- EUR/USD spikes up above the 1.0900 figure on extraordinary Fed’s comments.

- Support is seen near the 1.0900 and 1.0850 levels.

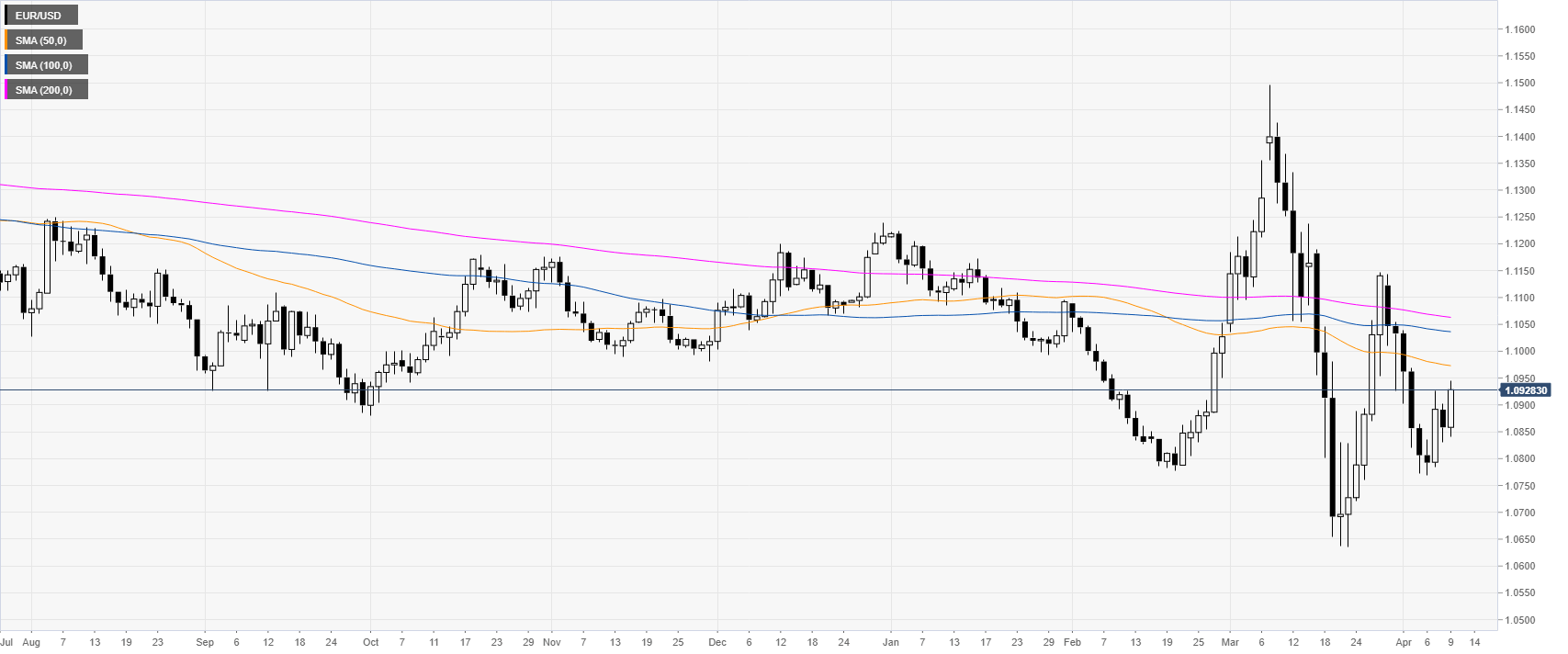

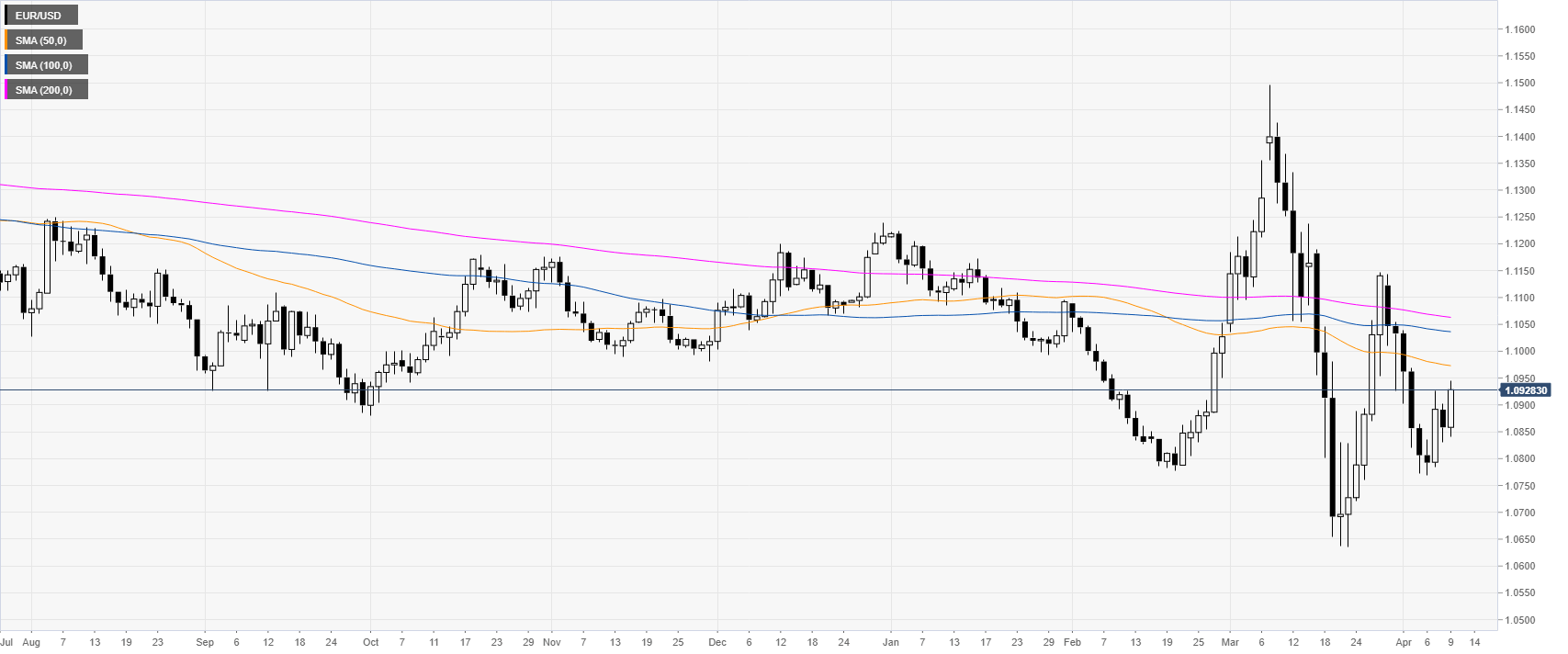

EUR/USD daily chart

EUR/USD is bouncing from the 1.0800 figure while trading below the main SMA (simple moving average) on the daily chart. The Fed announced it would inject $2.3 trillion in additional loans while US jobless claims were above 6.6 million, which was worse than expected.

