- EUR/USD eases from fresh high since September 01.

- RSI conditions warrant caution, bears are less likely to take entries above 1.1870.

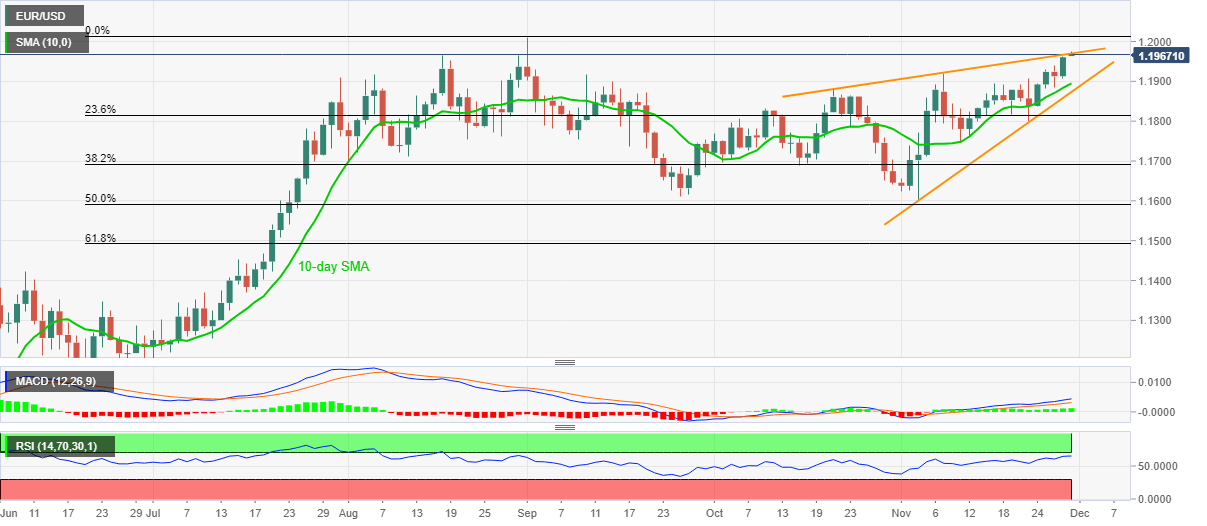

EUR/USD steps back from the multi-day high while declining to 1.1964 during Monday’s Asian session. The pair rose to the highest in three months before a few hours but couldn’t cross the upper line of a five-week-old ascending triangle formation.

Considering the nearly overbought RSI conditions, the EUR/USD prices are likely to ease a bit to 10-day SMA around 1.1900. However, any further weakness needs to slip beneath the stated triangle’s support line, currently around 1.1870, before recalling the bears.

Should EUR/USD prices drop below 1.1870 on a daily closing basis, November 11 low near 1.1745 and the monthly bottom close to 1.1600 will lure the sellers afterward.

Meanwhile, an upside clearance of 1.1970 will eye the 1.2000 round-figure and the yearly top, marked in September, around 1.2015.

It should additionally be noted that the September 2017 peak near 1.2095 adds to the upside filters.

EUR/USD daily chart

Trend: Pullback expected