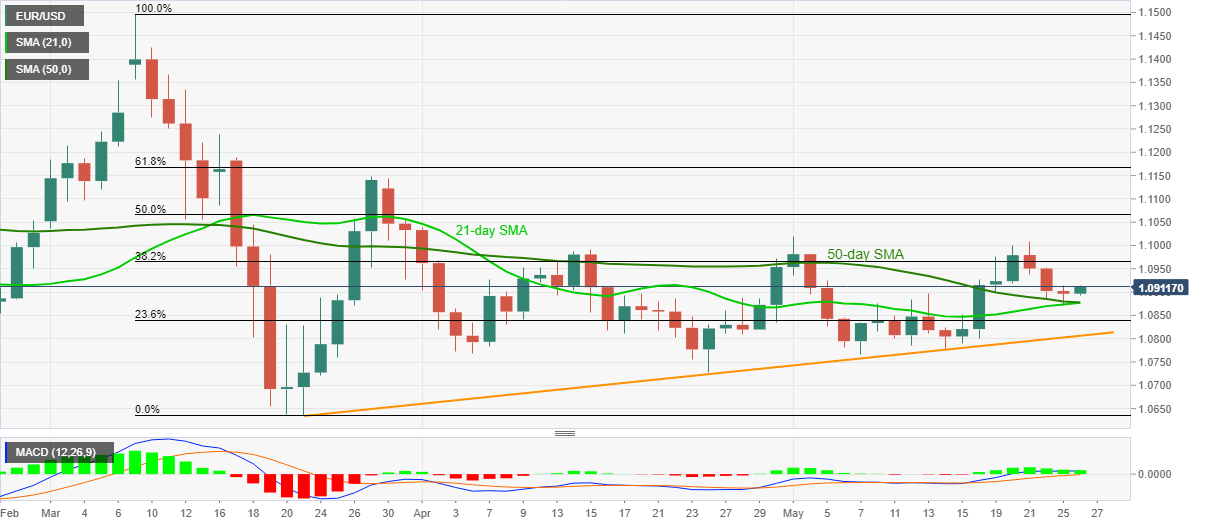

- EUR/USD bounces off 21/50-day SMA confluence to pierce 1.0900 mark.

- A two-month-old ascending trend line offers strong support below the SMA joint.

- The monthly top offers key resistance on the upside.

EUR/USD takes the bids to 1.0911, up 0.14% on a day, during Tuesday’s Asian session. In doing so, the quote recovers from a confluence of 21 and 50-day SMA while snapping the previous three-day losing streak.

That said, the pair currently aims to visit 38.2% Fibonacci retracement of March month fall, around 1.0965, whereas Thursday’s top near 1.1010 could lure the bulls next.

It should, however, be noted that the quotes’ upside past-1.1010 will be dependent upon how well it manages to stay beyond 1.1020.

Meanwhile, a daily closing under 1.0880/75 support confluence can quickly fetch EUR/USD prices to 23.6% Fibonacci retracement level of 1.0838.

Though, an ascending trend line from March 23, currently around 1.0805, could challenge the bears afterward.

EUR/USD daily chart

Trend: Further recovery expected