- The euro is bouncing from the session’s low ahead of the FOMC.

- The spot is likely trapped in the 1.1150-1.1190 range.

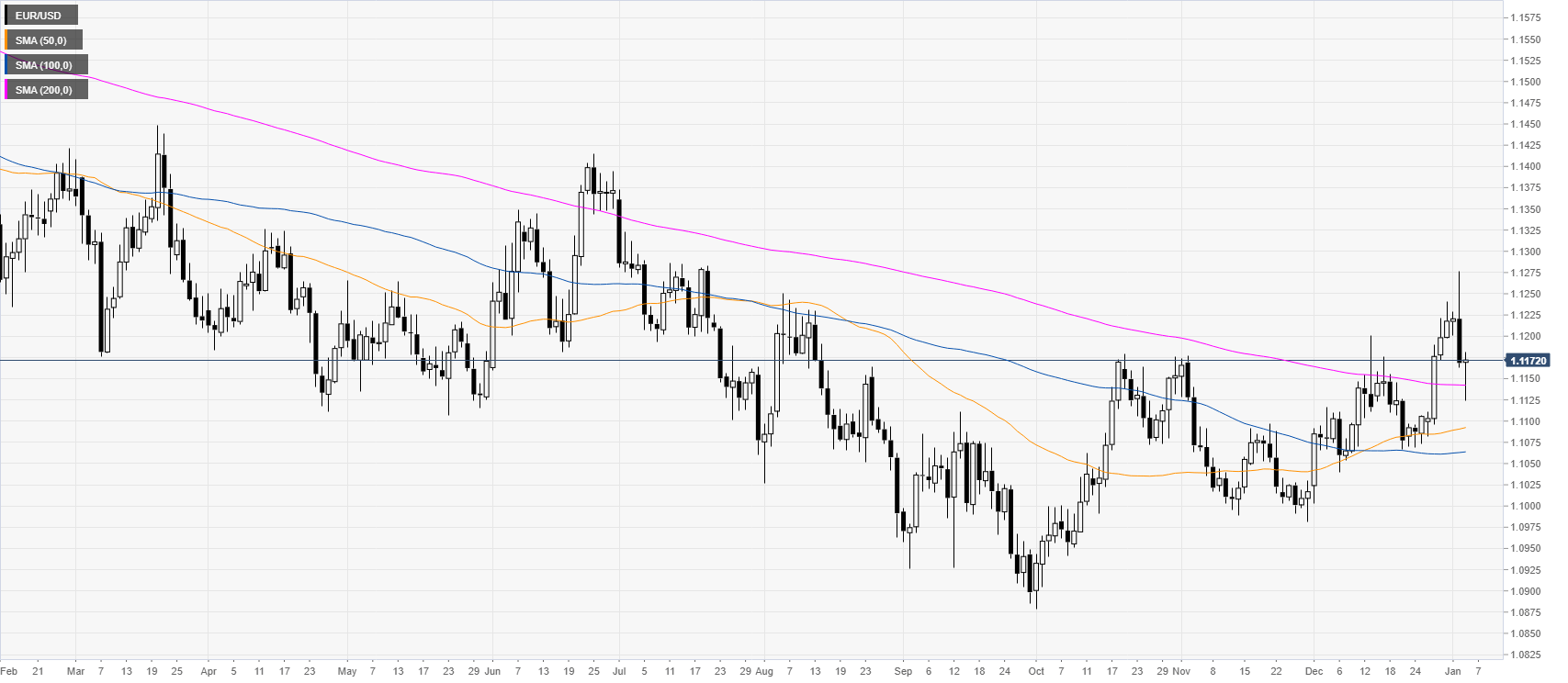

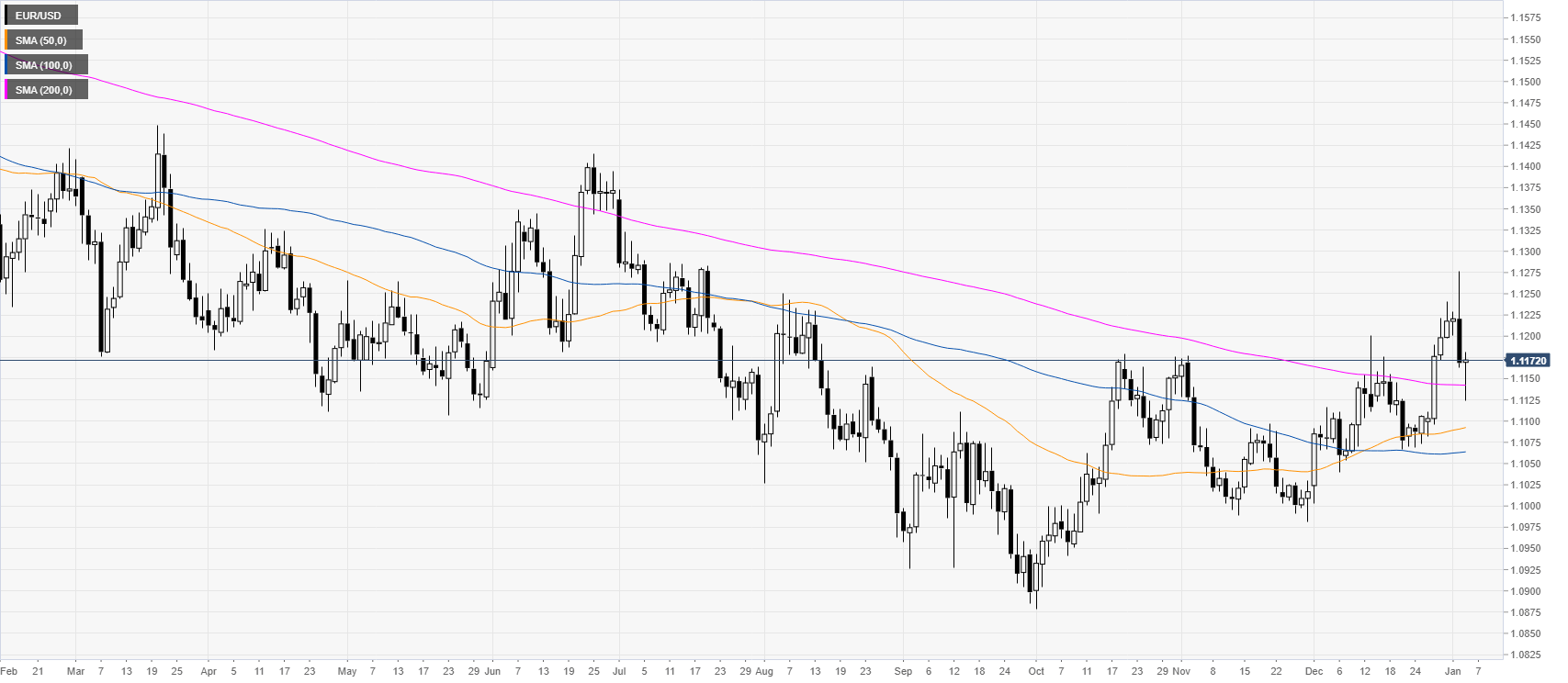

EUR/USD daily chart

The spot is retracing down while trading above the main SMAs on the daily chart. However, the euro is trading mixed ahead of the FOMC at 19:00 GMT. According to analysts, the event is not expected to be a major market mover.

