- EUR/USD takes offers near the lowest since December 09, 2020.

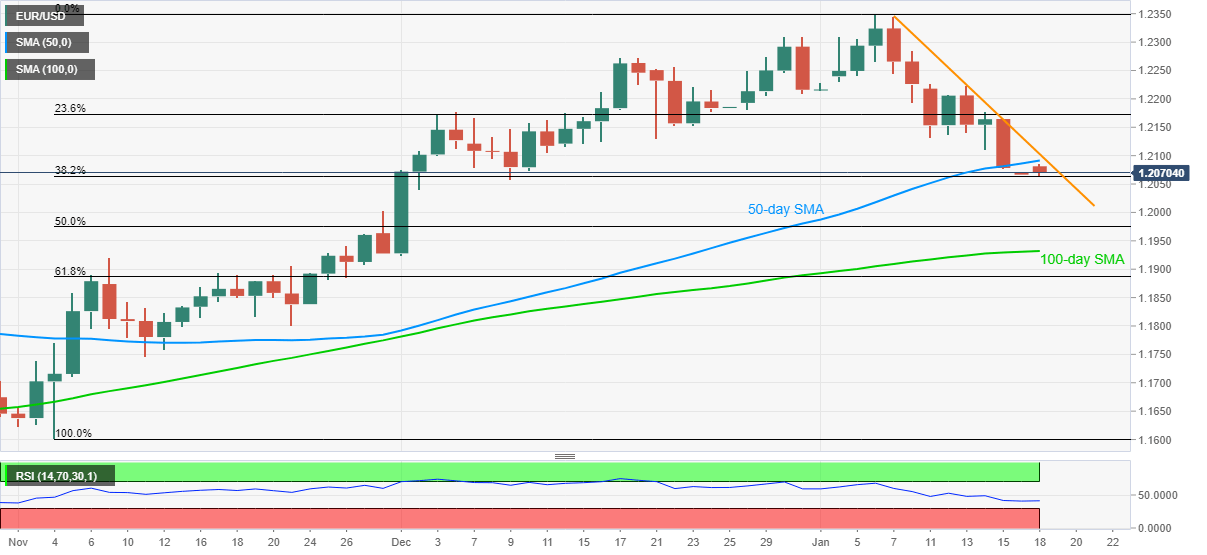

- Sustained break of 50-day SMA, downward sloping RSI favor sellers.

- Seven-day-old falling trend line adds to the upside barriers.

EUR/USD takes offers near 1.2065, down 0.10% intraday, during Monday’s Asian session. In doing so, the currency pair drops to the fresh low since early December 2020 while stretching Friday’s downside break of 50-day SMA.

In addition to the successful break below 50-day SMA, descending RSI line, which is far from oversold conditions, also back the EUR/USD bears in attacking 38.2% Fibonacci retracement of an upside from November 2020 to the monthly high.

It should, however, be noted that December 02 low near 1.2040 and the 1.2000 threshold will be tough nuts to crack for the EUR/USD sellers ahead of 50% Fibonacci retracement near 1.1975.

If at all the quote refrains from bouncing off 1.1975, 100-day SMA and 61.8% Fibonacci retracement, respectively around 1.1930 and 1.1885, will be in focus.

Meanwhile, an upside clearance of 50-day SMA, at 1.2091 now, will have to cross a falling trend line from January 07, currently around 1.2105, to confirm corrective pullback towards the multiple lows marked since late-December around 1.2130.

During the EUR/USD upside beyond 1.2130, the previous month’s top near 1.2310 and the monthly peak surrounding 1.2350 can lure the bulls.

EUR/USD daily chart

Trend: Further weakness expected