork, the bearish bias remains intact as long as the pair is traded below the upper median line (UML). The major near-term target is represented at 1.1280.

–Are you interested in learning more about forex robots? Check our detailed guide-

A new lower low, a valid breakdown below this level, may open the door for a larger drop. As long as it stays within the descending pitchfork’s body, the median line (ml) could attract the price. The current sideways movement could represent a distribution pattern. Only a valid breakout above the immediate resistance levels could invalidate a larger drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money