- The EUR/USD pair continues to recover but falls back below 1.0900.

- Hawkish comments from the ECB hinted at a possible hike in July.

- Philadelphia Fed Index, Powell, initial claims are the key events to watch.

The EUR/USD price pushed further north of the 1.0900 hurdle on Thursday, breaking new 2-week highs in the 1.0940 region. However, the pair could not sustain the gains and fell below 1.0900.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

ECB boosts the Euro

As sentiment toward the European currency was bolstered by hawkish comments from ECB Vice President L De Guindos, who hinted at a likely rate hike in July, EUR/USD rose for the third straight Thursday for the first time since late March. P. Wunsch, the ECB board member, also expected interest rates to turn positive this year at the beginning of the meeting.

EUR/USD is recovering some of its structure and has cleared the 1.0900 level, relatively stable so far. However, a sustained recovery remains to be seen due to the bearish outlook for the pair. In addition, it is influenced by the performance of the dollar, geopolitical concerns, and the divergence between the Fed and the ECB.

In addition to occasional strength in the single currency, speculation that the ECB might hike rates shortly is likely to support the Euro, as are higher yields in Germany, elevated inflation, a reasonable pace of economic recovery, and benign developments in key fundamentals in the region as well.

The US 10-year government bond yields continued to climb along the curve, while the German yields rose above 0.99%.

What’s next to watch for EUR/USD price?

The final inflation figures showed that the CPI rose slightly below the preliminary reading by 7.4% y/y (from 7.5%), while the core CPI rose by 2.9% y/y (from 3.0%). In addition, a preliminary indicator of consumer confidence in the region will be released by the European Commission in April.

Later in the session, Chief Powell will speak at a global economy event hosted by the IMF. In addition, the registry must submit an index backed by the Philadelphia Federal Reserve Bank and a leading CB index to submit weekly claims.

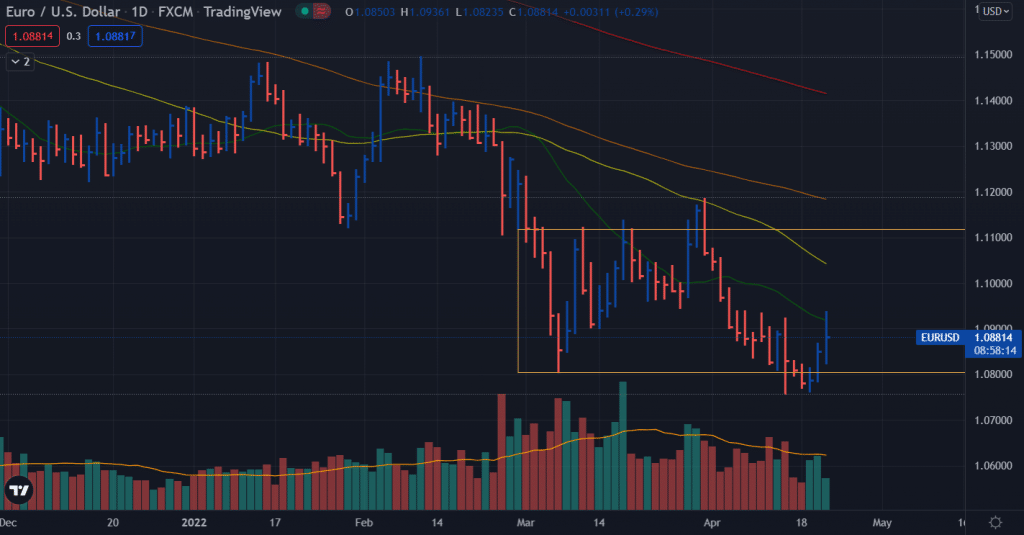

EUR/USD price technical analysis: Bulls shy of 1.0900

The EUR/USD price is struggling to break the 20-day SMA. The Price has been lying below the 20-day SMA since 4th April. However, the volume for the upside bars is rising. It indicates the existence of upside potential.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Contrarily, staying below the 1.0900 level will attract more sellers, and the upside potential will remain vague. On the downside, 1.0800 remains strong support ahead of the double bottom at 1.0760.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money