- EUR/USD meets resistance following a string correction.

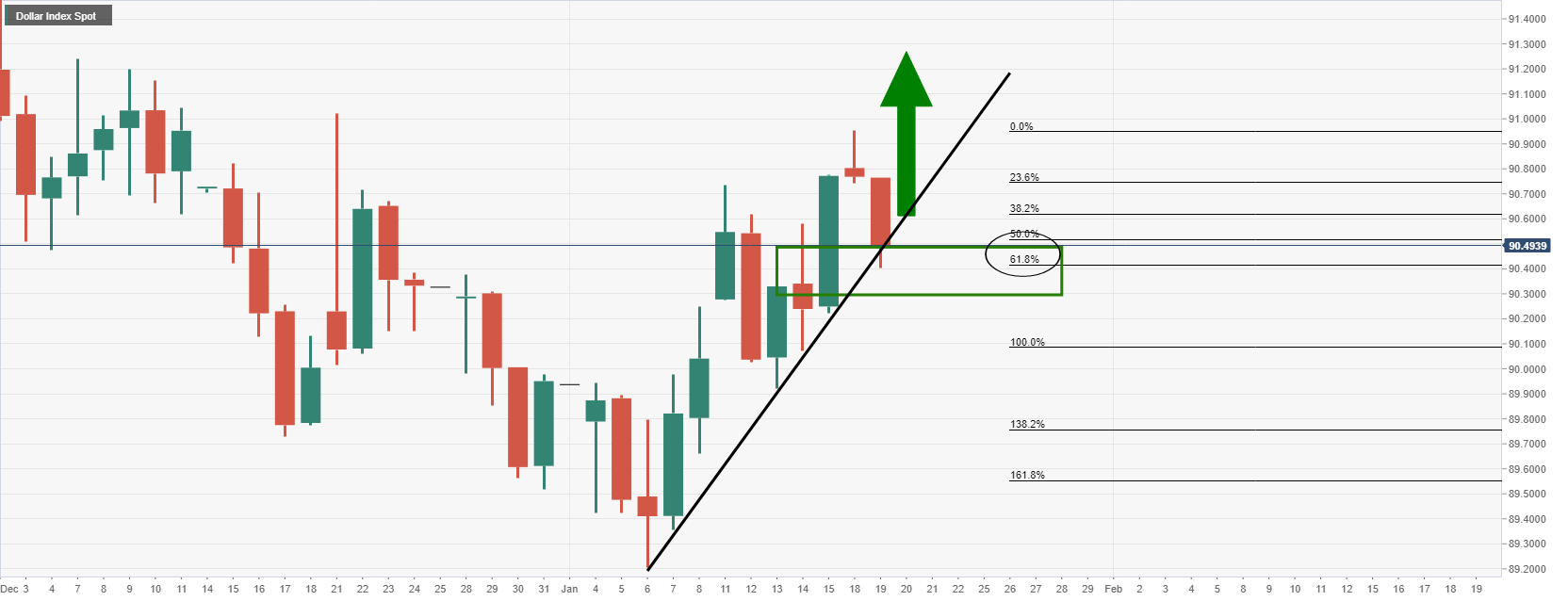

- DXY on the verge of bringing in the buyers for an upside continuation of the correction.

