- EUR/USD remains sluggish around 1.1500 area after Fed-led losses.

- US GDP printed at 6.9% for Q4 against the expected 5.3%.

- Risk aversion remains in action amid Russia-Ukraine.

A sluggish Friday morning saw the EUR/USD price analysis hover around 1.1150 as markets took a breather from a highly volatile post-Fed session.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

With fundamentals favoring further US strength, this level could fall in the medium term if yield differentials between the two currencies widen. However, a break below 1.1000 could be prevented by a key number in the near term. Powell this week added another bearish layer to the weekly chart to break the recent series of higher weekly lows.

While this is happening, the major currency pair is also recovering from the lowest level since June 2020 recorded the previous day, breaking a four-day downtrend. After that, however, the pair is expected to decline for the first time since mid-June 2021.

Furthermore, the latest market move can be seen in conjunction with cautious sentiment ahead of Germany’s fourth-quarter GDP preliminary data, forecast at -0.3% vs. 1.7% earlier, as well as US core PCE price index data for December, forecast at +4.8, related % y/y versus 4.7% previously.

Mixed worries over fears of a Russian invasion of Ukraine and the associated risks to the EU are also concerning EUR/USD traders. US President Joe Biden spoke with his Ukrainian counterpart, Volodymyr Aleksandrovich Zelenskyj, and expressed his willingness to provide additional economic support.

These developments have resulted in benchmark US 10-year Treasury yields remaining firmer by 1.81% the previous day after their biggest drop in a month. At press time, S&P 500 futures are also posting a modest gain near 4330.

According to Germany’s GfK consumer confidence survey, the final score improved to -6.7% as opposed to -7.8% and -6.9% previously expected. In addition, US Advance Q4 GDP rose 6.9% y/y versus earlier estimates of 5.5% and 2.3%. Similarly, US jobless claims for the week ended Jan. 21 came in at 206k compared to expectations of 260k and 290k. Furthermore, US durable goods orders fell 0.9% in December, compared to the market consensus of 0.5%.

If there is a correction after the recent sharp drop, it may be wise to wait a bit before entering a short EUR/USD trade. Moving into the 1.1250-1.1300 area would give traders an excellent entry point below 1.1000.

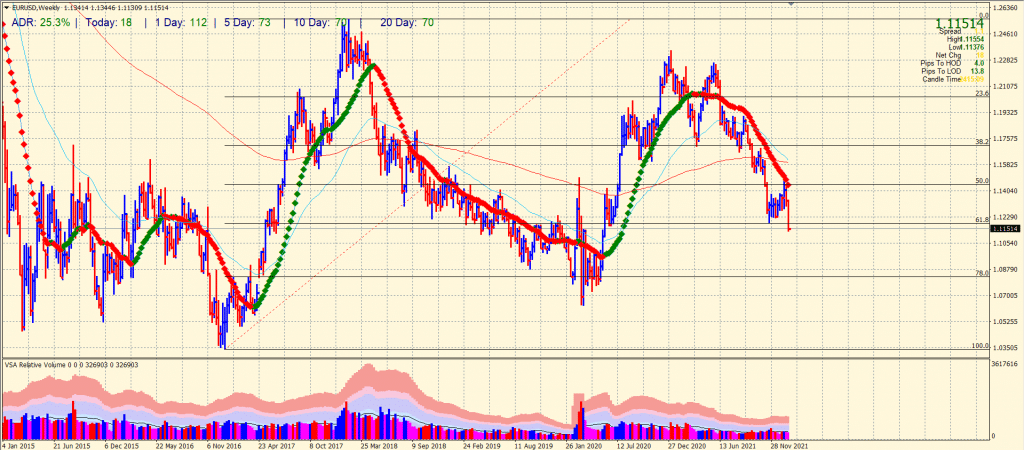

EUR/USD price technical analysis: Bears eying 1.1000

The EUR/USD pair is currently pushing against the multi-week support, and if it breaks through, the pair will return to levels last seen in June 2020 and a key Fibonacci retracement level.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The EUR/USD rate is trading at 1.1190 and just above 1.1185 at the end of November. If it breaks, which is likely to happen, then the Fibonacci 61.8% retracement at 1.1182 will fall as well. In the absence of this support, it becomes more difficult to spot a mini swing low near 1.1168, the only real resistance before levels below 1.1000 on the weekly chart comes into play.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.