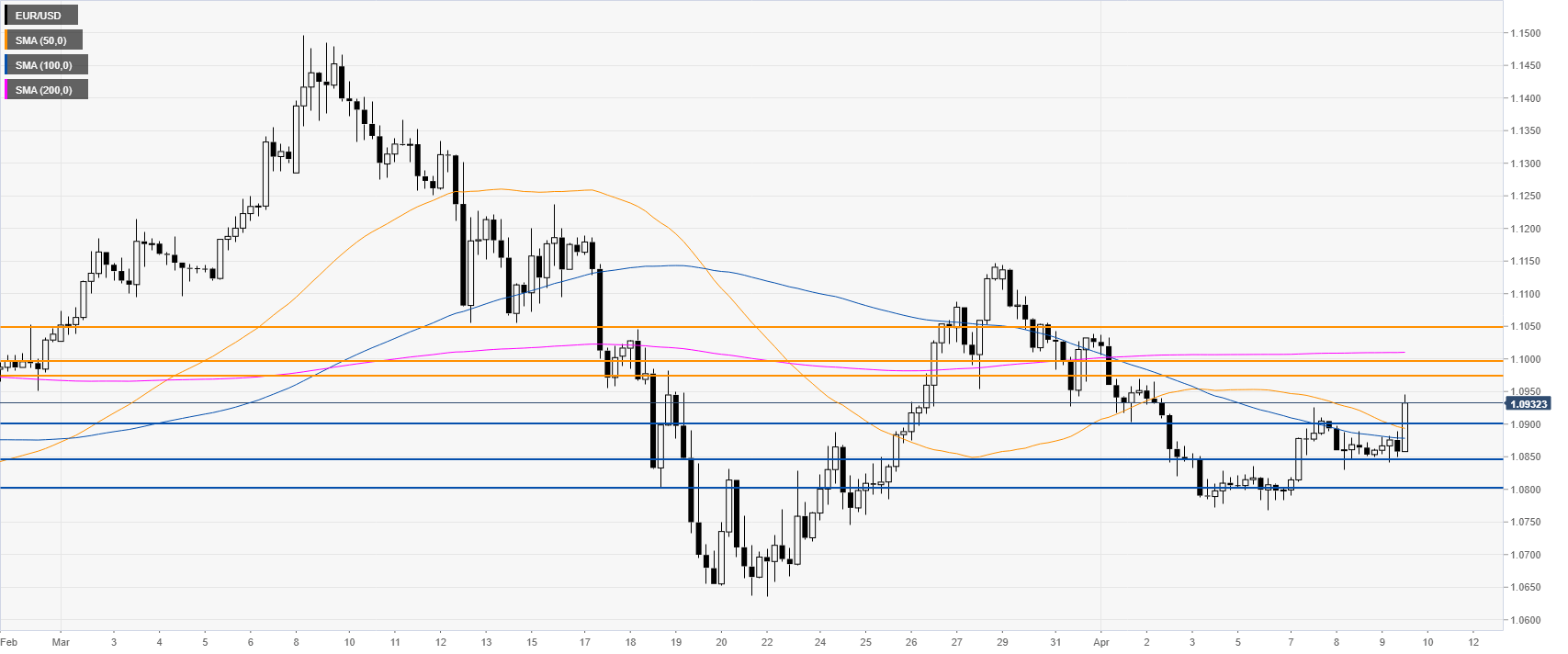

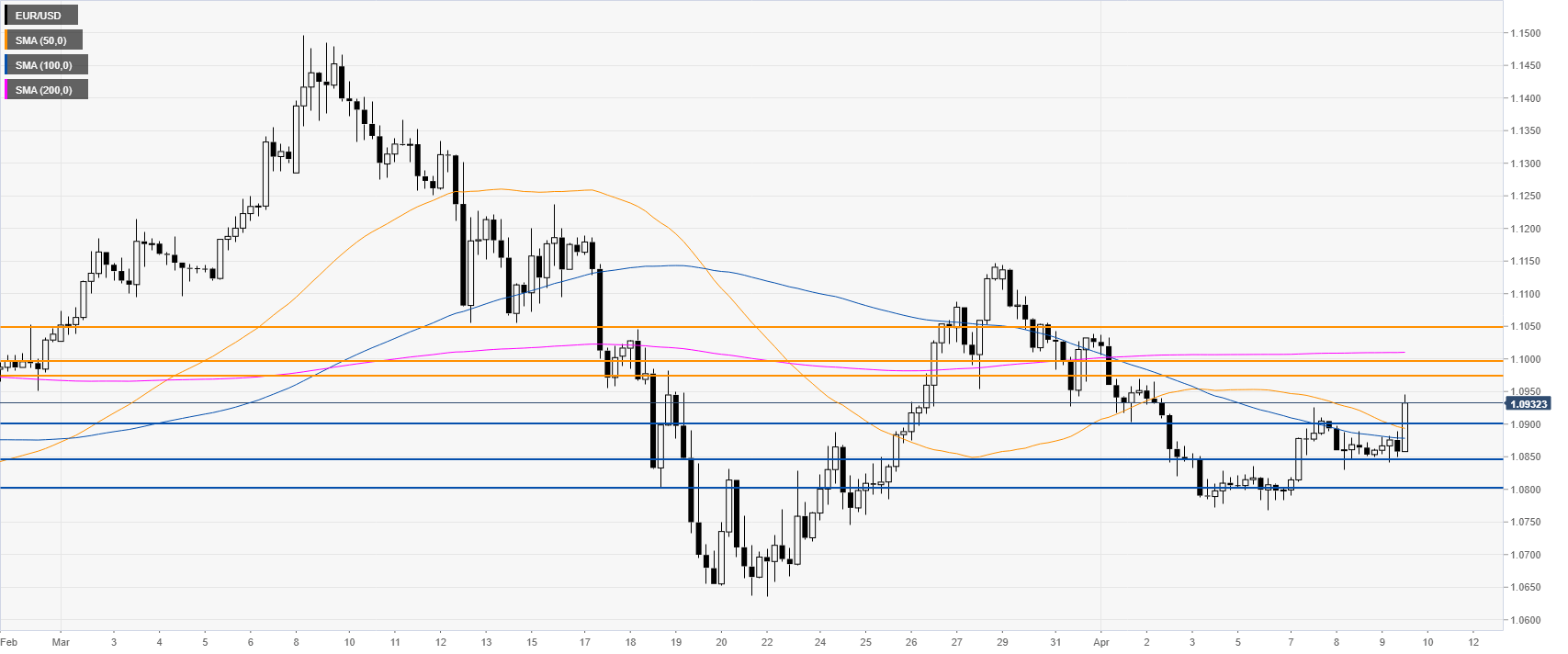

EUR/USD four-hour chart

EUR/USD is in consolidation mode while trading below the 200 SMA suggesting a bearish bias in the medium term. However, this Thursday, the market had a spike to the upside as bears want to keep the spot below the 1.0973/1.1000 band. Sellers will be looking for a break below the 1.0900 level end route to the 1.0850 and 1.0800 levels on the way down, according to the Technical Confluences Indicator.

Resistance: 1.0973, 1.1000, 1.1050

Support: 1.0900, 1.0850, 1.0800

Additional key levels