- EUR/USD picks up bids after two-day uptrend, Good Friday restricts the moves.

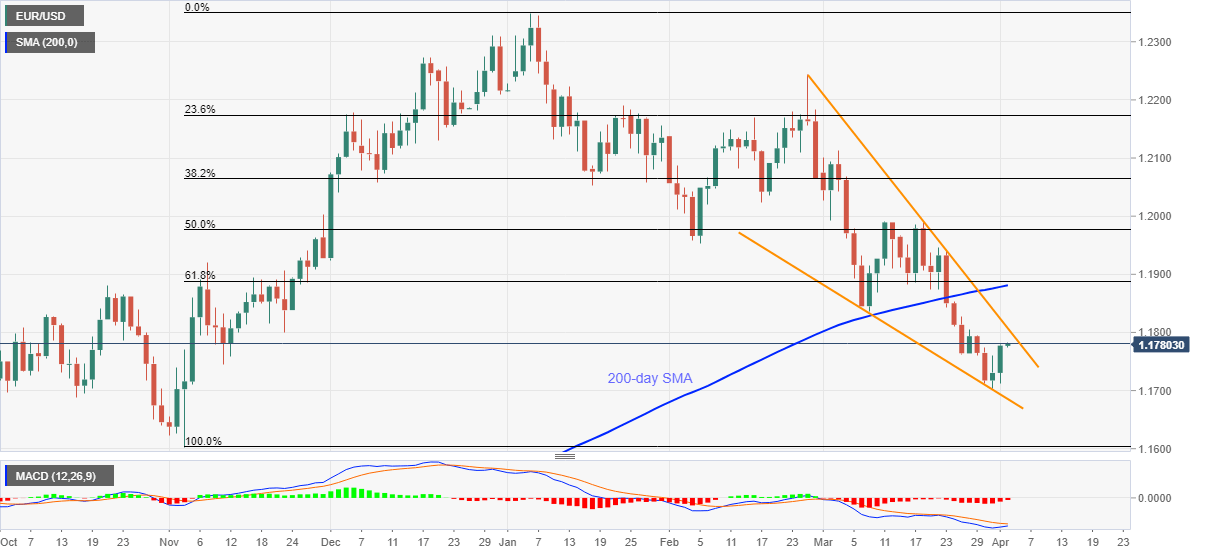

- Receding bearish bias of MACD suggests confirmation of bullish chart pattern.

- Convergence of 200-day SMA, 61.8% Fibonacci retracement becomes the key hurdle to north.

Despite holiday-thinned moves in Asia, EUR/USD keeps the previous two-day upside, recently picking up bids, amid early Friday.

The currency major pair’s latest recovery moves from a four-month low portrays falling wedge bullish chart formation on the daily (D1) play. This, together with the receding bearish bias of MACD, keeps buyers hopeful.

Though, a clear upside break of 1.1810 becomes necessary to extend the pair’s run-up towards 200-day SMA and 61.8% Fibonacci retracement of November 2020 to January 2021 upside, around 1.1880-85.

Meanwhile, 1.1760 and the latest low near 1.1700 precede the support line of the stated chart pattern, around 1.1685 to restrict short-term EUR/USD downside.

In a case where the quote drops below 1.1685 on a daily closing basis, its south-run to the 1.1600 becomes imminent.

Overall, EUR/USD bulls seem to roll up their sleeves ahead of the key US NFP data, even if holiday mood challenges the momentum.

EUR/USD daily chart

Trend: Further recovery expected