- EUR/USD rises for the fourth consecutive day while probing the highest levels since April 2018.

- Sustained trading beyond 10-day SMA, eight-week-old support line favor buyers.

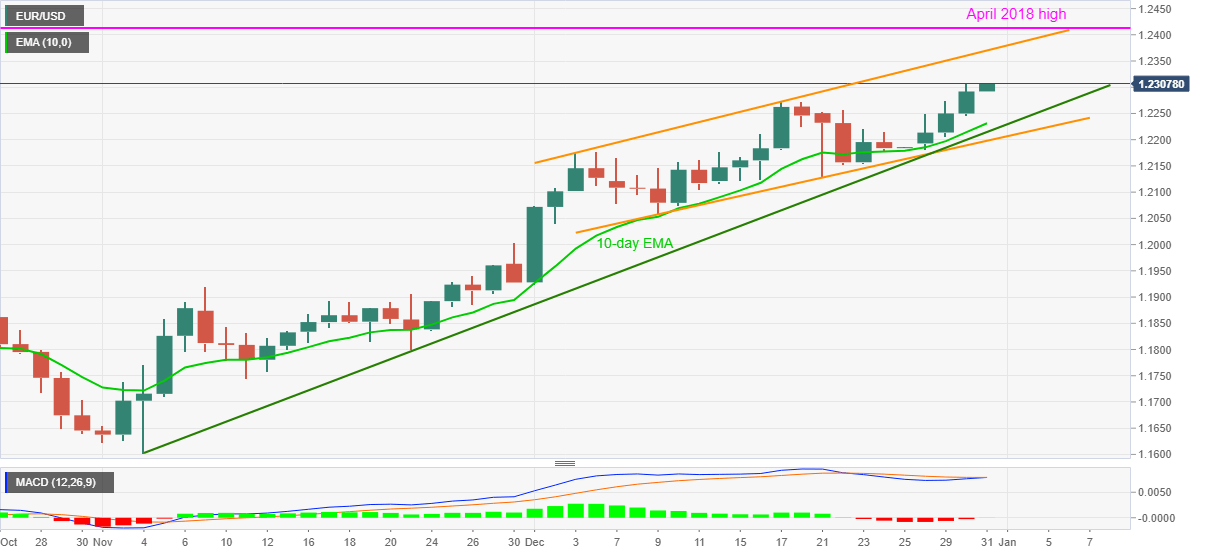

EUR/USD pokes the 32-month high, flashed the previous day, while taking rounds to 1.2305, up 0.12% intraday, during early Thursday. The pair jumped to the multi-month high on Wednesday after clearing December 17 top.

Also favoring the EUR/USD buyers is the quote’s successful trading above 10-day SMA and an upward sloping trend line from November 04 as MACD flirts with the bulls.

That said, the present upside momentum eyes on the ascending trend line from December 03, at 1.2370 now, ahead of challenging the 1.2400 round-figure. However, the April 2018 peak near 1.2415/20 can offer breathing space to the EUR/USD bulls afterward.

On the contrary, a downside break of the early-month high near 1.2270 can re-test the 10-day EMA level of 1.2230. Though, trendlines stretched from early November and December 09, respectively around 1.2215 and 1.2200, will probe the quote’s further weakness.

In a case where the EUR/USD bears retake control below 1.2200, the 1.2000 and the early November high near 1.1920 will gain the market’s attention.

EUR/USD daily chart

Trend: Bullish