- EUR/USD violates bullish trendline, after rejection above 1.22.

- The weekly chart suggests scope for a re-test of February lows.

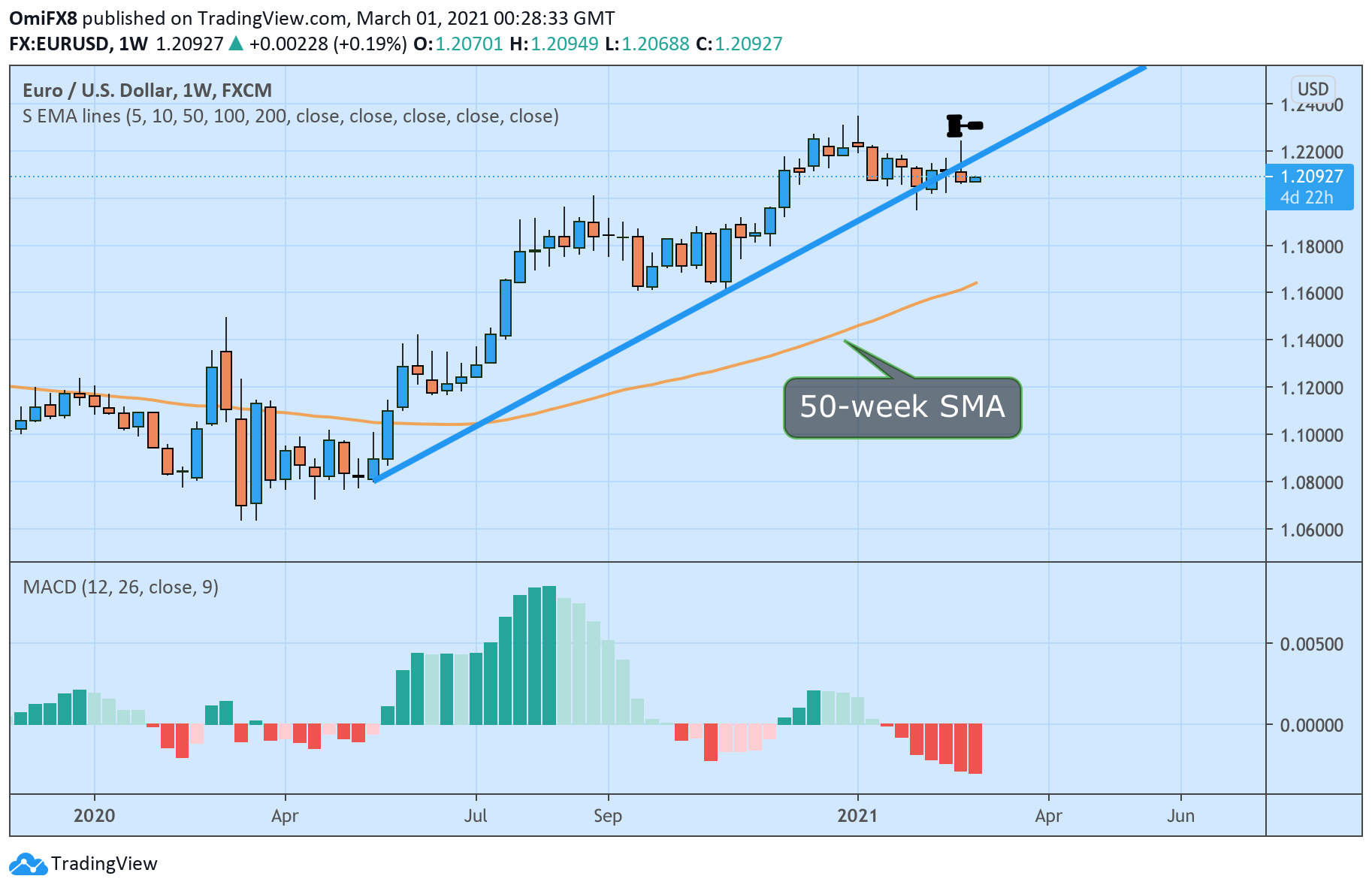

EUR/USD failed to keep gains above 1.22 on Thursday and ended Friday at 1.2070, forming a weekly red candle with a long upper shadow, a bearish sign, and a downside break of the trendline rising from May and November lows.

The breakdown is backed by a negative or bearish reading on the weekly chart MACD histogram; an indicator used to gauge trend strength and identify trend changes.

The pair could revisit February’s low of 1.1952, under which the ascending 50-week Simple Moving Average, currently at 1.1644, could offer support.

A close above 1.2243 (Thursday’s high) is needed to revive the bullish outlook.

Weekly chart

Trend: Bearish

Technical levels