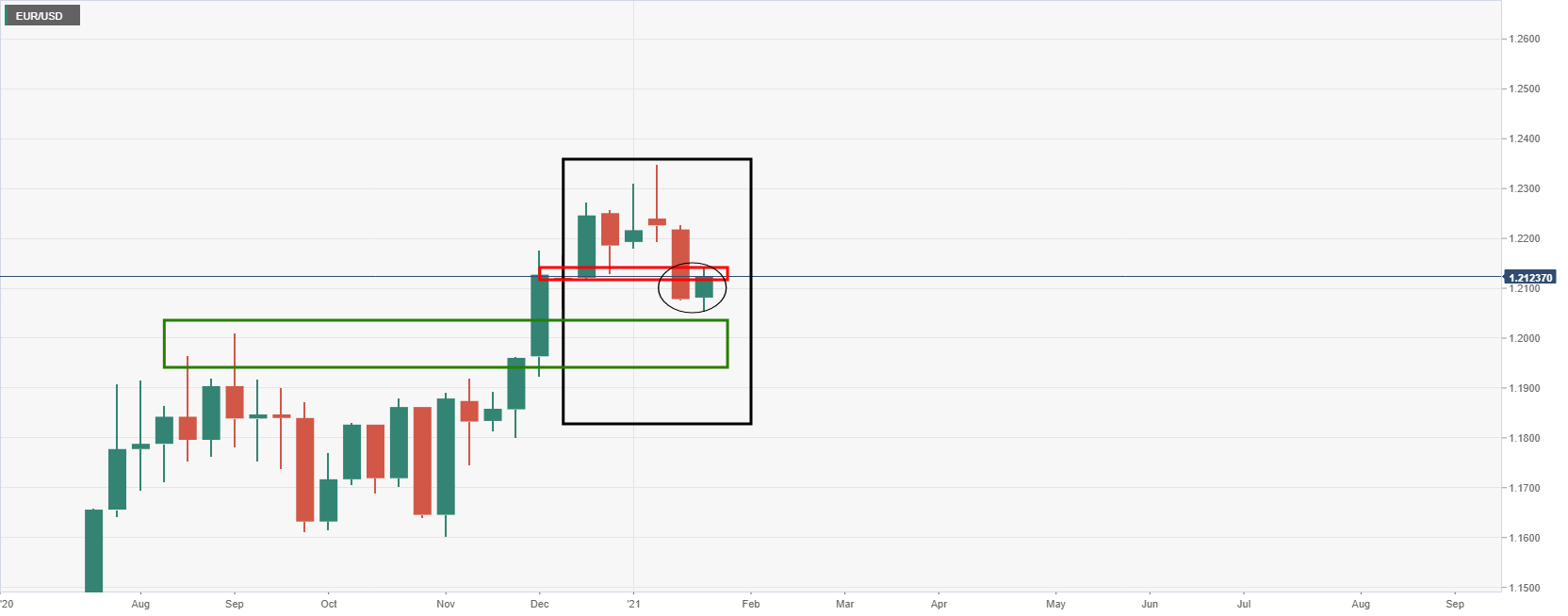

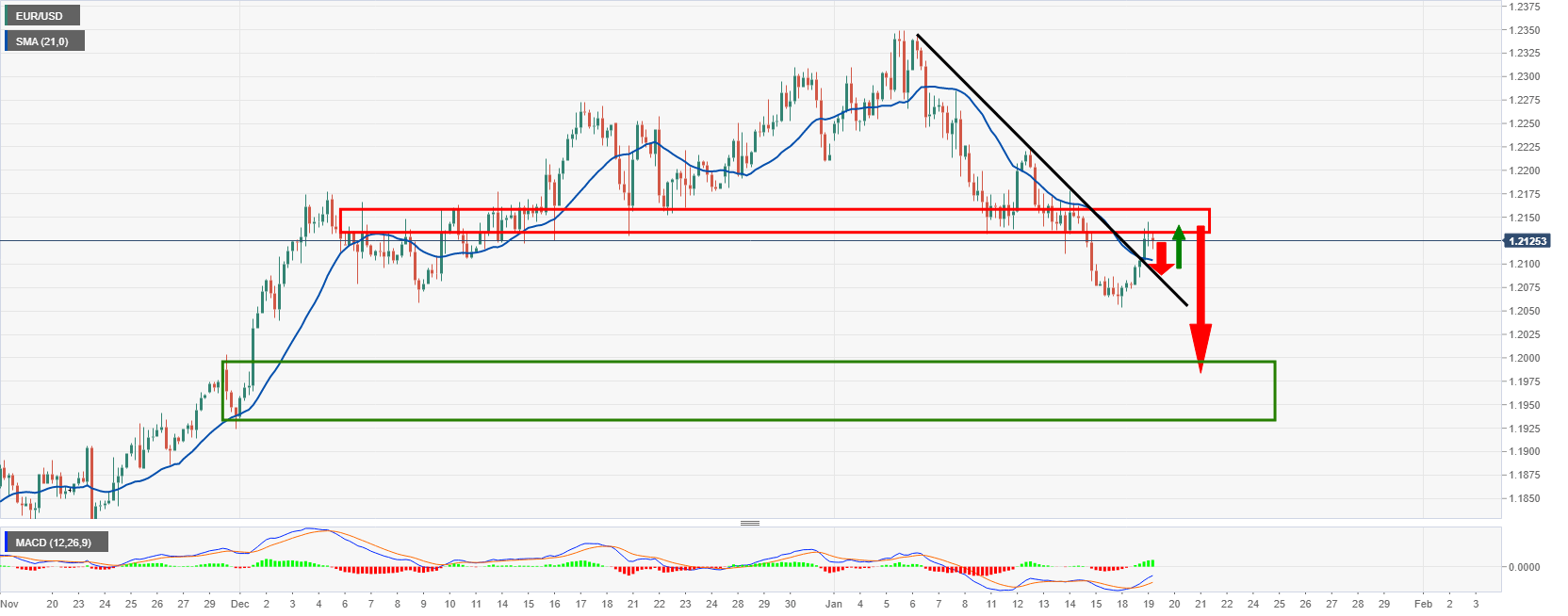

Further to the prior analysis, EUR/USD embarking on a bullish correction, 1.2120 eyed, the price has completed a 50% mean reversion of the bearish impulse as the US dollar corrects within its own retracement.

