- The EUR/USD is trying to recover after its worst drop in three weeks.

- German bond coupons hit a two-month high while US government bond yields remained six weeks high.

- Health and economies are being challenged by Covid infections at record levels, but concerns over a Fed rate hike remain.

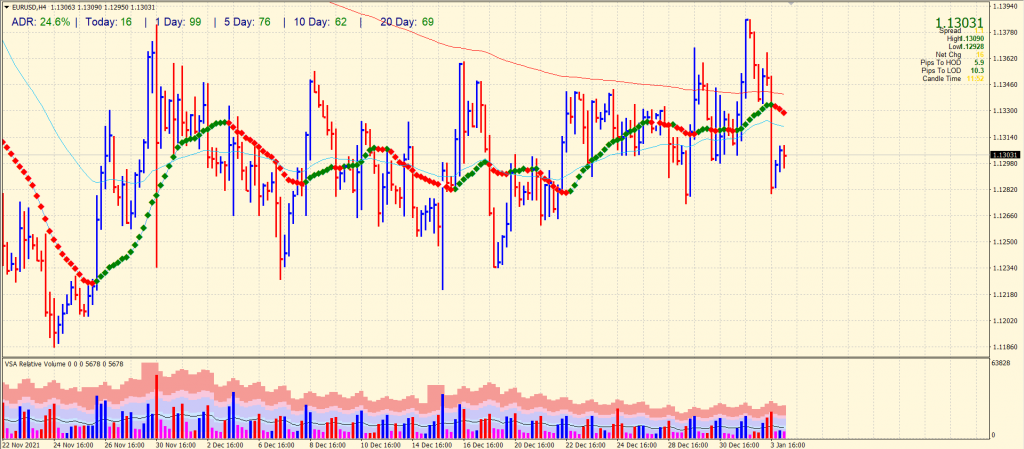

The EUR/USD price analysis shows a bearish bias as the US dollar rebounds amid risk-off sentiment stemming from the Omicron crisis. After its sharpest daily drop since December 17, the EUR/USD trades at 1.1300 ahead of Tuesday’s European session. The main currency pair tracks stable government bond yields in anticipation of secondary data from Germany and the US.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

Bond yields, German bund coupons, and Wall Street benchmarks set the stage for an excellent start to 2022. However, the US dollar index has risen because of concerns about the South African variant of Covid and financial market concerns from China. As a result, the dollar index gained more than it lost on Friday. The dollar is also favored by Reuters news: “Money markets fully accounted for the first US rate hike in May and two more in 2022.”

However, the recent sluggishness in bond markets has put EUR/USD traders above Germany’s November retail sales, which are expected to fall -0.5% m/m against -0.3% earlier. In addition, the Managers Index US procurement ISM for put Manufacturing prepares for testing. The December forecast is 60.2, compared with 61.1 in November.

Over the past few days, Covid infections have reached new all-time highs in Spain, France, and the United States. Additionally, the doubling of viruses in recent days underlines Omicron’s fears, even as politicians try to calm the bears down.

The 10-year break-even point of the Federal Reserve Bank of St. Louis (FRED) has also increased to a new high in six weeks due to more robust US inflation expectations – Falken allowed himself to be controlled. The yield on US Treasury bonds increases as a result.

Additionally, talks of German tax breaks in 2023 and French aid to pandemic-hit companies generate European profits but not pull back EUR/USD buyers.

EUR/USD price technical analysis: Bulls struggling

The EUR/USD price plunged below the key 1.1300 mark with very high volume. The pair is now trying to neutralize the bears around the 1.1300 mark while the volume is not encouraging for the bulls.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

The average daily range for the pair is 24%, which is a little lower than usual. The key moving averages are lying above the price, suggesting bearish pressure.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.