- EUR/USD trades flat in Asia after defense of 1.20 on Wednesday.

- Technical charts favor a minor bounce to the 5-day SMA.

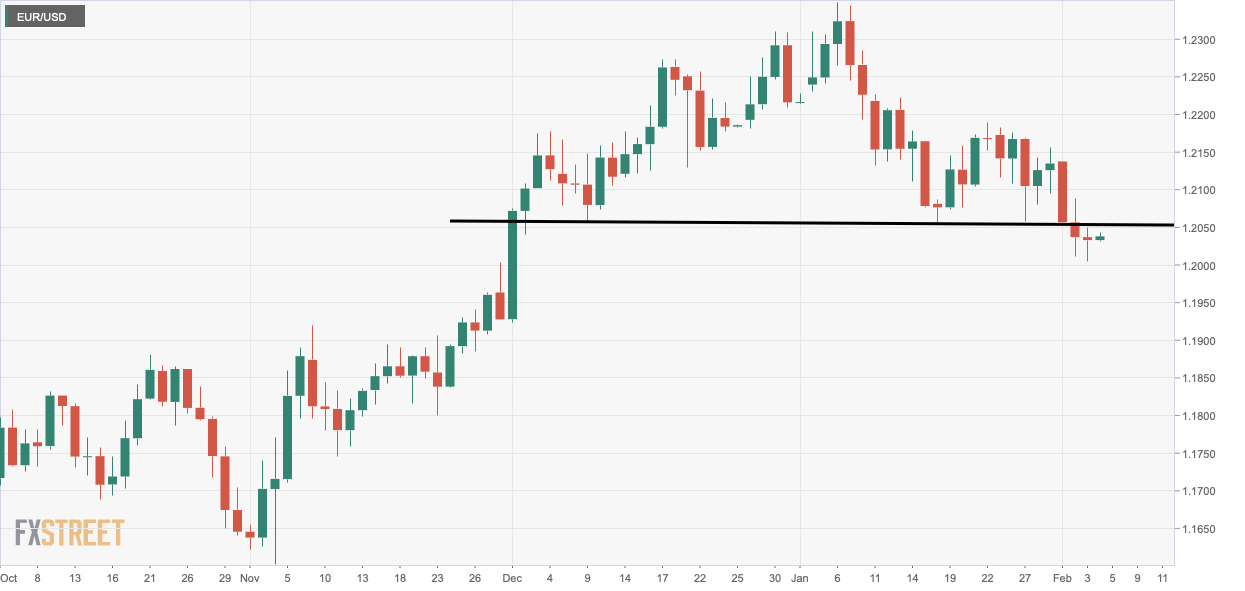

EUR/USD trades mostly unchanged on the day near 1.2036 at press time.

The pair carved out a candle with a long-tail for the second straight day on Wednesday, signaling downtrend fatigue near the psychological support of 1.20.

That, along with a bullish divergence of the 4-hour chart Relative Strength Index (RSI), suggests scope for a bounce to the 5-day Simple Moving Average (SMA), currently at 1.2061.

Acceptance under 1.20 would revive the bearish view put forward by the head-and-shoulders breakdown confirmed earlier this week.

Daily chart

Trend: Bearish

Technical levels