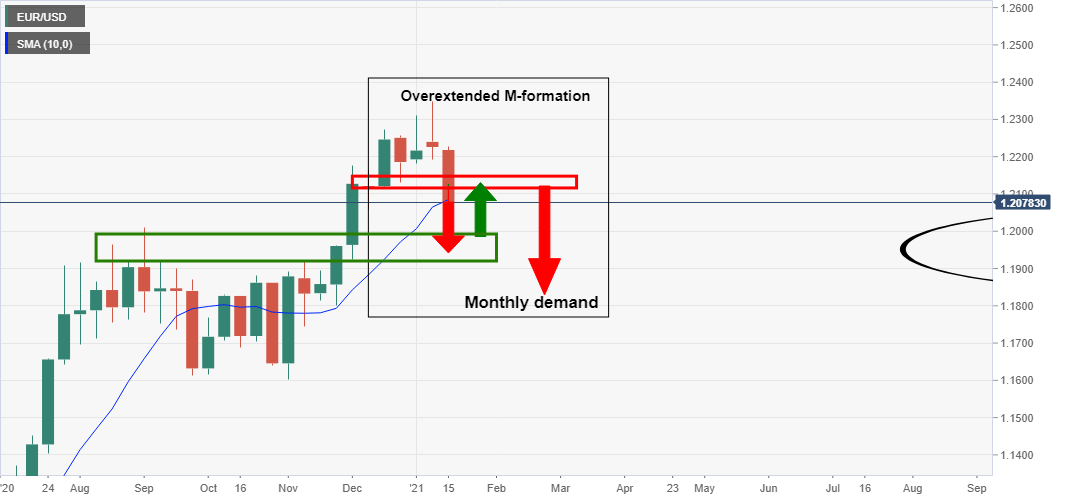

The following is a top-down analysis which illustrates the market structure and potential for a downside continuation in the euro.

Casting eyes back over the prior analysis, The Chart of the Week: EUR/USD enters the bear’s lair, there was a weekly bias to the downside, but the price action was forecasted as follows:

Live market:

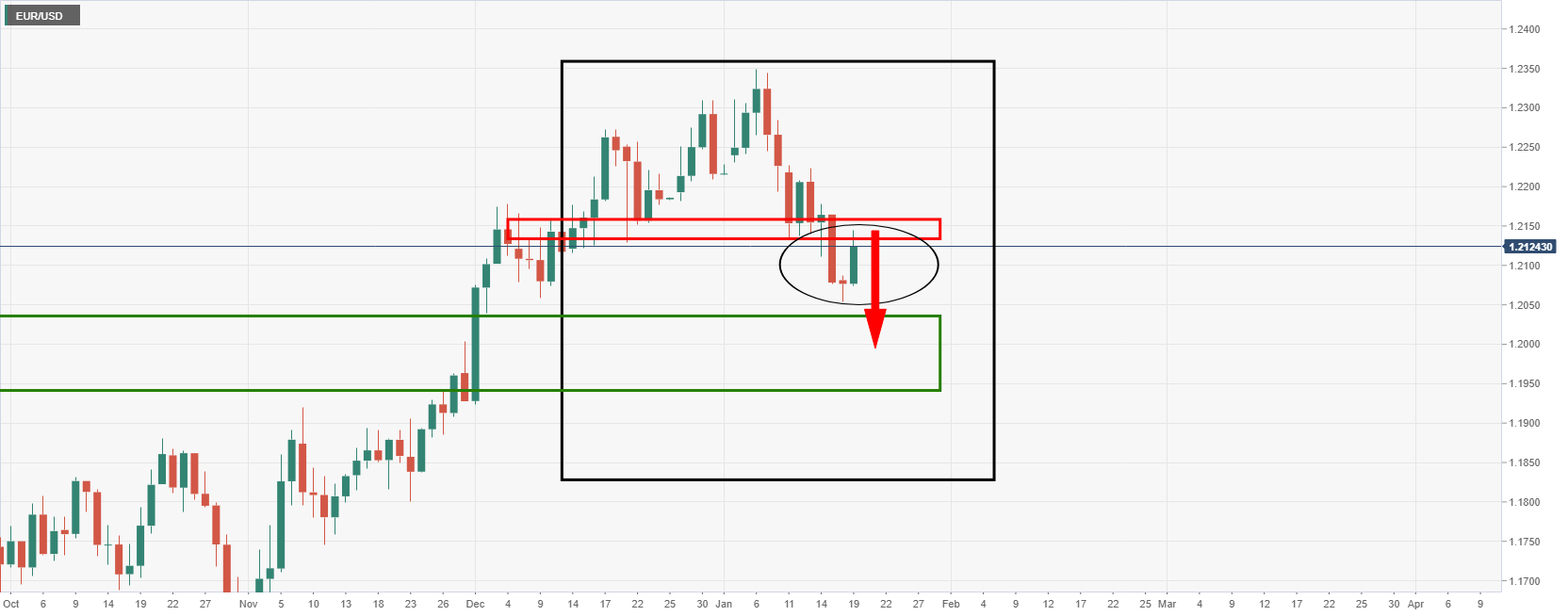

At this juncture, the price would be expected to extend to the downside and test the demand area properly:

Daily chart

The US dollar can be monitored for a continuation of the upside correction from here.

DXY daily chart

EUR/USD 4-hour chart

The correction has been strong and it has broken the dynamic resistance.

The 4-hour time frame can be monitored for supply from the structure for a continuation to the downside.