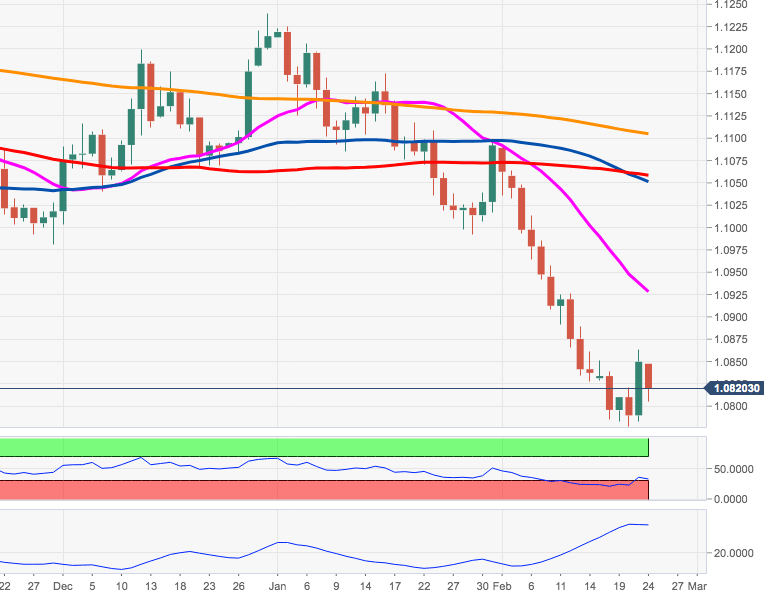

- EUR/USD is fading Friday’s gains and returned to the 1.0820 area.

- Rallies are seen struggling initially in the 1.0880/90 zone.

EUR/USD has come under pressure on Monday after failing to sustain the move to the 1.0860/65 band last Friday.

In the meantime, current “oversold” conditions, as per the RSI indicator, remain the only driver behind occasional bouts of strength that should face initial hurdle in the 1.0880 region, where sits a Fibo retracement of the 2020 drop and the October 2019 low.

On the broader scenario, the bearish view remains unchanged as long as the spot trades below the 55-day SMA, today at 1.1045. However, the inability of sellers to push through the 1.0780/75 band in the short-term horizon could spark some consolidation, leaving that area as an interim bottom.

EUR/USD daily chart