- EUR/USD’s rebound falters, as sellers return on Tuesday.

- Pre-US CPI report caution trading lifts the US dollar bids.

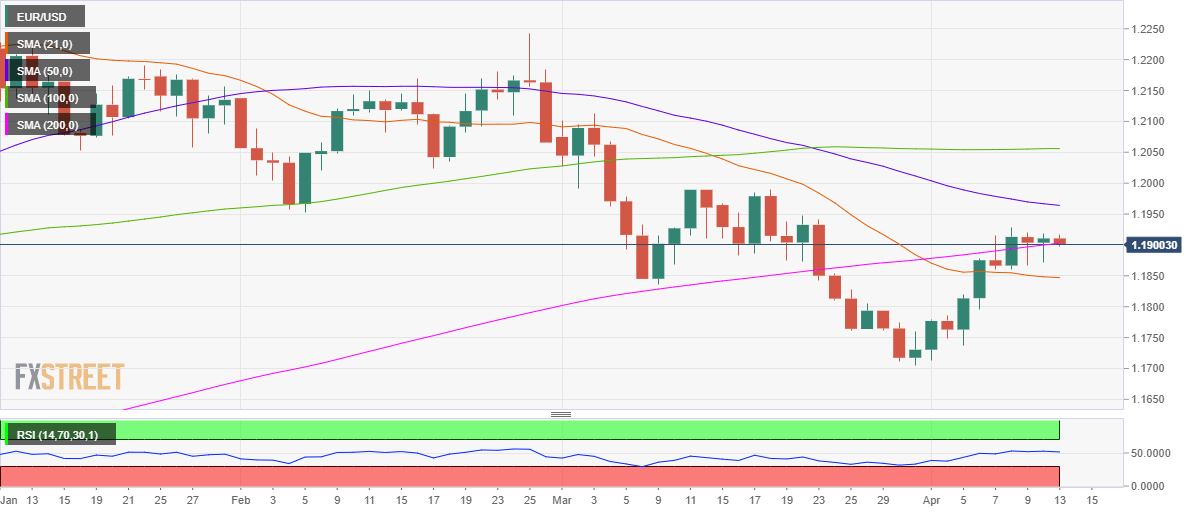

- Bullish RSI keeps the upside alive while EUR/USD battles 200-DMA.

EUR/USD continues to move back and forth around 1.1900, lacking a clear directional bias, as investors eagerly await the US CPI data release for a fresh trading impetus.

Markets have turned cautious amid the earnings seasons and after Fed Chair Powell said that the economy is at an inflection point. Monday’s Treasuries auction failed to have any market impact.

From a near-term technical perspective, the price clings onto the all-important 200-daily moving average (DMA) at 1.1903, extending its range play into a fifth straight session this Tuesday.

Despite closing Monday above the 200-DMA, the sellers fought back control amid the market’s nervousness.

A sustained move below the latter could call for a test of the intermittent lows around the 1.1870 region.

The next relevant target for the bears is seen at the horizontal 21-DMA at 1.1847.

EUR/USD: Daily chart

However, with the 14-day Relative Strength Index (RSI) still holding above the central line, a potential move higher remains on the cards.

The main currency pair could likely test the bearish 50-DMA at 1.1954 should the buying pressure intensify.

Further up, the 1.2000 psychological magnate is expected to lure the EUR buyers.

EUR/USD: Additional levels