- EUR/USD poses a downside risk despite a little support at YTD lows.

- US dollar gained against most of the currencies in anticipation of upbeat US NFP data.

- Technically, the price is supported and may test 1.1600.

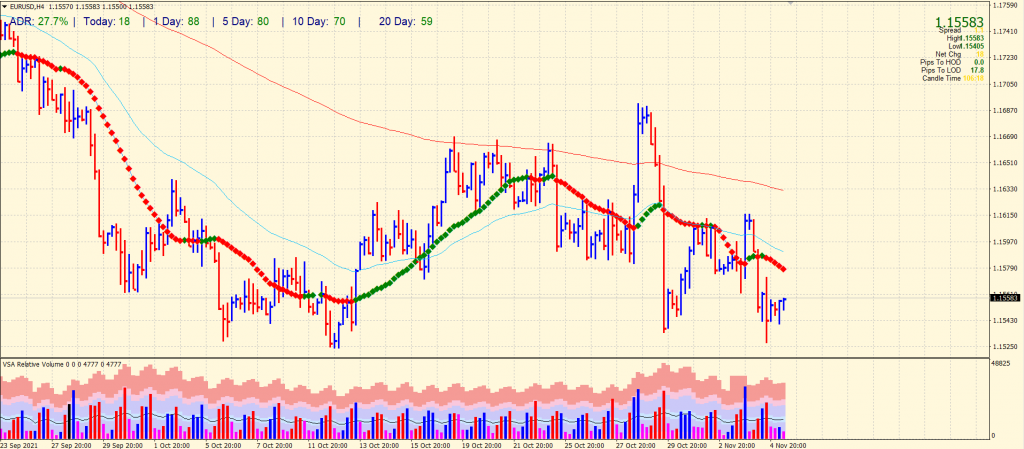

The EUR/USD price analysis suggests a neutral bias for now. However, the price is vulnerable to breaking the YTD lows as Greenback regains strength.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started.

As traders capitalized on interest rate expectations, risk appetite remained resilient after the Bank of England’s surprise decision resulted in lower yield curves by geographic region. In contrast, the EUR/USD exchange rate has fallen to a new monthly low, 1.1615 to 1.1528. Today, the pair is trading between 1.1545, the current Tokyo low, and 1.1555, its previous Asian low.

On Friday, the US dollar recovered against major competitors for a second consecutive week as traders bought the dollar’s loss in anticipation of the release of today’s US non-farm employment report, which could impact when the Federal Reserve increases interest rates.

Analysts at Westpac predict that the number of jobs outside agriculture will increase strongly in October (market median f / c + 450,000, Westpac + 500,000). Even with a higher employment rate, the unemployment rate will fall to 4.7%. In the meantime, wage growth will continue to be supported by labor shortages.

After the Federal Reserve meeting, the DXY dollar index, which measures the dollar against a basket of six competitors, rose from a low of 93.82 to 94.47 and rose 0.51% on Thursday. This resulted in 0.21% gains for the week.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

EUR/USD price technical analysis: YTD lows to support

After testing the support zone around YTD lows, the EUR/USD price is stuck around the 1.1550 area. The pair has only a 26% average daily range so far, which shows that the market participants are waiting for a catalyst. The pair can test the resistance of 20-period SMA around 1.1575 ahead of the round number hurdle of 1.1600.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.