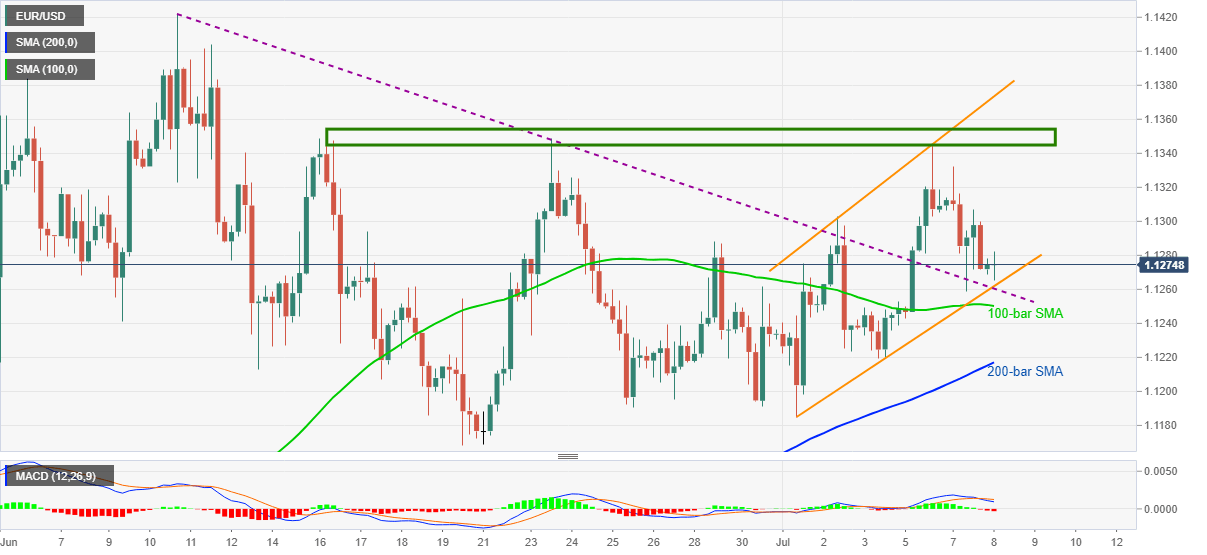

- EUR/USD recovers from 1.1265 while respecting a one-week-old ascending trend channel.

- A resistance-turned-support line stretched from June 10 also adds strength to the 1.1265/60 support zone.

- Bulls can eye multiple tops marked since the mid-June during the further upside.

EUR/USD trims the early-day gains while taking rounds to 1.1270/75 amid Wednesday’s Asian session. The major pair recently bounced off an immediate rising channel’s lower line. The support also gains strength from a monthly falling trend line that was once considered a key resistance.

Hence, the buyers may take a risk entry while targeting 1.1300 as an immediate gain point. Though, the major attention will be given to the 1.1345/55 area comprising multiple highs since June 16.

Also likely to hinder the bull’s path will be the said channel’s resistance line, at 1.1375 now, a break of which could quickly break 1.1400 in search of the previous month’s top of 1.1422.

On the downside, a clear break below 1.1265/60 support confluence will have a 100-bar SMA level of 1.1250 as an extra filter before revisiting the 1.1215/20 region including 200-bar SMA.

Though, the pair’s extended fall past-1.1215, might not refrain from attacking June month’s bottom of 1.1168.

EUR/USD four-hour chart

Trend: Pullback expected