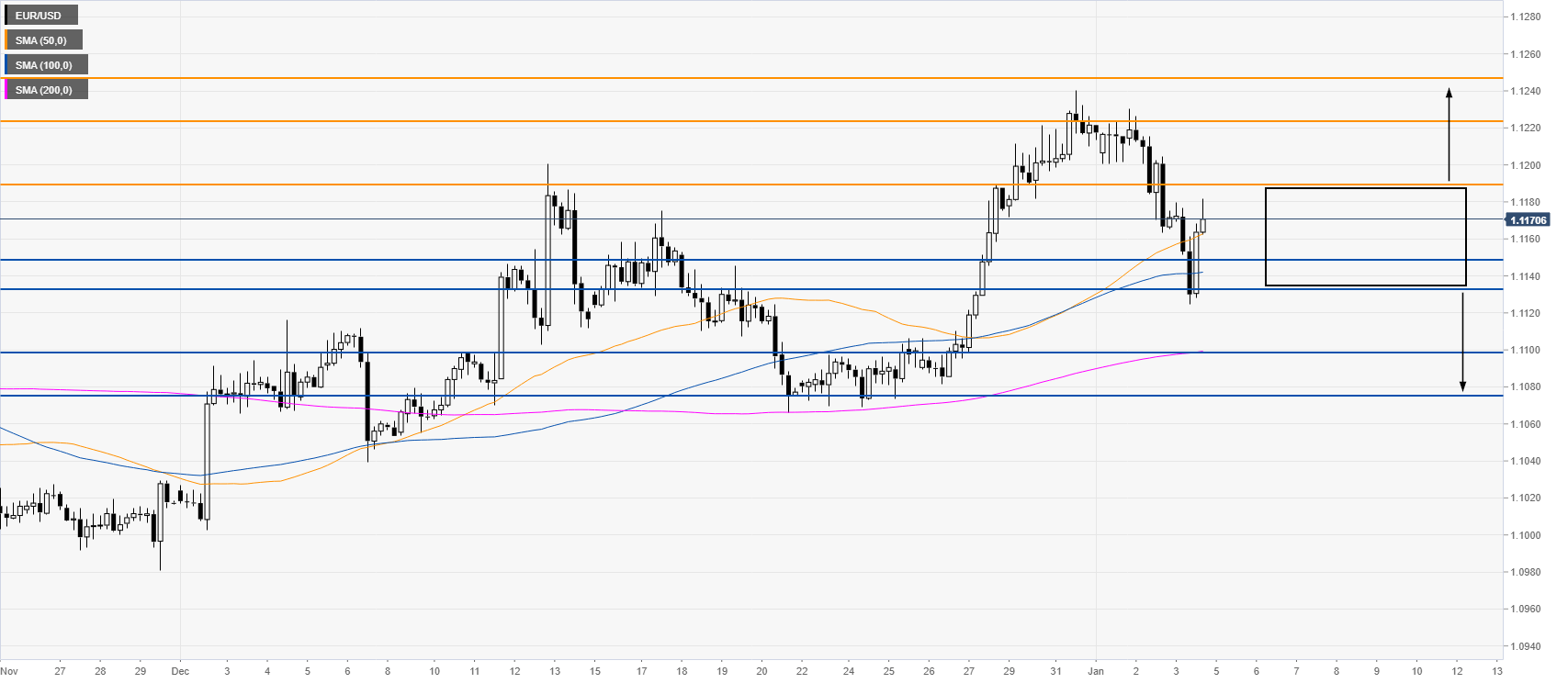

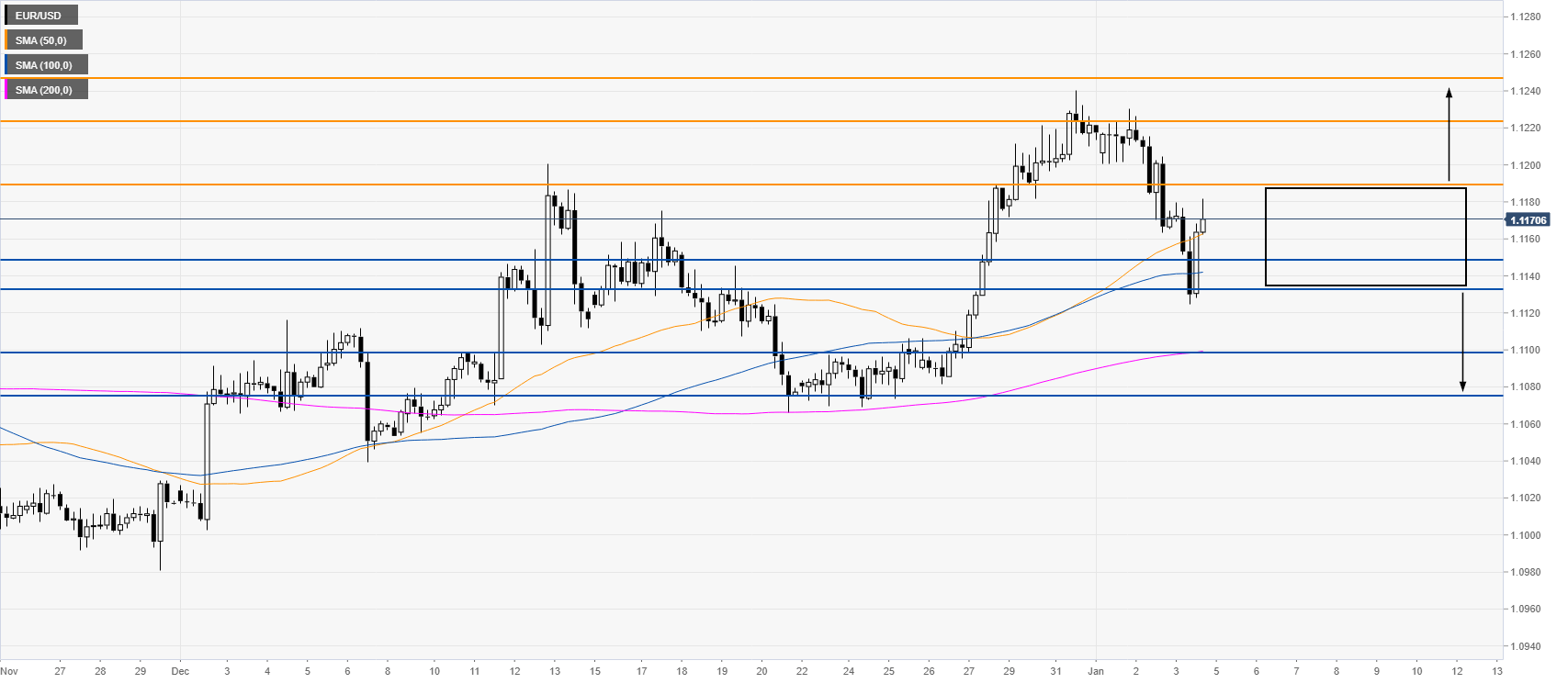

EUR/USD four-hour chart

The euro is bouncing from the 1.1150/32 support zone while above the main SMAs. Bulls want a break of the 1.1190 resistance. However, since the market has been so two-sided of late the spot is more likely to stay within the 1.1150-1.1190 range in the medium term. A clear break above 1.1190 is necessary to reach 1.1225 and 1.1248 levels, according to the Technical Confluences Indicator. On the flip side, bears would need to pierce the 1.1150/32 price zone to reach the 1.1098/74 level.

Additional key levels