- EUR/USD consolidates last week’s losses below the 1.1240 level.

- The level to beat for bears is the 1.1056 support.

- The Fed slashes interest rates to near zero in an emergency move.

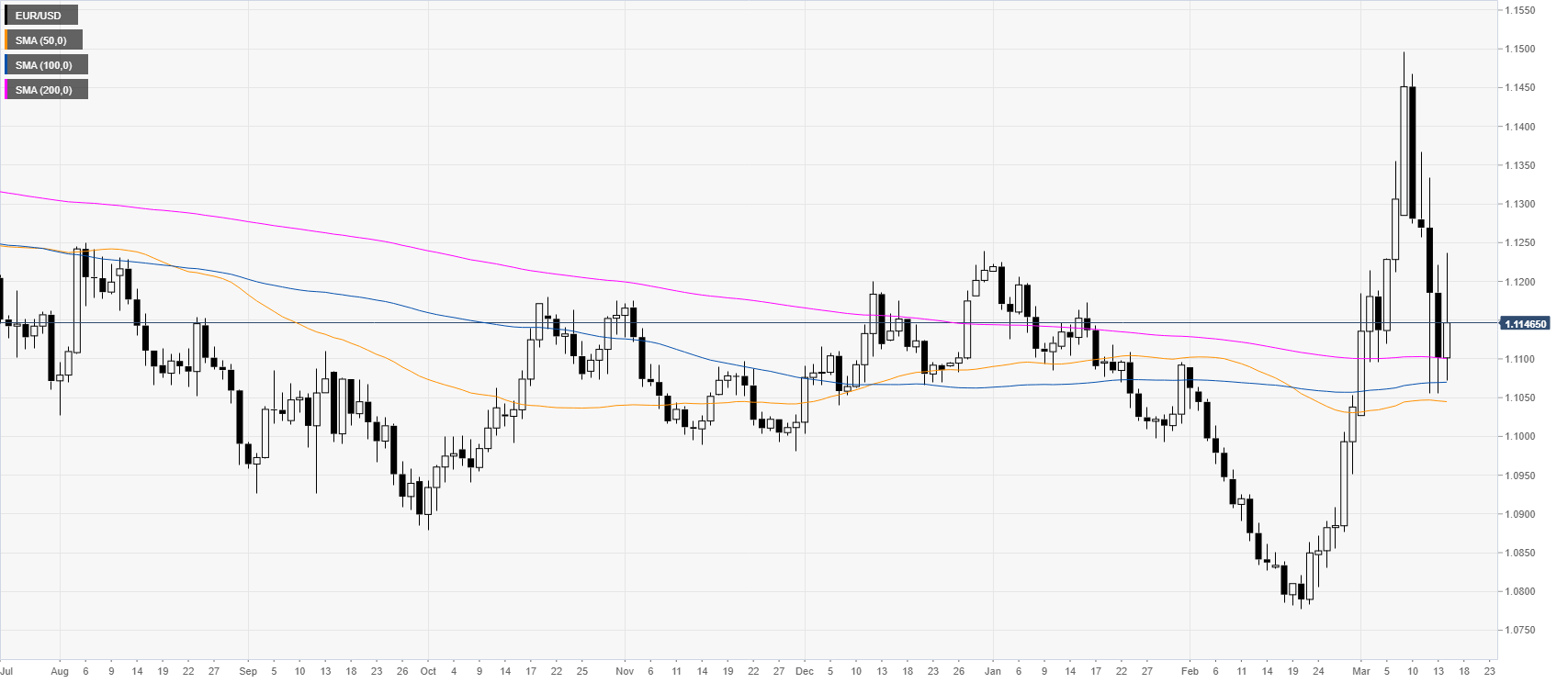

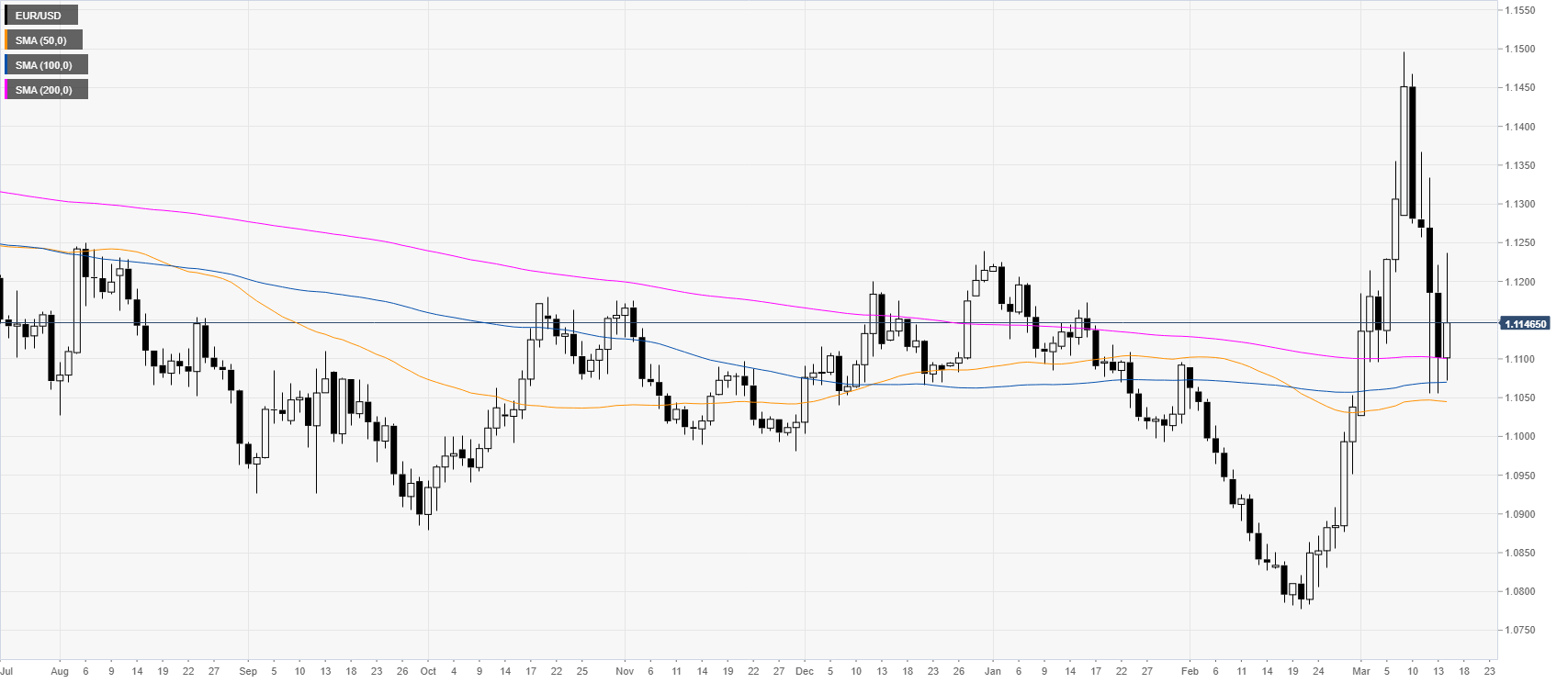

EUR/USD daily chart

EUR/USD is consolidating last week’s decline while trading just above the main SMAs. DXY (US dollar index) remains supported despite the 100bps rate cut by the Fed.

