- EUR/USD trades near 1.2110 versus 1.2160 on Monday.

- The daily chart indicators signal scope for deeper pullback.

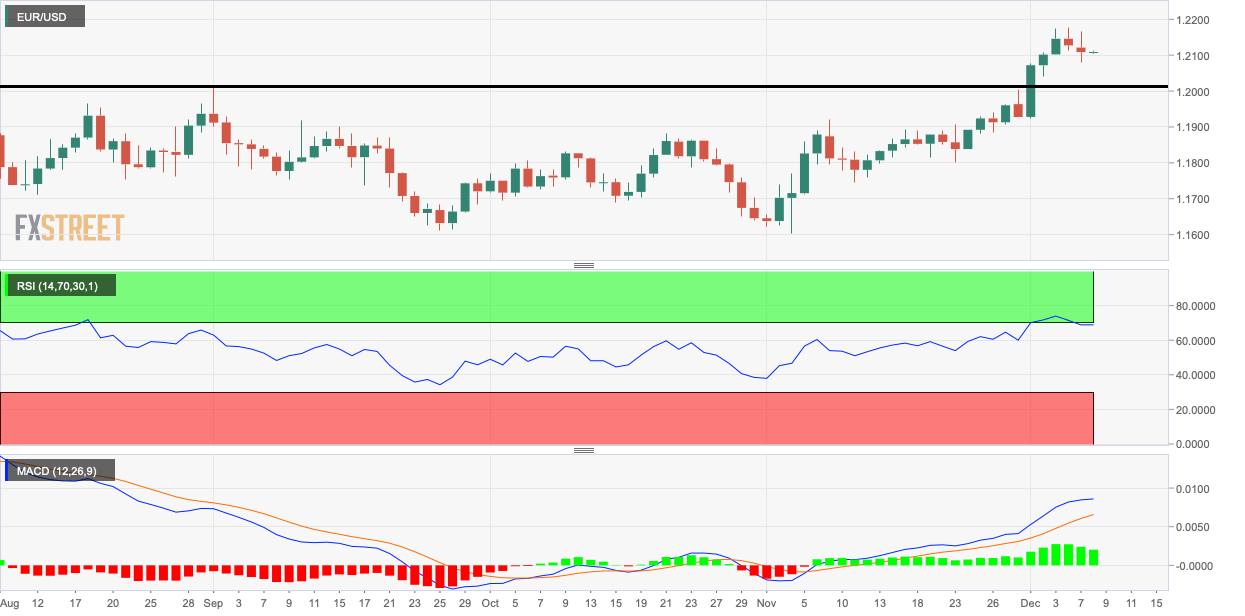

EUR/USD is trading in a sideways manner around 1.2110 at press time, having faced rejection near 1.2170 in the previous three trading days.

Monday’s drop confirmed the uptrend fatigue signaled by the long upper wicks attached to the previous two daily candles and an above-50 or overbought reading on the 14-day Relative Strength Index.

The MACD histogram, an indicator used to identify trend strength and trend changes, is now charting lower highs, also a sign of buyer exhaustion.

The stage looks set for a drop to the former hurdle-turned-support of 1.2011 (September high). A close above 1.2178 (Friday’s high) is needed to revive the bullish bias.

Daily chart

Trend: Bearish

Technical levels