- EUR/USD reverses the initial pessimism and regains 1.21 and above.

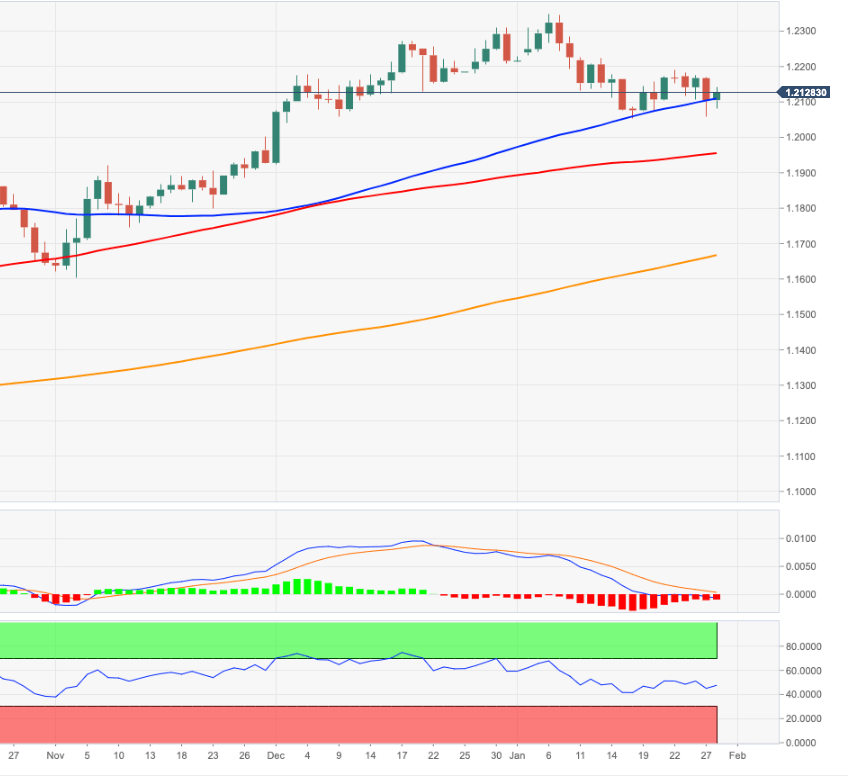

- Interim resistance is located at the Fibo level at 1.2173.

EUR/USD leaves behind the initial weakness and manages to advance past the 1.2100 mark on Thursday.

Immediately to the upside aligns the key resistance zone around 1.2180/90, where converges the 21-day SMA, a Fibo retracement of the November-January rally and weekly highs. A surpass of this region on a sustainable fashion is need to allow for a move to the 2021 tops near 1.2350 (January 6).

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1652.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart