- EUR/USD remains positive around 1.1750 as risk sentiment soars.

- Fed’s Kaplan left dovish comments that weighed on the Greenback.

- Risk sentiment can deteriorate amid the Taliban issue and Sino-US clash on listing Chinese companies in the US SEC.

The EUR/USD price analysis provides a bullish view as the US dollar continues to slide from multi-month highs as the risk sentiment soars.

As of writing, the EUR/USD is at 1.1743, 0% up on Tuesday.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The EUR/USD pair recovered from last week’s losses, rallying 0.38% to end the New York session at 1.1746. The market’s confidence is bolstered by both Robert Kaplan’s words regarding the Fed and the fact that China has not reported any local cases of Covid.

A hawk such as Dallas Fed President Robert S. Kaplan said he was ready to change his mind about whether the Fed should hold back on asset purchases sooner or later if the Delta variant persists.

Last seen at 93.00, the US dollar started the week on the back foot, shedding 0.50%. A trend toward higher yields is also reflected in the yield on 10-year US Treasuries, which declined by 29 basis points (bps) to 1.253%.

Meanwhile, the UK is convening an emergency videoconference of the G7 leaders to discuss Taliban-related issues. In addition, a lack of listing Beijing companies by the US Securities and Exchange Commission (SEC) will deteriorate risk sentiment. In a similar vein, the pursuit of technology stocks by Beijing, Sino-US clashes, and fears of a slowdown in China’s economic recovery are viewed as an early roundabout.

In addition to the second reading of German Q2 GDP, expected to confirm 1.5% q/q forecasts, the US July new home sales report of 0.69m, compared to 0.66m forecasts, could drive the EUR/USD prices to the upside. The Jackson Hole symposium this week will pay particular attention to qualitative factors before speaking.

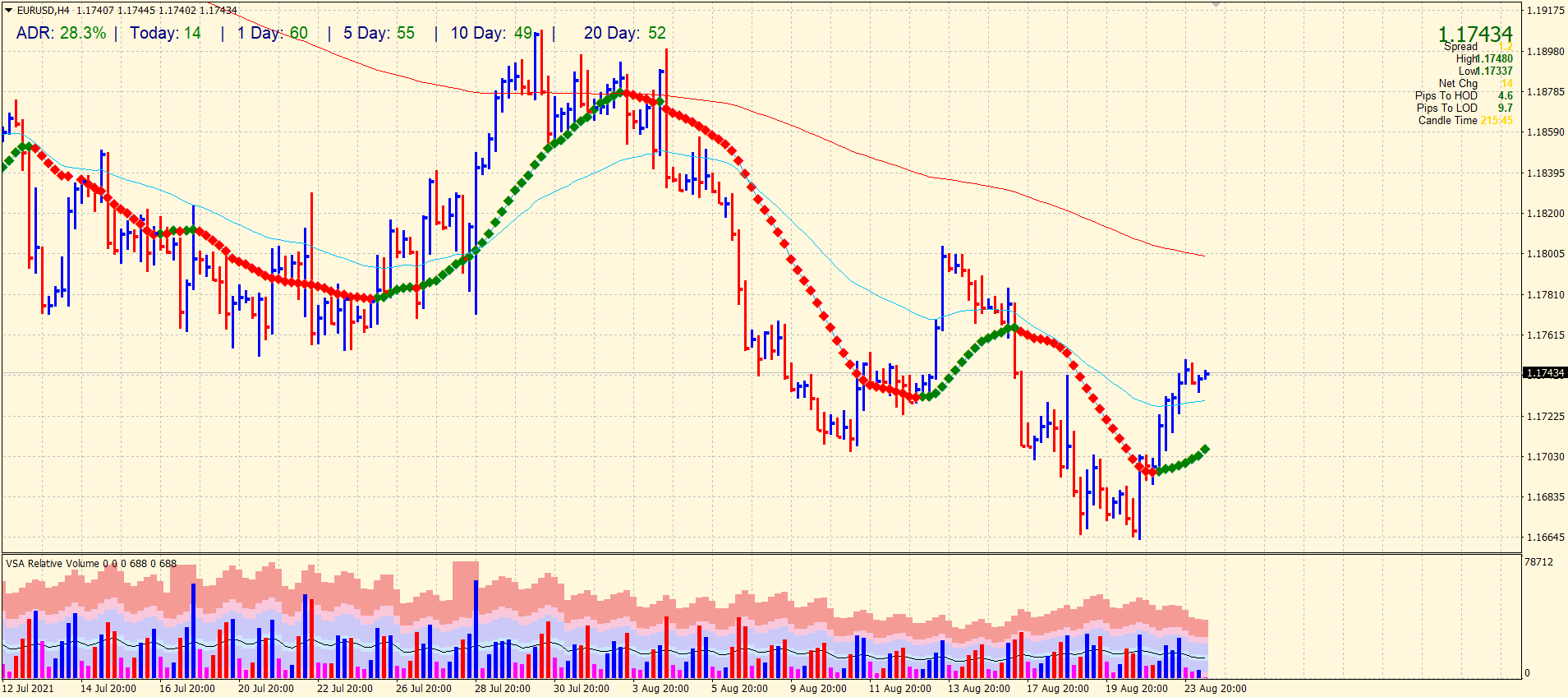

EUR/USD price technical analysis: Aiming for 200 SMA

Yesterday, the EUR/USD price climbed above the 20 and 50 SMAs on the 4-hour chart. The price is now wobbling around mid-1.1700, awaiting any catalyst to trigger volatility. The volume bars have climbed with the rise in prices. The pair has done a 28% average daily range so far.

–Are you interested to learn more about forex signals? Check our detailed guide-

On the upside, immediate resistance lies at 1.1770 (horizontal level) ahead of 1.1800 (horizontal level and 200-period SMA). On the downside, 50-period SMA at 1.1725 is the interim support ahead of 20-period SMA at 1.1700.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.