- Because of the uncertainty around the announcement of the US CPI, the EUR/USD has fallen below 1.0800.

- The dollar is gaining ground due to rising rates.

- In April, economic confidence in Germany and the Eurozone fell.

At the start of the London session, the EUR/USD price fell below 1.0900 amid the stronger greenback. The market is eying the US CPI.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Safe-haven greenback in action

In the backdrop of a Fed that is now focused on combatting inflation, the US Dollar has continued to rise. This is primarily due to the Fed’s continued parade of speakers touting their hawkish credentials.

The turn of Chicago Fed President Charles Evans came last night, with the possibility of a 50 basis-point raise at the next FOMC meeting in May.

Moreover, the 10-year US Treasury bond yield has risen over 2.8 percent for the first time since December 2018.

ZEW survey

The Economic Sentiment Index fell slightly to -41 in April from -39.3 in March, according to the findings of the German ZEW poll released on Tuesday. However, this result was far better than the market forecast of -48.

Talks of stagflation

The European Central Bank meeting on Thursday might be another stressful moment for policymakers grappling with record-high inflation and the economic fallout from the Ukraine conflict.

Military activity in Ukraine’s eastern regions has sparked worries of stagflation in the Eurozone.

Some ECB Governing Council members are pressing for an interest rate hike sooner rather than later, as some of the most dovish global central banks shift their tune to combat increasing inflation.

EUR/USD data events ahead

The March inflation data will be released today by the US Bureau of Labor Statistics. A stronger-than-expected CPI reading might pave the way for another DXY leap higher.

We don’t have anything to report about the Euro today. As a result, all eyes will be on the CPI in the United States today.

What’s next to watch for EUR/USD price?

Although economic data is important to Fiber, the ECB’s monetary policy decision on Wednesday will be the real show stopper. The ECB’s interest rate decision will remain steady at 0%.

EUR/USD price technical analysis: Trading in the red for now

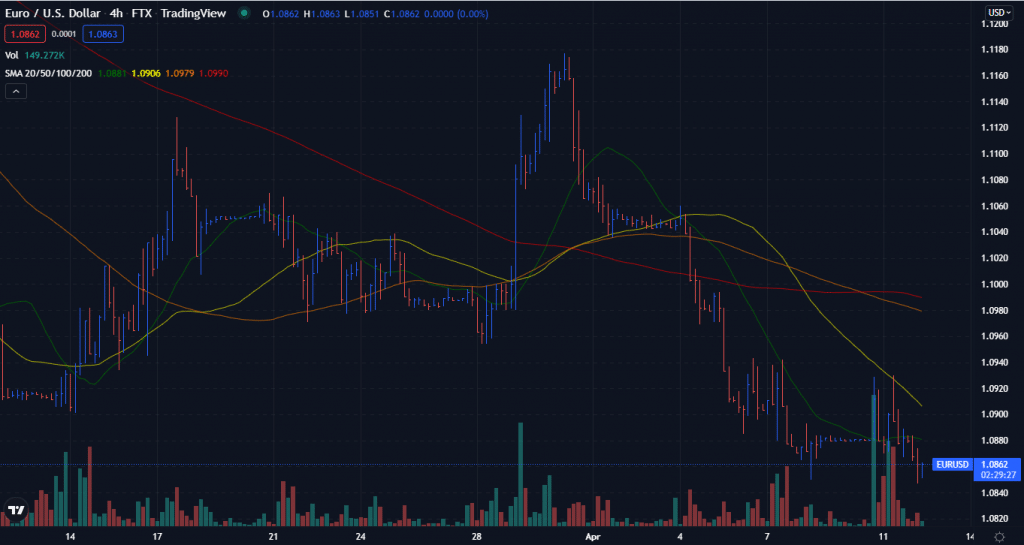

The EUR/USD price is hovering around the 1.0862 level. The 4-hour chart shows a bearish crossover of 100 and 200 SMAs. The price is below 20, 50, 100, and 200 SMAs. It signifies a bearish trend.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The next key resistance level for the Fiber is 1.0924. If the price goes above this level, it can further move towards 1.0957.

On the flip side, the next support is at 1.0850. If the price declines below this level, we can see it further drifting towards the 1.0800 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money