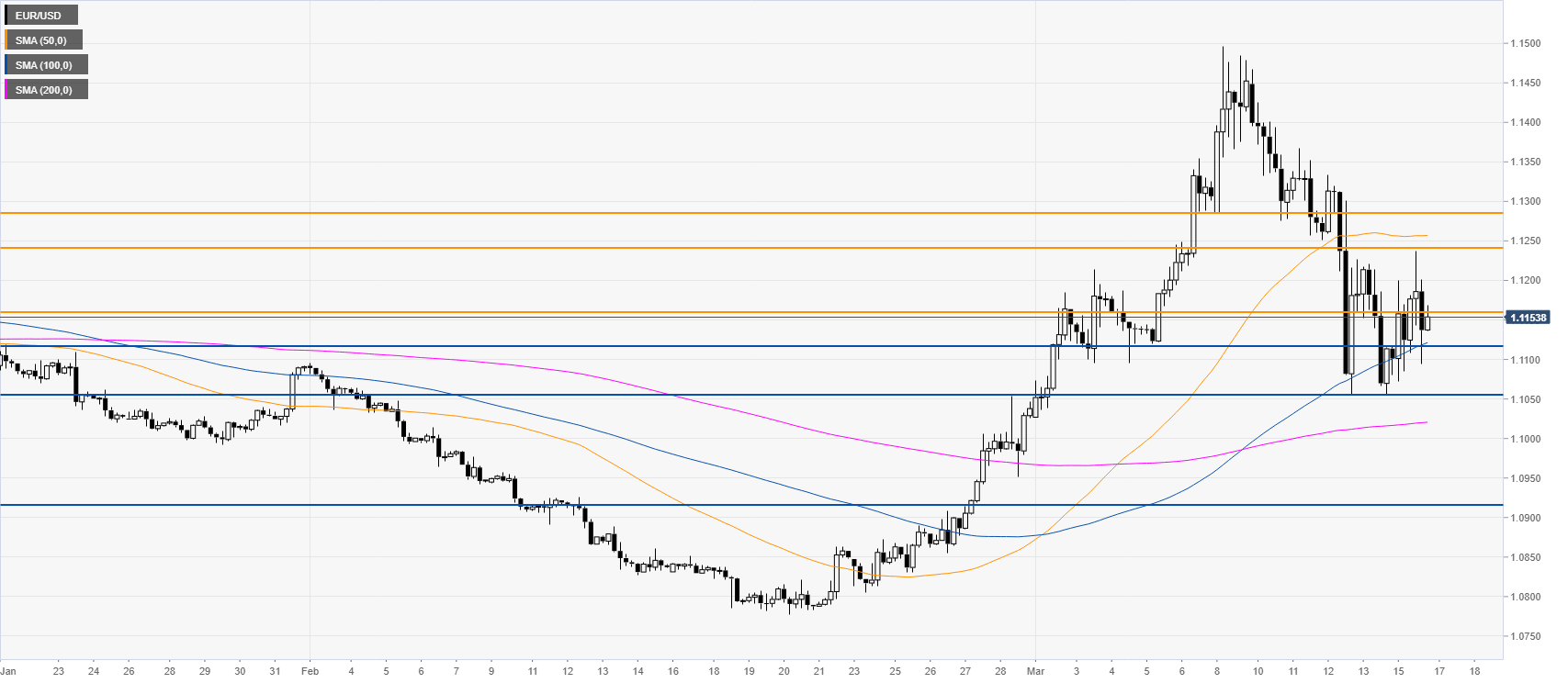

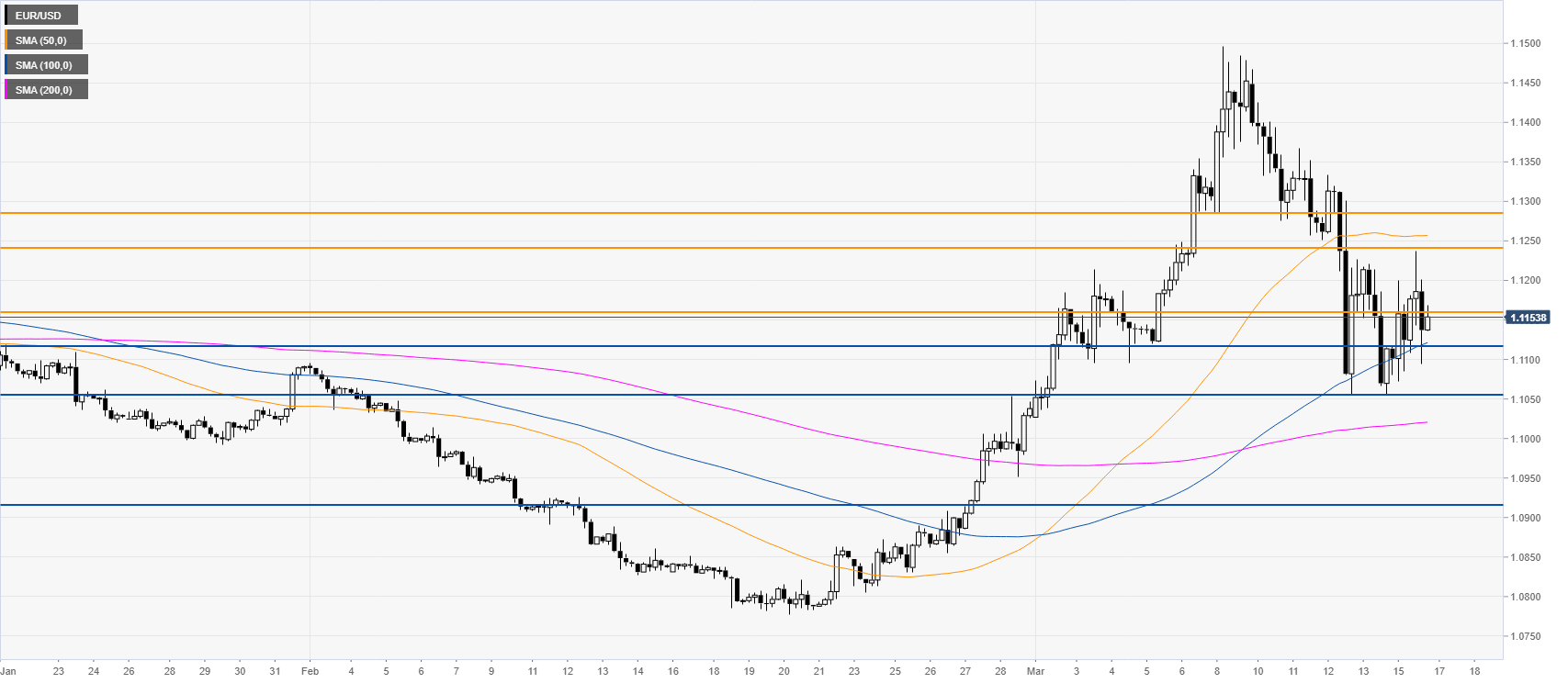

EUR/USD four-hour chart

EUR/USD consolidates below the 1.1240 level and the 50 SMA on the four-hour chart in a relatively quiet session this Monday. Bears want a resumption of the strong bearish move, however, they need to overcome the 1.120/1.1056 support zone. A break below the above-mentioned price zone could potentially see EUR/USD decline towards the 1.0910 level in the coming sessions. Resistance can be expected neat 1.1160, 1.1240 and 1.1288 resistance levels, according to the Technical Confluences Indicator.

Resistance: 1.1160, 1.1240, 1.1288

Support: 1.1120, 1.1056, 1.0910

Additional key levels