- EUR/USD remains on the backfoot during the day, still above the 1.1800 area.

- Risk sentiment deteriorates amid Australia-UK-US nuclear submarine partnership.

- Inflation remains the key concern for Fed and ECB.

The EUR/USD price analysis is bearish to neutral. The bulls got weaker as the risk sentiment got hurt by America’s move to combat China.

Before Thursday’s European session, EUR/USD has reversed recent gains near an intraday low of around 1.1800 area. Before catalysts for risk containment and caution about US retail sales, the major currency pair benefitted from cautious positivity regarding the Fed’s and the European Central Bank’s actions the day before.

An Australia-UK-US nuclear submarine partnership signals a further deterioration in China relations and impacted market sentiment earlier today. Further, Australia, China, and New Zealand have higher pandemic cases, making it increasingly difficult to accept risk and the higher price of the US dollar.

Markets fear the US will prepare to fight China again next week, which negatively affects sentiment, as it adds the UK to its list of greetings for the White House diplomatic talks.

A weaker US Consumer Price Index (CPI) supported the ECB policymakers’ earlier outlook for the Fed to pull back from tightening, along with Fed comments from Wednesday. In a similar vein, ECB chief economist Philip Lane said that monetary policy drives core inflation in the euro area, Reuters reported. However, executive Board member Isabelle Schnabel was more restrictive as she said, “The market may overestimate the risks to global growth.”

Market sentiment has been reflected in equity futures as early gains in Asia have been offset. The 10-year US Treasury yield has been corrected by one basis point (bps).

Following Lagarde’s remarks, other central bankers in the bloc will need to reaffirm their cautious optimism in response to her remarks. A more significant event will be the weekly US employment and retail sales data for August. Since market optimism has dwindled, risks may ease if the data indicate further declines.

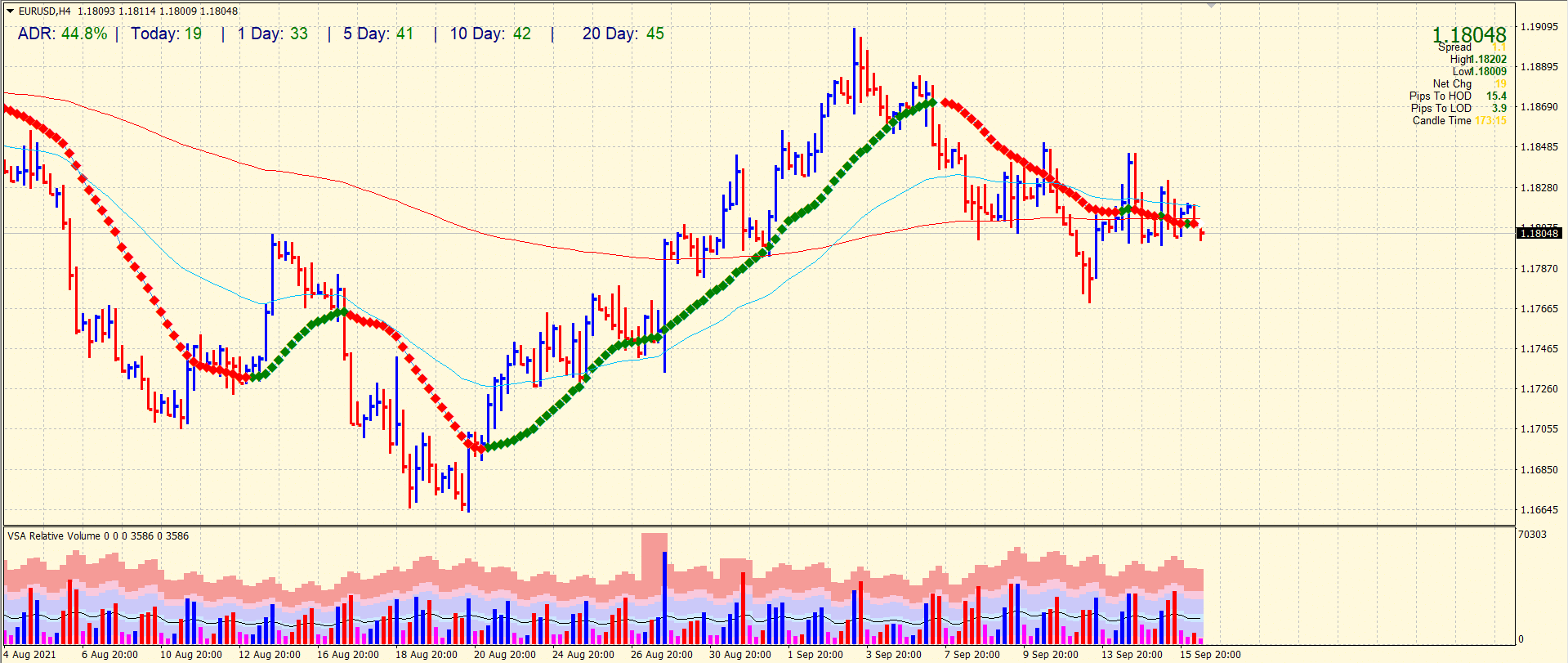

EUR/USD price technical analysis: 1.1800 remains the key

The EUR/USD price is wobbling around the key SMA congestion, slightly above the 1.1800 level. The average daily range for the pair is 38% so far. So, plenty of action is still due on the day. However, the 1.1800 level remains the key. If it is broken, the pair may drag down to 1.1770 ahead of 1.1730. On the upside, the double top at 1.1910 keeps the pair under pressure.